Region:Middle East

Author(s):Dev

Product Code:KRAC2757

Pages:87

Published On:October 2025

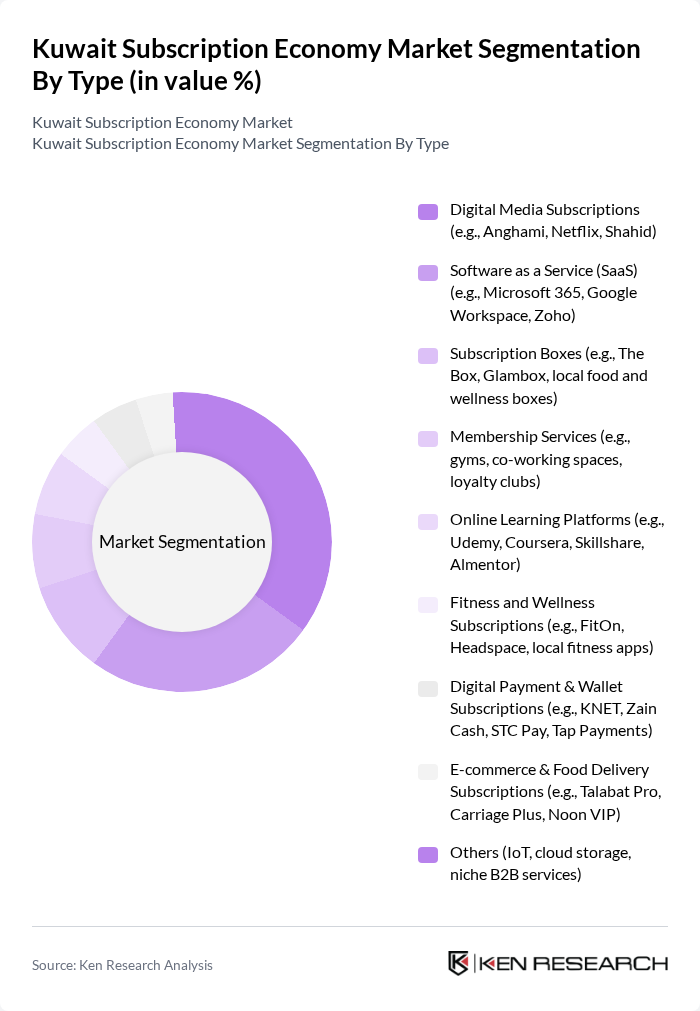

By Type:The Kuwait Subscription Economy Market can be segmented into various types, including Digital Media Subscriptions, Software as a Service (SaaS), Subscription Boxes, Membership Services, Online Learning Platforms, Fitness and Wellness Subscriptions, Digital Payment & Wallet Subscriptions, E-commerce & Food Delivery Subscriptions, and Others. Among these, Digital Media Subscriptions and SaaS are particularly prominent due to the increasing demand for streaming services and cloud-based solutions. Subscription boxes, especially in organic produce and wellness, are also gaining traction, with the organic produce subscription segment alone valued at approximately USD 150 million. The market is seeing diversification with the rise of multi-screen commerce, including smart TVs, voice assistants, and in-store kiosks, which are expanding the ways consumers engage with subscription services.

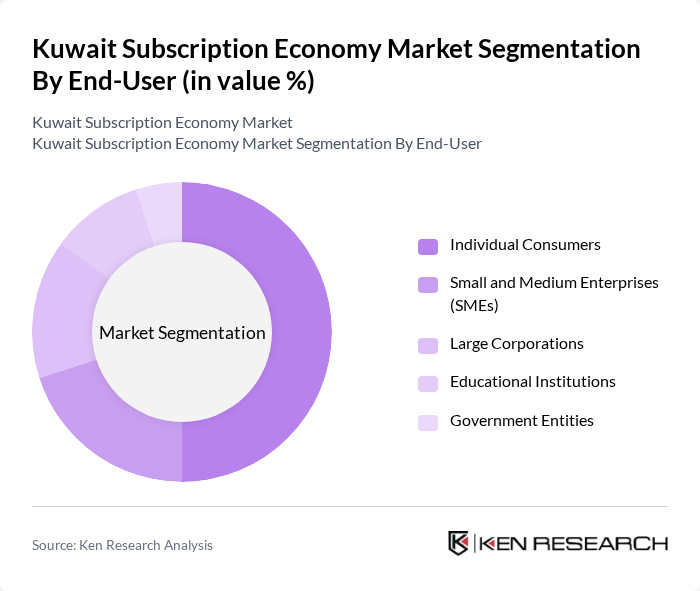

By End-User:The end-user segmentation of the Kuwait Subscription Economy Market includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Educational Institutions, and Government Entities. Individual Consumers are the largest segment, driven by the increasing popularity of digital content and services, while SMEs are also rapidly adopting subscription models to enhance operational efficiency, supported by government e-invoicing mandates and digital procurement incentives.

The Kuwait Subscription Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Group, Ooredoo Kuwait, STC Kuwait, Talabat, Carriage, Noon, Anghami, Shahid, Netflix, Spotify, Amazon Prime, Udemy, Skillshare, Coursera, FitOn, Headspace, KNET, Tap Payments, Boubyan Bank, Al Ahli Bank of Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the subscription economy in Kuwait appears promising, driven by technological advancements and changing consumer behaviors. As digital literacy increases, more consumers are likely to embrace subscription models across various sectors. Additionally, the integration of artificial intelligence in subscription management is expected to enhance customer experiences, leading to higher retention rates. Companies that prioritize sustainability and personalized offerings will likely gain a competitive edge, positioning themselves favorably in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Media Subscriptions (e.g., Anghami, Netflix, Shahid) Software as a Service (SaaS) (e.g., Microsoft 365, Google Workspace, Zoho) Subscription Boxes (e.g., The Box, Glambox, local food and wellness boxes) Membership Services (e.g., gyms, co-working spaces, loyalty clubs) Online Learning Platforms (e.g., Udemy, Coursera, Skillshare, Almentor) Fitness and Wellness Subscriptions (e.g., FitOn, Headspace, local fitness apps) Digital Payment & Wallet Subscriptions (e.g., KNET, Zain Cash, STC Pay, Tap Payments) E-commerce & Food Delivery Subscriptions (e.g., Talabat Pro, Carriage Plus, Noon VIP) Others (IoT, cloud storage, niche B2B services) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Educational Institutions Government Entities |

| By Sales Channel | Direct Sales Online Platforms Retail Partnerships Affiliate Marketing |

| By Subscription Model | Monthly Subscriptions Annual Subscriptions Pay-Per-Use |

| By Consumer Demographics | Age Groups Income Levels Geographic Distribution |

| By Pricing Strategy | Tiered Pricing Freemium Models Bundled Services |

| By Customer Loyalty Programs | Points-Based Systems Subscription Discounts Referral Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Media Subscription Services | 120 | Content Managers, Marketing Directors |

| Food Delivery Subscriptions | 100 | Operations Managers, Customer Experience Leads |

| E-commerce Subscription Models | 120 | Product Managers, Business Development Executives |

| Fitness and Wellness Subscriptions | 80 | Fitness Trainers, Health Program Coordinators |

| Digital Content Platforms | 90 | Content Creators, User Engagement Specialists |

The Kuwait Subscription Economy Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by the increasing adoption of digital services and a shift in consumer behavior towards subscription models.