Region:Central and South America

Author(s):Dev

Product Code:KRAD0359

Pages:99

Published On:August 2025

By Type:The market is segmented into various types, including Adventure Tourism, Cultural Tourism, Eco-Tourism, Medical Tourism, Luxury Tourism, Business Tourism, Cruise Tourism, Visiting Friends and Relatives (VFR), Specialty/Activity/Sports Tourism, and Others. Each of these segments caters to different traveler preferences and experiences, with adventure and cultural tourism experiencing notable growth due to increased demand from millennial and Gen Z travelers seeking unique and immersive experiences. Eco-tourism continues to expand as sustainability becomes a priority for both travelers and regional governments .

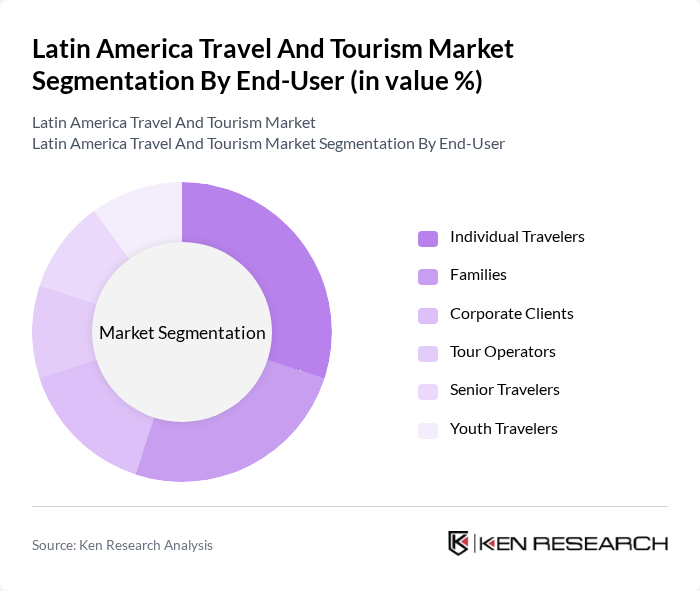

By End-User:The end-user segmentation includes Individual Travelers, Families, Corporate Clients, Tour Operators, Senior Travelers, and Youth Travelers. Each group has distinct travel needs and preferences, influencing the types of services and experiences they seek. Individual and family travelers represent the largest segments, with corporate and youth travel also showing steady demand as business and educational travel increase in the region .

The Latin America Travel And Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Despegar.com, LATAM Airlines Group S.A., CVC Corp, Grupo Posadas, S.A.B. de C.V., GOL Linhas Aéreas Inteligentes S.A., Avianca Group International Limited, Marriott International, Inc., Hilton Worldwide Holdings Inc., Airbnb, Inc., Booking.com B.V., Expedia Group, Inc., Tangol SRL, Condor Travel, TUI Group, and Royal Caribbean Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Latin American travel and tourism market appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized experiences, businesses that adapt to these demands will thrive. Additionally, the integration of sustainable practices is expected to gain momentum, aligning with global trends. The region's rich cultural heritage and natural beauty will continue to attract tourists, while ongoing investments in infrastructure will enhance accessibility and overall visitor satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Adventure Tourism Cultural Tourism Eco-Tourism Medical Tourism Luxury Tourism Business Tourism Cruise Tourism Visiting Friends and Relatives (VFR) Specialty/Activity/Sports Tourism Others |

| By End-User | Individual Travelers Families Corporate Clients Tour Operators Senior Travelers Youth Travelers |

| By Travel Purpose | Leisure Business Education Health Events & Festivals |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Booking (Hotel/Airline Websites) Travel Agents Mobile Apps Others |

| By Duration of Stay | Short-term (1-3 days) Medium-term (4-7 days) Long-term (8+ days) |

| By Accommodation Type | Hotels Hostels Vacation Rentals Resorts Cruise Ships Eco-Lodges |

| By Travel Style | Group Travel Solo Travel Family Travel Backpacking Luxury Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Travel Preferences | 100 | Frequent Travelers, Travel Bloggers |

| Business Travel Insights | 90 | Corporate Travel Managers, Business Executives |

| Adventure Tourism Trends | 70 | Outdoor Enthusiasts, Tour Guides |

| Cultural Tourism Engagement | 60 | Museum Curators, Cultural Heritage Managers |

| Impact of COVID-19 on Travel | 50 | Travel Agency Owners, Health and Safety Officers |

The Latin America Travel and Tourism Market is valued at approximately USD 105 billion, driven by increased disposable income, a rise in travel, and the region's rich cultural and natural attractions.