Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3933

Pages:91

Published On:November 2025

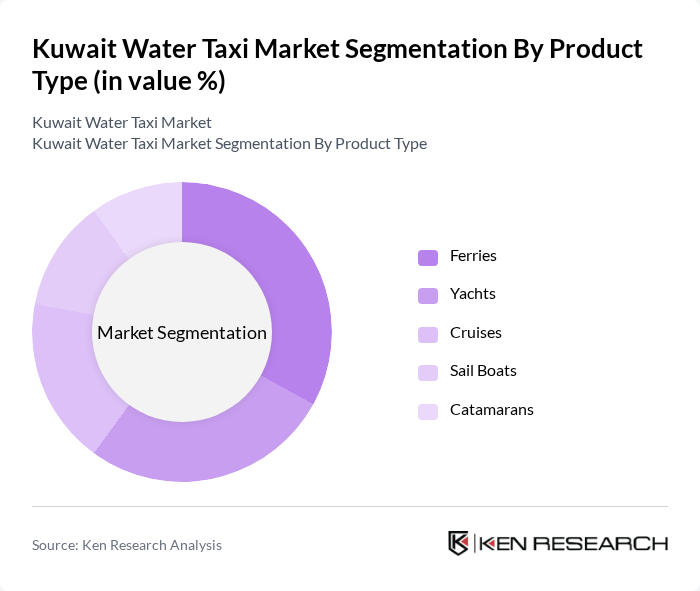

By Product Type:The product type segmentation includes ferries, yachts, cruises, sailboats, and catamarans. Ferries are the most popular due to their ability to transport larger passenger groups efficiently, making them ideal for public transit and tourism. Yachts and cruises target the leisure segment, attracting tourists seeking premium experiences. Sailboats and catamarans, though less prevalent, are favored for recreational outings. The demand for ferries is driven by their cost-effectiveness and accessibility, positioning them as the leading subsegment in Kuwait’s market.

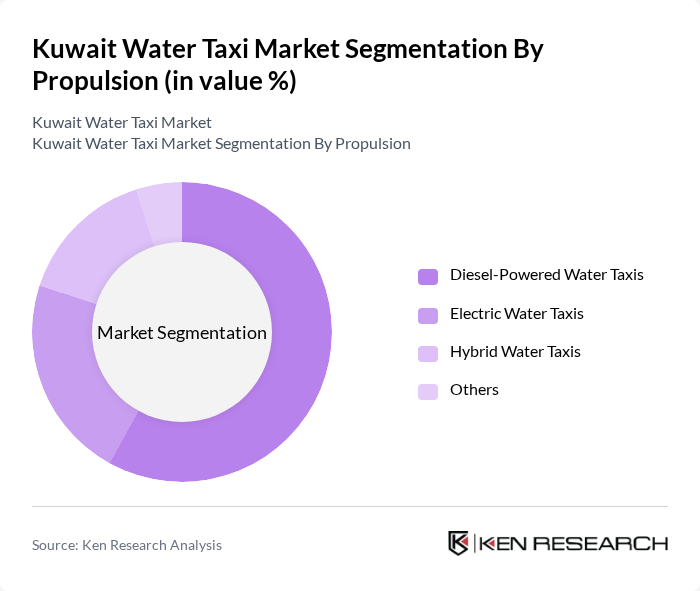

By Propulsion:The propulsion segmentation covers diesel-powered, electric, hybrid, and other water taxis. Diesel-powered water taxis dominate due to operational reliability and established infrastructure. However, there is a notable shift toward electric and hybrid models, propelled by environmental policies and government incentives for sustainable transport. Adoption of electric and hybrid technologies is gradually increasing, though diesel remains the primary choice for most operators.

The Kuwait Water Taxi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Water Taxi Co., Al-Manshar Marine Services, City Group Co. K.S.C.P., Al-Bahar Marine Services, Gulf Water Transport, Sea Breeze Water Taxis, Marina Waves, Aqua Marine Transport, Blue Wave Water Taxis, Kuwait Maritime & Mercantile Co. (KMMC), Pearl Water Taxis, Coastal Water Transport, Al-Jazeera Water Taxis, Desert Water Taxis, Marina Bay Water Taxis contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait water taxi market is poised for significant transformation, driven by urbanization and tourism growth. As the government invests in marine transport infrastructure, the operational landscape will evolve, enhancing service reliability and customer experience. The integration of technology, such as mobile booking apps, will streamline operations and attract a tech-savvy clientele. Additionally, the focus on eco-friendly initiatives will likely shape future developments, positioning water taxis as a sustainable transport option in Kuwait's urban mobility framework.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Ferries Yachts Cruises Sail Boats Catamarans |

| By Propulsion | Diesel-Powered Water Taxis Electric Water Taxis Hybrid Water Taxis Others |

| By Service Type | Scheduled Services On-Demand Services Charter Services Others |

| By End-User/Application | Public Transportation Leisure & Tourism Business & Corporate Transport Personal Use Others |

| By Passenger Capacity | Up to 12 Passengers Above 12 Passengers |

| By Boat Size | Up to 10 meters Above 10 meters |

| By Technology Integration | GPS Tracking Mobile App Integration Payment Gateway Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tourist User Experience | 100 | Tourists, Travel Agents |

| Local Commuter Preferences | 80 | Local Residents, Daily Commuters |

| Operator Insights | 50 | Water Taxi Operators, Fleet Managers |

| Regulatory Perspectives | 30 | Government Officials, Maritime Regulators |

| Environmental Impact Assessments | 40 | Environmental Consultants, Urban Planners |

The Kuwait Water Taxi Market is valued at approximately USD 85 million, reflecting a five-year historical analysis and regional share within the Middle East & Africa water taxi market. This valuation highlights the growing demand for efficient urban transportation and tourism services.