Region:Middle East

Author(s):Shubham

Product Code:KRAA8674

Pages:93

Published On:November 2025

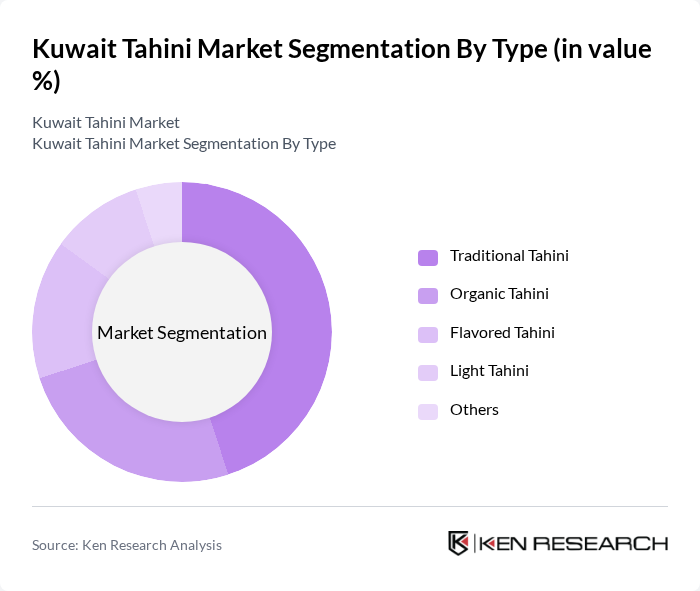

By Type:The tahini market is segmented into Traditional Tahini, Organic Tahini, Flavored Tahini, Light Tahini, and Others. Traditional Tahini remains the most popular, favored for its authentic taste and use in classic dishes. Organic Tahini is gaining momentum as consumers prioritize natural, chemical-free foods. Flavored Tahini is emerging as a trendy option, especially among younger consumers seeking novel and diverse flavors.

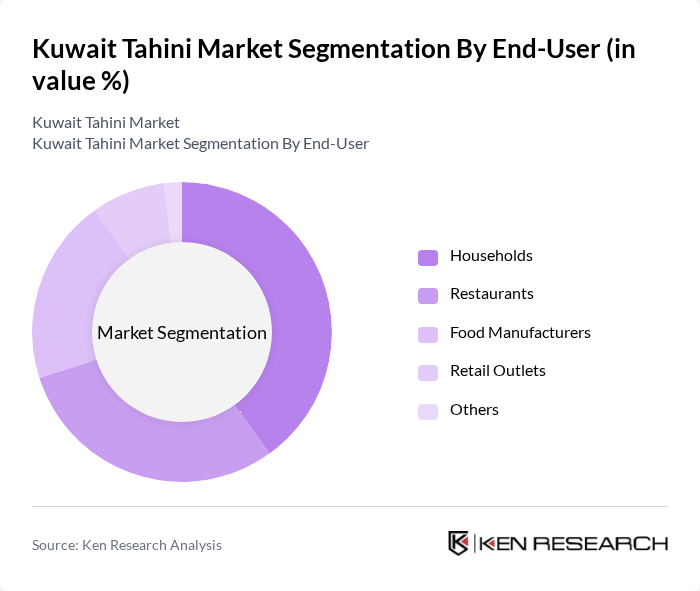

By End-User:End-user segmentation includes Households, Restaurants, Food Manufacturers, Retail Outlets, and Others. Households represent a significant share, as tahini is a staple for dips, spreads, and dressings. Restaurants drive demand by incorporating tahini into a variety of dishes, while food manufacturers use tahini as an ingredient in packaged and ready-to-eat foods, broadening its market reach.

The Kuwait Tahini Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Wazzan Food Industries, Al Kout Food Group, Al-Masah Food Products, Al-Homaizi Food Industries, Al-Qurain Food Industries, Al-Bahar Foods, Al-Mansour Tahini, Al-Safwa Food Products, Al-Muhalab Food Industries, Al-Jazeera Foods, Al-Masri Tahini, Al-Fahad Food Products, Al-Sultan Food Industries, Al-Mahfouz Food Products, and Al-Rashid Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tahini market in Kuwait appears promising, driven by increasing health consciousness and the expansion of the food service sector. As consumers continue to seek nutritious and plant-based options, tahini is well-positioned to benefit from these trends. Additionally, the rise of e-commerce platforms is expected to facilitate greater accessibility to tahini products, allowing for wider distribution and consumer engagement. Innovations in product offerings will further enhance market dynamics, catering to diverse consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Tahini Organic Tahini Flavored Tahini Light Tahini Others |

| By End-User | Households Restaurants Food Manufacturers Retail Outlets Others |

| By Packaging Type | Glass Jars Plastic Containers Pouches Bulk Packaging Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales Others |

| By Region | Kuwait City Hawalli Al Ahmadi Farwaniya Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Gourmet, Traditional) Others |

| By Product Form | Liquid Tahini Paste Tahini Powdered Tahini Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Health-Conscious Consumers, Food Enthusiasts |

| Food Service Industry | 80 | Restaurant Owners, Chefs |

| Distribution Channel Analysis | 70 | Distributors, Wholesalers |

| Market Trends and Innovations | 50 | Food Industry Analysts, Product Developers |

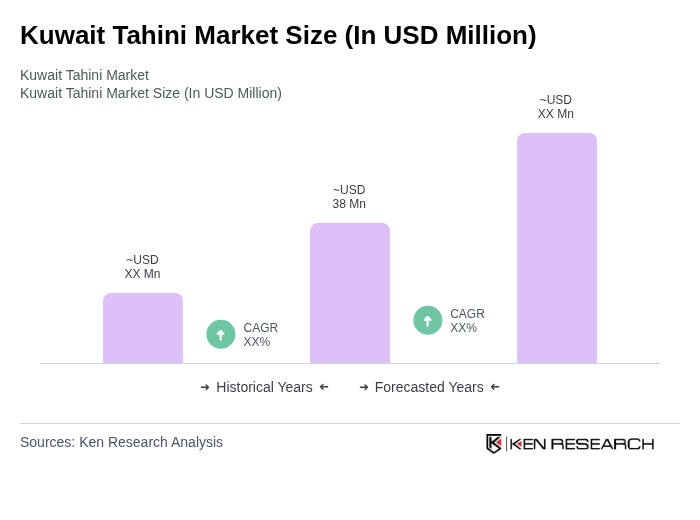

The Kuwait Tahini Market is valued at approximately USD 38 million, reflecting a steady increase in consumption driven by the popularity of Mediterranean and Middle Eastern cuisine, as well as a growing focus on health and nutrition among consumers.