Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4504

Pages:87

Published On:October 2025

By Type:The market is segmented into three main types: Ground-based systems, Space-based systems, and Hybrid systems. Ground-based systems utilize advanced radar and optical telescopes for monitoring and tracking satellites, providing essential collision avoidance and orbital prediction capabilities. Space-based systems leverage sensors positioned in orbit to provide a broader perspective on space situational awareness, enabling continuous monitoring of space objects. Hybrid systems combine both ground-based and space-based approaches to enhance data accuracy, reliability, and real-time tracking precision.

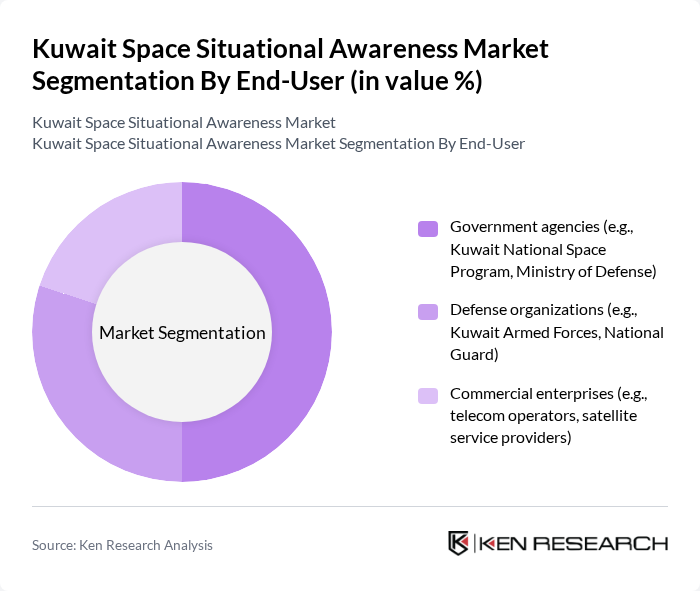

By End-User:The end-user segmentation includes Government agencies, Defense organizations, and Commercial enterprises. Government agencies are the primary users due to their need for national security and comprehensive space monitoring capabilities, driven by increasing concerns about space debris and orbital congestion. Defense organizations utilize these systems for strategic military operations, threat detection, and protection of critical satellite infrastructure from both accidental and intentional threats. Commercial enterprises, including telecommunications operators and satellite service providers, leverage space situational awareness data to safeguard their assets and ensure operational continuity in an increasingly crowded orbital environment.

The Kuwait Space Situational Awareness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Space Research Center, Kuwait Institute for Scientific Research (KISR), Lockheed Martin Corporation, L3Harris Technologies, Inc., Northrop Grumman Corporation, Kratos Defense & Security Solutions, Inc., Airbus Defence and Space, Thales Alenia Space, Boeing Defense, Space & Security, Maxar Technologies, GMV Innovating Solutions, ExoAnalytic Solutions, Etamax Space, Elecnor Deimos Group, Parsons Corporation contribute to innovation, geographic expansion, and service delivery in this space.

As Kuwait continues to invest in space technology, the future of its space situational awareness market looks promising. The integration of advanced satellite technologies and data analytics will enhance the country's capabilities in monitoring space activities. Additionally, increased collaboration with international space agencies will facilitate knowledge transfer and innovation. By focusing on sustainable practices and developing indigenous satellite systems, Kuwait can position itself as a regional leader in space situational awareness, driving economic growth and technological advancement.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground-based systems Space-based systems Hybrid systems |

| By End-User | Government agencies (e.g., Kuwait National Space Program, Ministry of Defense) Defense organizations (e.g., Kuwait Armed Forces, National Guard) Commercial enterprises (e.g., telecom operators, satellite service providers) |

| By Application | Satellite tracking Space debris monitoring Collision avoidance |

| By Component | Sensors (optical, radar, RF) Software solutions (data fusion, analytics, visualization) Data analytics tools (AI/ML platforms, predictive modeling) |

| By Sales Channel | Direct sales (government contracts, defense procurement) Distributors (local technology integrators, regional partners) Online platforms (cloud-based SSA services, SaaS offerings) |

| By Investment Source | Government funding (national space budget, R&D grants) Private investments (venture capital, corporate R&D) International grants (collaborative programs with ESA, NASA, GCC partners) |

| By Policy Support | Government subsidies (for local space startups, technology adoption) Tax incentives (for foreign and domestic SSA providers) Research grants (for academic institutions, public-private partnerships) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Space Agencies | 60 | Policy Makers, Program Managers |

| Private Sector Space Technology Firms | 50 | CEOs, R&D Directors |

| Academic Institutions and Research Centers | 40 | Researchers, Professors in Aerospace Engineering |

| Defense and Security Organizations | 45 | Defense Analysts, Security Strategists |

| International Space Collaboration Entities | 40 | Project Coordinators, International Relations Officers |

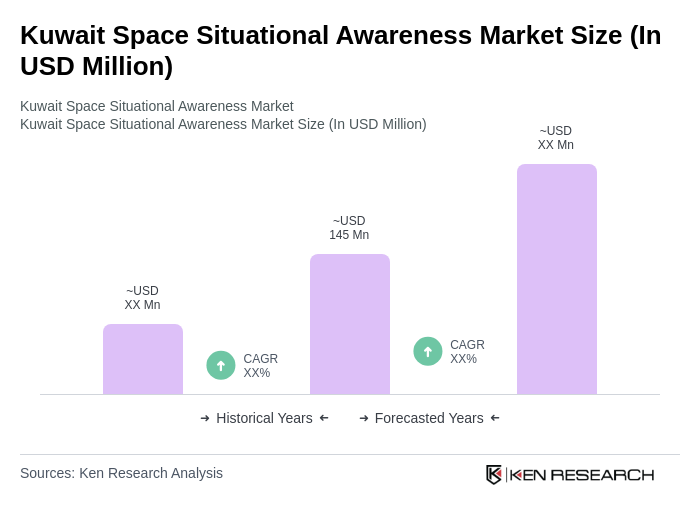

The Kuwait Space Situational Awareness Market is valued at approximately USD 145 million, reflecting significant growth driven by investments in satellite technology, national security needs, and space debris management awareness.