Region:Middle East

Author(s):Dev

Product Code:KRAA4930

Pages:90

Published On:September 2025

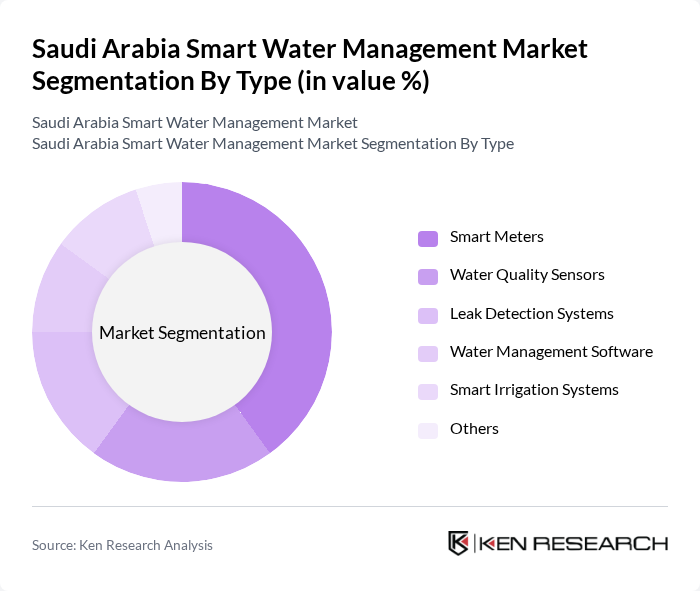

By Type:The market is segmented into various types, including Smart Meters, Water Quality Sensors, Leak Detection Systems, Water Management Software, Smart Irrigation Systems, and Others. Among these, Smart Meters are leading the market due to their ability to provide real-time data on water usage, which helps in efficient resource management and cost savings for consumers. The increasing adoption of IoT technologies further enhances the demand for smart meters, making them a crucial component in the smart water management ecosystem.

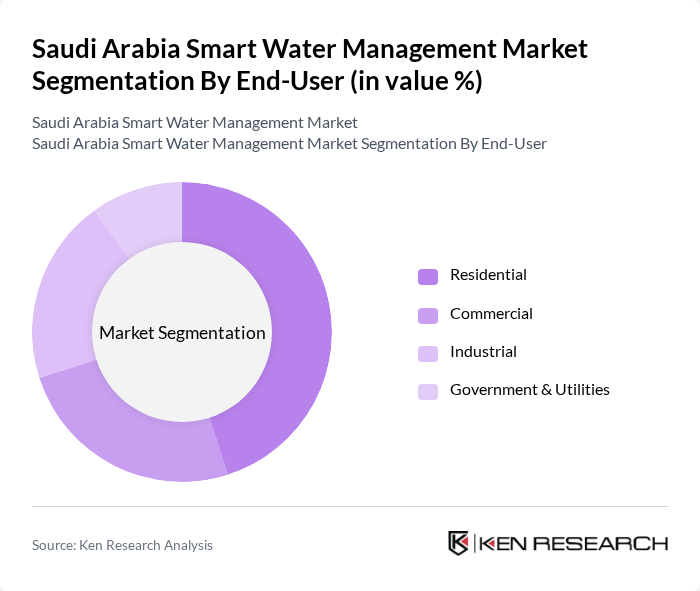

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the dominant end-user, driven by the increasing awareness of water conservation among homeowners and the rising installation of smart water solutions in households. This trend is further supported by government incentives aimed at promoting sustainable water usage practices among residents.

The Saudi Arabia Smart Water Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environnement S.A., Suez S.A., Xylem Inc., Siemens AG, ABB Ltd., Honeywell International Inc., Schneider Electric SE, Itron, Inc., Azbil Corporation, Kamstrup A/S, Badger Meter, Inc., Emerson Electric Co., Endress+Hauser AG, Trimble Inc., Aclara Technologies LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia smart water management market appears promising, driven by increasing investments in technology and government support for sustainable practices. In future, the focus on integrating AI and IoT will likely enhance operational efficiencies, enabling real-time data analytics for better decision-making. Additionally, the expansion of smart city projects will create a conducive environment for innovative water management solutions, fostering collaboration between public and private sectors to address water scarcity challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Meters Water Quality Sensors Leak Detection Systems Water Management Software Smart Irrigation Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Water Distribution Wastewater Management Irrigation Management Water Quality Monitoring |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Authorities | 100 | Water Resource Managers, Policy Makers |

| Smart Water Technology Providers | 80 | Product Development Managers, Sales Directors |

| Environmental Consultants | 60 | Senior Consultants, Project Managers |

| Academic Researchers in Water Management | 50 | Professors, Research Fellows |

| Private Sector Water Users | 70 | Facility Managers, Sustainability Officers |

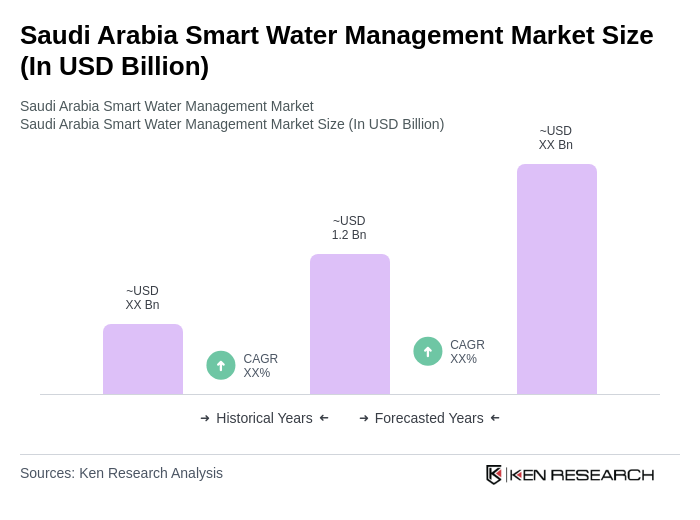

The Saudi Arabia Smart Water Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, population growth, and the need for sustainable water resource management solutions in the region.