Region:Middle East

Author(s):Shubham

Product Code:KRAD3592

Pages:95

Published On:November 2025

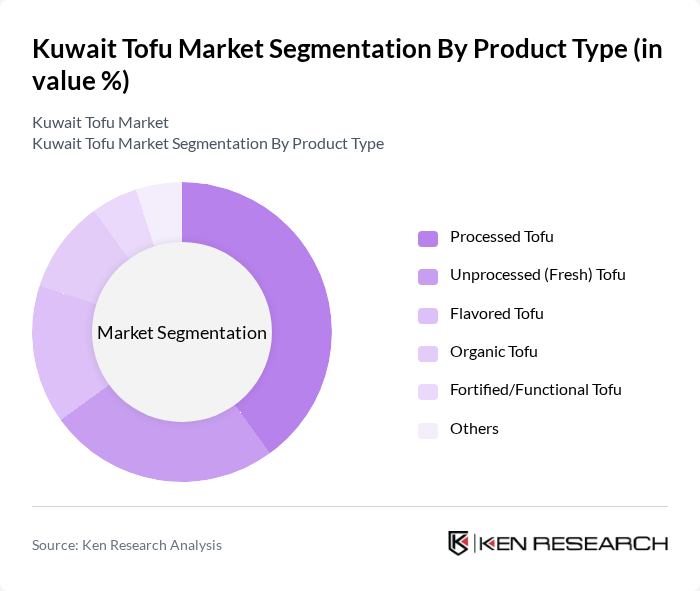

By Product Type:The product type segmentation includes various forms of tofu that cater to different consumer preferences and dietary needs. The subsegments are processed tofu, unprocessed (fresh) tofu, flavored tofu, organic tofu, fortified/functional tofu, and others. Among these, processed tofu is currently leading the market due to its convenience, extended shelf life, and versatility in cooking. Consumers are increasingly opting for ready-to-use products that save time and effort in meal preparation. The demand for organic tofu is also on the rise as health-conscious consumers seek products free from pesticides and artificial additives. Flavored and fortified tofu variants are gaining traction among younger consumers seeking innovative plant-based options .

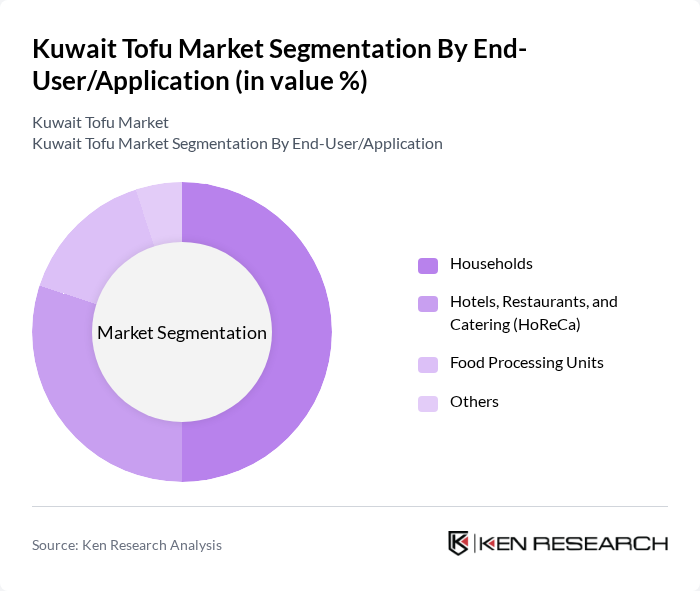

By End-User/Application:The end-user segmentation encompasses households, hotels, restaurants, catering (HoReCa), food processing units, and others. Households represent the largest segment, driven by the increasing trend of home cooking, growing awareness of healthy eating, and the influence of social media on dietary choices. The HoReCa sector is also expanding as more restaurants and cafes incorporate tofu into their menus to cater to the rising demand for vegetarian and vegan options. Food processing units are increasingly using tofu as an ingredient in various products, further driving market growth .

The Kuwait Tofu Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Watania Foodstuff Company, Al Ain Food & Beverages, Almarai Company, Al Kabeer Group, Al Safi Danone, Al-Faisal Food Company, Al-Muhaidib Foods, Al-Jazeera Foodstuff Company, Al-Babtain Food Industries, Green Giant Foods (Kuwait), Americana Group, Al-Qatami Foods, Al-Mansouriya Food Industries, Al-Mahfouz Group, House Foods Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tofu market in Kuwait appears promising, driven by increasing health awareness and a shift towards plant-based diets. As the government continues to support sustainable food initiatives, tofu is likely to gain traction among health-conscious consumers. Innovations in product offerings, such as flavored and organic tofu, will cater to evolving consumer preferences. Additionally, the rise of online grocery shopping is expected to enhance accessibility, further boosting tofu's market presence in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Processed Tofu Unprocessed (Fresh) Tofu Flavored Tofu Organic Tofu Fortified/Functional Tofu Others |

| By End-User/Application | Households Hotels, Restaurants, and Catering (HoReCa) Food Processing Units Others |

| By Distribution Channel | Supermarkets/Hypermarkets Grocery Stores/Convenience Stores Online Retail Specialty Stores Others |

| By Packaging Type | Plastic Packaging Vacuum Packaging Carton Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Nutritional Content | High Protein Low Fat Fortified Tofu (e.g., with Calcium, Iron, Vitamins) Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Convenience Seekers, Vegan/Vegetarian) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Tofu Sales | 100 | Store Managers, Grocery Buyers |

| Consumer Preferences | 120 | Health-conscious Consumers, Vegetarians |

| Food Service Sector Insights | 80 | Restaurant Owners, Chefs |

| Nutritionist Perspectives | 40 | Registered Dietitians, Nutrition Experts |

| Market Distribution Channels | 60 | Wholesalers, Distributors |

The Kuwait Tofu Market is valued at approximately USD 6 million, reflecting a growing trend towards plant-based protein sources and increased health consciousness among consumers in the region.