Region:Middle East

Author(s):Rebecca

Product Code:KRAD2844

Pages:97

Published On:November 2025

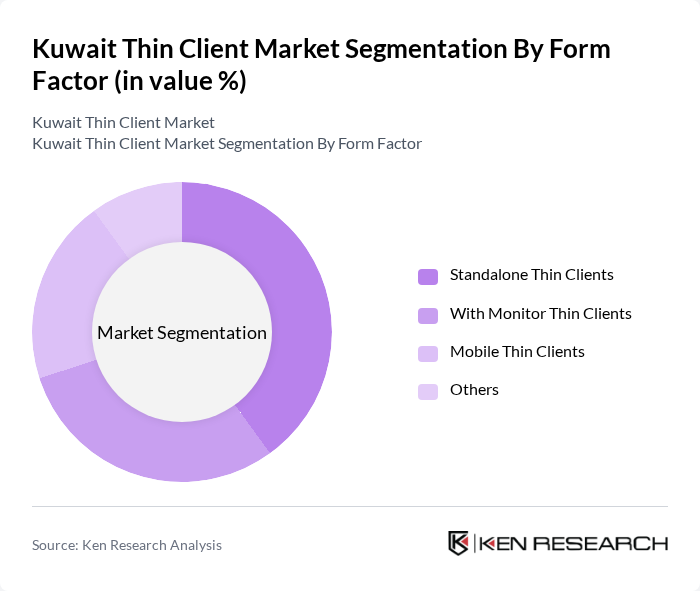

By Form Factor:The thin client market in Kuwait is segmented into Standalone Thin Clients, With Monitor Thin Clients, Mobile Thin Clients, and Others. Standalone Thin Clients are favored for their deployment flexibility and ease of integration into diverse IT environments. With Monitor Thin Clients are widely adopted in educational and healthcare settings, where space optimization and simplified device management are critical. Mobile Thin Clients are gaining traction among enterprises supporting remote and hybrid workforces, enabling secure access to cloud-based applications. The Others segment includes industry-specific devices tailored for specialized operational needs.

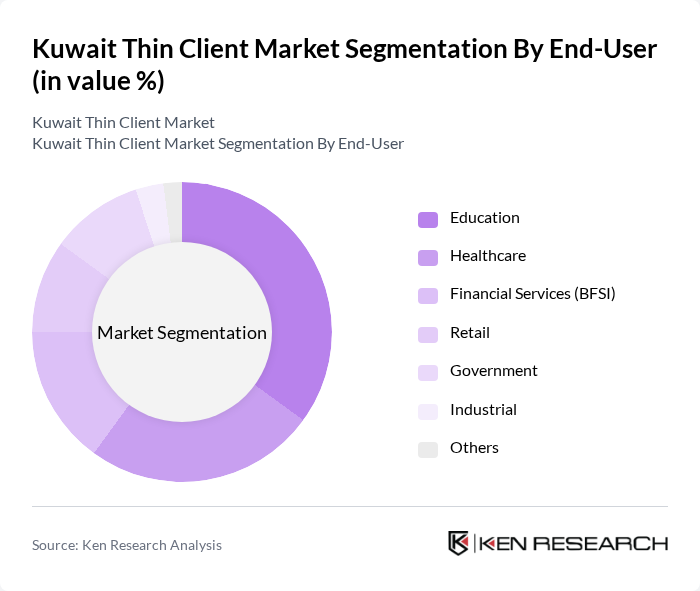

By End-User:End-user segmentation in Kuwait includes Education, Healthcare, Financial Services (BFSI), Retail, Government, Industrial, and Others. Education is the leading segment, as schools and universities prioritize affordable, easy-to-manage computing solutions. Healthcare institutions are significant adopters, requiring secure, efficient access to patient data and compliance with data protection standards. The BFSI sector is increasing its adoption of thin clients for enhanced security and regulatory compliance. Retail and Government sectors are progressively integrating thin client solutions to support digital transformation and operational efficiency.

The Kuwait Thin Client Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Dell Technologies, Lenovo Group Limited, Citrix Systems, Inc., IGEL Technology GmbH, NComputing Co., Ltd., 10ZiG Technology, ViewSonic Corporation, Parallels International GmbH, VMware, Inc., Microsoft Corporation, Fujitsu Technology Solutions, Thin Client Computing, Atrust Computer Corp., and Scale Computing contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait thin client market is poised for significant growth as businesses increasingly recognize the benefits of cost-effective and secure computing solutions. The shift towards virtual desktop infrastructure (VDI) and the integration of AI technologies are expected to drive innovation in this sector. Additionally, as remote work becomes more prevalent, the demand for mobile thin clients will likely rise, further enhancing the market's potential. Overall, the future looks promising, with a focus on sustainability and energy efficiency shaping the landscape.

| Segment | Sub-Segments |

|---|---|

| By Form Factor | Standalone Thin Clients With Monitor Thin Clients Mobile Thin Clients Others |

| By End-User | Education Healthcare Financial Services (BFSI) Retail Government Industrial Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Deployment Others |

| By Industry Vertical | IT and Telecommunications Manufacturing Transportation and Logistics Others |

| By Region | Kuwait City Hawalli Al Ahmadi Others |

| By Enterprise Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Support Services | Technical Support Maintenance Services Training Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector Deployment | 100 | IT Directors, School Administrators |

| Healthcare IT Infrastructure | 70 | Healthcare IT Managers, System Administrators |

| Government Agency Adoption | 60 | Government IT Officers, Procurement Managers |

| Corporate Sector Implementation | 80 | Corporate IT Managers, CIOs |

| SME Technology Adoption | 50 | Small Business Owners, IT Consultants |

The Kuwait Thin Client Market is valued at approximately USD 15 million, reflecting a growing demand for cost-effective computing solutions, particularly in sectors like education and healthcare, where budget efficiency is crucial.