Region:Middle East

Author(s):Dev

Product Code:KRAC3507

Pages:92

Published On:January 2026

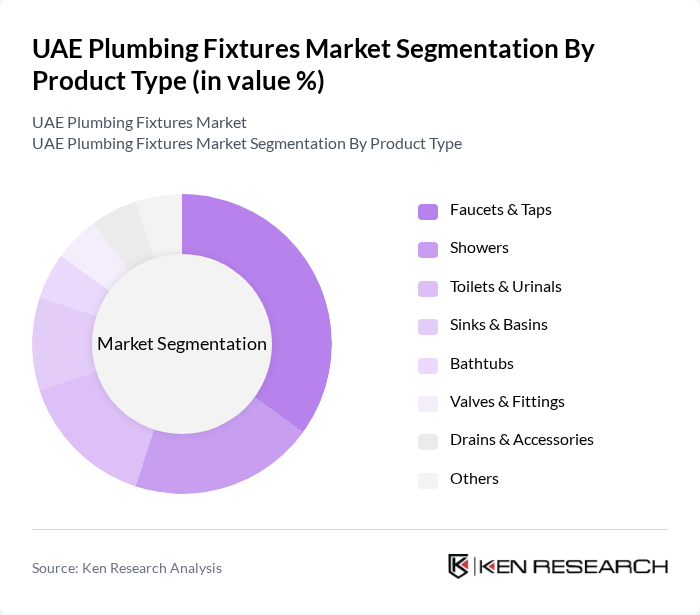

By Product Type:The product type segmentation includes various categories such as Faucets & Taps, Showers, Toilets & Urinals, Sinks & Basins, Bathtubs, Valves & Fittings, Drains & Accessories, and Others. Among these, Faucets & Taps dominate the market due to their essential role in both residential and commercial settings, consistent with global and regional plumbing fixtures market structures where faucets, taps, and mixers account for a significant share of demand. The increasing trend towards smart and touchless faucets is also driving growth in this segment, as consumers seek convenience and modernity in their plumbing fixtures, supported by broader adoption of sensor-based, low-flow, and smart-control fittings to enhance hygiene and water efficiency.

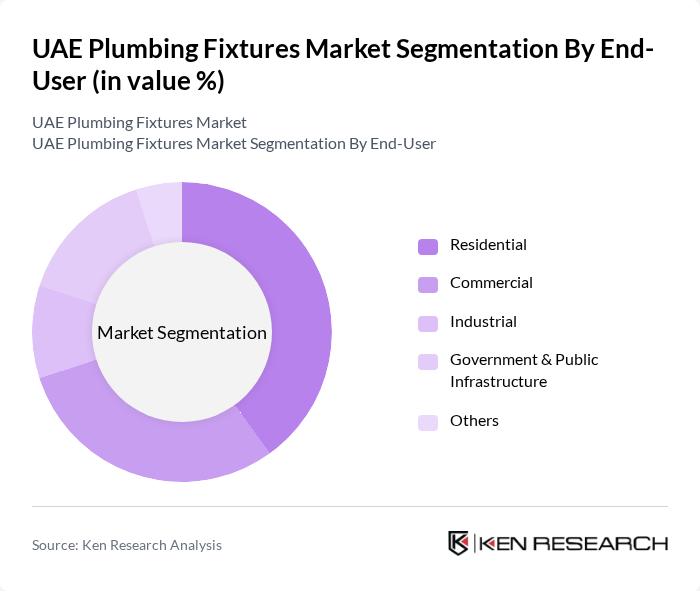

By End-User:The end-user segmentation encompasses Residential, Commercial (including Hospitality, Offices, Retail, Healthcare, Education, etc.), Industrial, Government & Public Infrastructure, and Others. The Residential segment leads the market, driven by the growing population and increasing disposable incomes, which encourage homeowners to invest in modern plumbing fixtures, consistent with global and regional evidence that residential applications account for a major share of plumbing fixtures demand. Additionally, the rise in home renovations and new housing projects further supports the demand in this segment, with ongoing expansion of residential developments and refurbishment activity across the UAE boosting installations of upgraded, water-efficient fixtures.

The UAE Plumbing Fixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as RAK Ceramics, Al Khaleej Ceramics, Kohler Co., Grohe AG, Hansgrohe SE, American Standard (LIXIL Group), Duravit AG, TOTO Ltd., Ideal Standard International, Villeroy & Boch AG, Jaquar Group, Cera Sanitaryware Ltd., HSIL (Hindware), Somany Ceramics Ltd., and other emerging regional players contribute to innovation, geographic expansion, and service delivery in this space.

The UAE plumbing fixtures market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As smart home technologies gain traction, the integration of IoT in plumbing systems will enhance efficiency and user experience. Additionally, government policies promoting water conservation will further stimulate demand for eco-friendly fixtures. The market is expected to adapt to these trends, fostering innovation and creating opportunities for growth in the coming years, particularly in urban areas undergoing rapid development.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Faucets & Taps Showers Toilets & Urinals Sinks & Basins Bathtubs Valves & Fittings Drains & Accessories Others |

| By End-User | Residential Commercial (Hospitality, Offices, Retail, Healthcare, Education, etc.) Industrial Government & Public Infrastructure Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Application Area | Bathrooms Kitchens & Pantry Areas Utility & Service Areas Public Restrooms Others |

| By Material | Plastic Metal (Stainless Steel, Brass, etc.) Ceramic Glass & Composite Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| By Distribution Channel | Direct Sales Retail Outlets (Specialty & Home Improvement Stores) Online Sales Wholesale Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Plumbing Fixtures | 120 | Homeowners, Renovation Contractors |

| Commercial Plumbing Solutions | 100 | Facility Managers, Commercial Builders |

| Public Infrastructure Projects | 80 | Government Officials, Project Managers |

| Eco-friendly Plumbing Products | 70 | Sustainability Consultants, Product Designers |

| Plumbing Fixture Retail Market | 90 | Retail Managers, Supply Chain Coordinators |

The UAE Plumbing Fixtures Market is valued at approximately USD 1.1 billion, driven by rapid urbanization, increased construction activities, and a growing demand for modern plumbing solutions in both residential and commercial sectors.