Region:Global

Author(s):Rebecca

Product Code:KRAA2468

Pages:95

Published On:August 2025

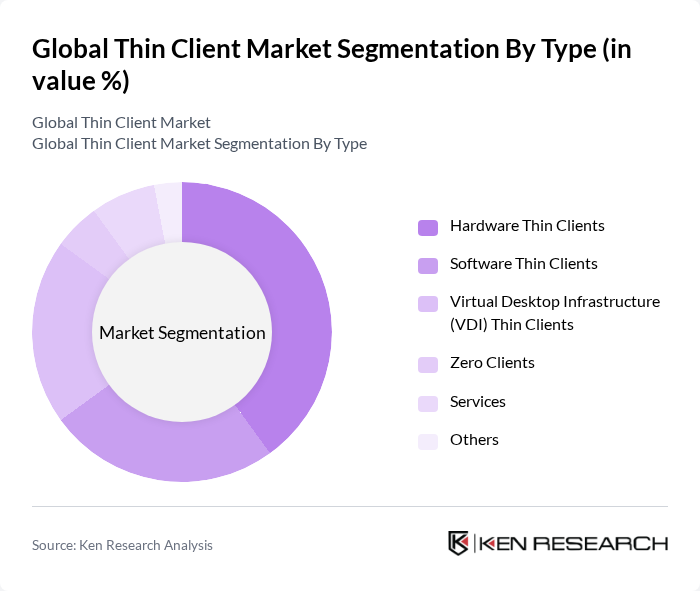

By Type:The thin client market is segmented into Hardware Thin Clients, Software Thin Clients, Virtual Desktop Infrastructure (VDI) Thin Clients, Zero Clients, Services, and Others. Among these,Hardware Thin Clientshold the largest share, favored for their reliability and performance in enterprise settings. Software Thin Clients are gaining momentum as organizations increasingly migrate to cloud-based environments, while VDI Thin Clients are widely adopted to support secure and flexible remote work arrangements.

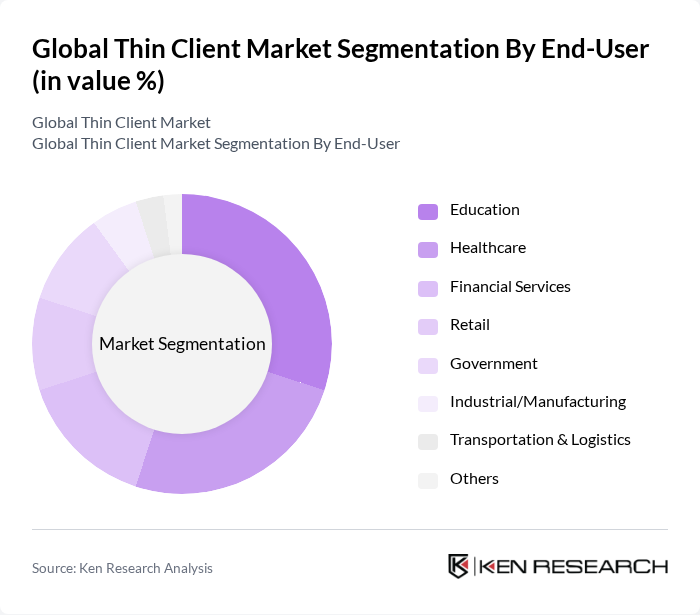

By End-User:End-user segments include Education, Healthcare, Financial Services, Retail, Government, Industrial/Manufacturing, Transportation & Logistics, and Others. TheEducationsector is a leading adopter, driven by the need for scalable, cost-effective computing in schools and universities.Healthcareis also a prominent segment, as secure, centralized management of patient data and compliance with data protection standards are critical.

The Global Thin Client Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dell Technologies Inc., HP Inc., IGEL Technology GmbH, NComputing Co., Ltd., Lenovo Group Limited, 10ZiG Technology, ViewSonic Corporation, Acer Inc., Samsung Electronics Co., Ltd., Fujitsu Technology Solutions, Parallels International GmbH, ThinClient.net, Atrust Computer Corp., VXL Technologies Ltd., Centerm Information Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thin client market appears promising, driven by the ongoing digital transformation across various sectors. As organizations increasingly adopt hybrid work models, the demand for flexible and secure computing solutions will likely rise. Furthermore, advancements in technology, such as AI integration and enhanced virtualization capabilities, are expected to improve the performance and appeal of thin clients. This evolution will position thin clients as a viable alternative to traditional computing solutions, fostering broader acceptance and usage.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Thin Clients Software Thin Clients Virtual Desktop Infrastructure (VDI) Thin Clients Zero Clients Services Others |

| By End-User | Education Healthcare Financial Services Retail Government Industrial/Manufacturing Transportation & Logistics Others |

| By Application | Remote Work Solutions Point of Sale (POS) Systems Digital Signage Call Centers Kiosks Industrial Automation Others |

| By Distribution Channel | Direct Sales Online Retail Value-Added Resellers (VARs) System Integrators Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Thin Clients Mid-Range Thin Clients Premium Thin Clients |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Government Institutions Educational Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Thin Client Usage | 100 | IT Directors, Healthcare Administrators |

| Education Sector Deployment Insights | 80 | IT Coordinators, School Administrators |

| Financial Services IT Infrastructure | 70 | Chief Information Officers, IT Managers |

| Manufacturing Sector Technology Adoption | 50 | Operations Managers, IT Specialists |

| Retail Sector IT Solutions | 60 | Store Managers, IT Support Staff |

The Global Thin Client Market is valued at approximately USD 1.5 billion, driven by the demand for cost-effective computing solutions, remote work trends, and enhanced data security measures.