Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3781

Pages:85

Published On:October 2025

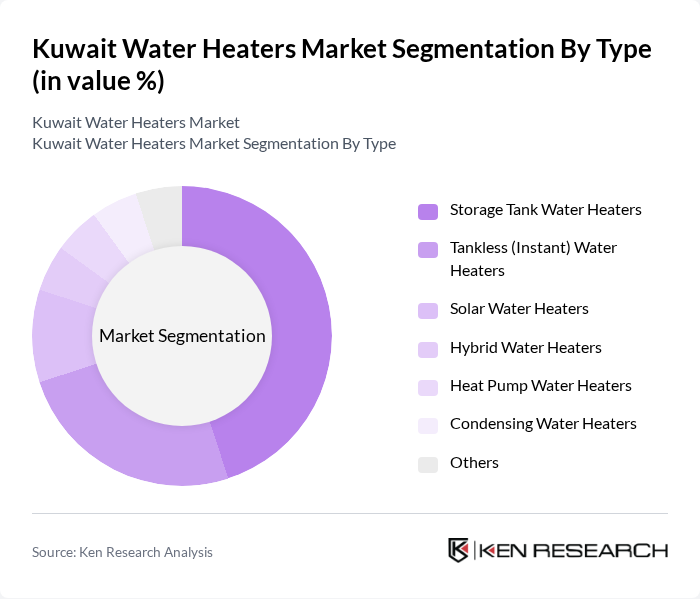

By Type:The market is segmented into Storage Tank Water Heaters, Tankless (Instant) Water Heaters, Solar Water Heaters, Hybrid Water Heaters, Heat Pump Water Heaters, Condensing Water Heaters, and Others. Storage Tank Water Heaters dominate the market, largely due to their widespread use in residential settings where consumers value reliability and capacity. Tankless water heaters are gaining traction, driven by energy efficiency and space-saving designs, appealing to consumers seeking innovative and sustainable solutions .

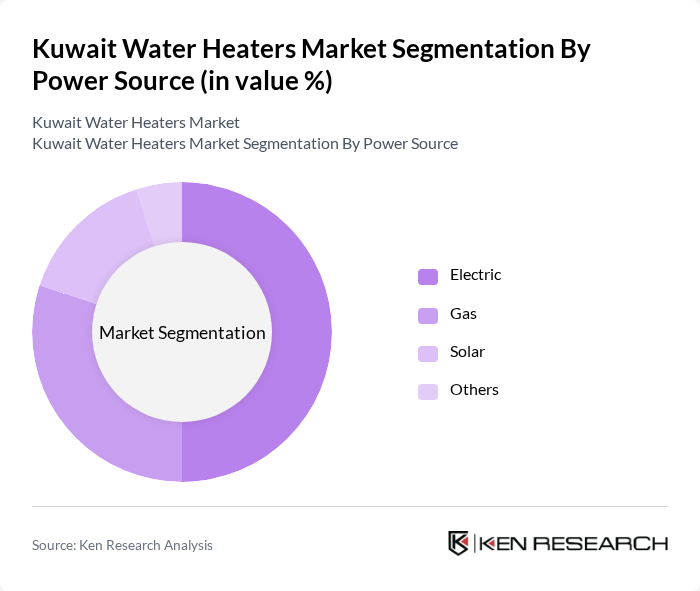

By Power Source:The market is categorized by power source into Electric, Gas, Solar, and Others. Electric water heaters hold a significant share, favored for their convenience and ease of installation, making them a popular choice among residential consumers. Gas water heaters are widely used in commercial settings for their rapid heating capabilities. Solar water heaters are gaining popularity as sustainability and energy efficiency become key purchasing criteria for both residential and commercial buyers .

The Kuwait Water Heaters Market is characterized by a dynamic mix of regional and international players. Leading participants such as A.O. Smith Corporation, Rheem Manufacturing Company, Ariston Thermo Group, Bosch Thermotechnology, Stiebel Eltron, Bradford White Corporation, Haier Group, Ferroli S.p.A., Vaillant Group, Gree Electric Appliances Inc., Panasonic Corporation, Mitsubishi Electric Corporation, Rinnai Corporation, Noritz Corporation, Ecostar (Al Babtain Group, Kuwait), Al Mulla Group (Kuwait), National Industries Company (NIC), Kuwait, and Alghanim Industries (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait water heaters market appears promising, driven by increasing investments in renewable energy and smart home technologies. As the government continues to implement policies supporting energy efficiency, the market is likely to see a shift towards more sustainable heating solutions. Additionally, the integration of IoT in water heating systems will enhance user experience and efficiency, making these products more appealing to consumers. Overall, the market is poised for growth as awareness and technology evolve.

| Segment | Sub-Segments |

|---|---|

| By Type | Storage Tank Water Heaters Tankless (Instant) Water Heaters Solar Water Heaters Hybrid Water Heaters Heat Pump Water Heaters Condensing Water Heaters Others |

| By Power Source | Electric Gas Solar Others |

| By Capacity | Below 30 Liters –100 Liters –250 Liters Above 250 Liters |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Domestic Use Commercial Use Industrial Processes Institutional Use |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Technology | Conventional Heating Advanced Heating Technologies Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Water Heater Purchases | 100 | Homeowners, Property Managers |

| Commercial Water Heating Solutions | 80 | Facility Managers, Business Owners |

| Retail Distribution Insights | 60 | Store Managers, Sales Representatives |

| Installation and Maintenance Services | 50 | Service Technicians, Installation Managers |

| Consumer Preferences and Trends | 90 | General Consumers, Market Analysts |

The Kuwait Water Heaters Market is valued at approximately USD 40 million, reflecting a five-year historical analysis of electric water heater imports and domestic consumption trends, driven by urbanization and rising disposable incomes.