South East Asia Travel and Tourism Market Overview

- The South East Asia Travel and Tourism Market is valued at USD 59 billion, based on a five-year historical analysis. This growth is primarily driven by the region's rich cultural heritage, diverse landscapes, and increasing disposable incomes among the middle class, which have led to a surge in both domestic and international travel. Recent years have also seen a significant rebound in travel demand following pandemic-related disruptions, with digital transformation and mobile commerce accelerating across the region .

- Countries such as Thailand, Indonesia, and Vietnam continue to dominate the market due to their well-established tourism infrastructure, attractive tourist destinations, and proactive government initiatives. Thailand is renowned for its beaches and vibrant culture, Indonesia offers unique experiences across its many islands, and Vietnam has seen robust growth in international arrivals, supported by expanding air connectivity and investment in hospitality infrastructure .

- In 2023, the government of Thailand implemented the “Sustainable Tourism Goals Policy” under the Ministry of Tourism and Sports (Thailand), allocating a budget of USD 200 million to promote eco-friendly travel options and enhance infrastructure in less-visited areas. The policy mandates sustainability standards for tourism operators, supports community-based tourism, and incentivizes investments in green infrastructure to ensure balanced growth and environmental stewardship .

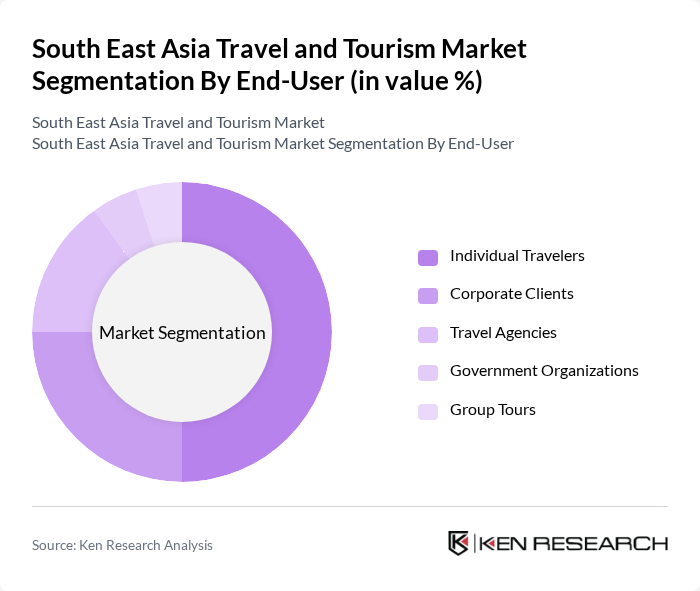

South East Asia Travel and Tourism Market Segmentation

By Type:The market is segmented into various types of travel, including Leisure Travel, Business Travel, Adventure Travel, Eco-Tourism, Cultural Tourism, Medical Tourism, Wellness Tourism, Culinary Tourism, Religious Tourism, and Others. Each of these segments caters to different consumer preferences and travel motivations. The demand for unique and authentic experiences, such as cultural immersion and eco-tourism, is rising, driven by younger travelers and the influence of social media .

By End-User:The market is also segmented by end-user categories, which include Individual Travelers, Corporate Clients, Travel Agencies, Government Organizations, and Group Tours. Each segment reflects different travel needs and preferences. Individual travelers account for the largest share, driven by the growth of online booking platforms and personalized travel experiences .

South East Asia Travel and Tourism Market Competitive Landscape

The South East Asia Travel and Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Traveloka, Agoda, Booking.com, AirAsia, Singapore Airlines, Vietnam Airlines, Philippine Airlines, Garuda Indonesia, Lion Air Group, Klook, TUI Group, Intrepid Travel, G Adventures, Minor Hotels (Minor International), and Banyan Tree Holdings contribute to innovation, geographic expansion, and service delivery in this space.

South East Asia Travel and Tourism Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The rise in disposable income across South East Asia is a significant growth driver for the travel and tourism market. In future, the average disposable income in the region is projected to reach approximately $4,800 per capita, up from $4,500. This increase allows more individuals to afford travel experiences, contributing to a surge in domestic and international tourism. Countries like Indonesia and Vietnam are witnessing a notable increase in middle-class households, further fueling travel demand.

- Rise in Digital Travel Platforms:The proliferation of digital travel platforms is transforming how consumers plan and book their travel. In future, online travel bookings in South East Asia are expected to exceed $55 billion, driven by platforms like Agoda and Traveloka. This shift towards digital solutions enhances accessibility and convenience for travelers, allowing them to compare prices and services easily. The growing smartphone penetration, projected at 85% in urban areas, further supports this trend, making travel planning more efficient.

- Government Initiatives Promoting Tourism:Governments in South East Asia are actively promoting tourism through various initiatives. For instance, Thailand's "Amazing Thailand" campaign aims to attract 45 million international visitors in future, up from 40 million. Additionally, Malaysia's Visit Malaysia Year initiative is expected to boost tourist arrivals significantly. These initiatives not only enhance the region's visibility but also improve infrastructure and services, creating a more attractive environment for tourists.

Market Challenges

- Political Instability in Certain Regions:Political instability remains a significant challenge for the South East Asia travel market. Countries like Myanmar and Thailand have experienced political unrest, which can deter tourists. In future, it is estimated that political instability could lead to a decline of up to 20% in tourist arrivals in affected areas. This unpredictability can negatively impact the overall perception of the region as a safe travel destination, affecting long-term growth.

- Environmental Concerns and Sustainability Issues:Environmental concerns are increasingly impacting the travel and tourism sector in South East Asia. In future, it is projected that tourism-related carbon emissions will reach 220 million tons, raising alarms about sustainability. The region faces challenges such as over-tourism and habitat destruction, which can lead to stricter regulations. Addressing these issues is crucial for maintaining the region's natural beauty and ensuring sustainable tourism practices moving forward.

South East Asia Travel and Tourism Market Future Outlook

The South East Asia travel and tourism market is poised for significant evolution in the coming years, driven by a combination of technological advancements and changing consumer preferences. As travelers increasingly seek personalized and immersive experiences, the demand for tailored travel packages is expected to rise. Additionally, the focus on sustainability will likely shape travel offerings, encouraging businesses to adopt eco-friendly practices. This shift presents opportunities for growth, particularly in niche markets catering to wellness and adventure tourism, which are gaining traction among consumers.

Market Opportunities

- Expansion of Luxury Travel Segments:The luxury travel segment in South East Asia is projected to grow significantly, with an estimated market value of $35 billion in future. This growth is driven by increasing affluence among consumers and a rising demand for exclusive experiences. High-end resorts and personalized services are becoming more prevalent, catering to affluent travelers seeking unique and luxurious experiences in the region.

- Increased Focus on Wellness Tourism:Wellness tourism is emerging as a lucrative opportunity, with the market expected to reach $25 billion in South East Asia in future. This growth is fueled by a rising awareness of health and well-being among travelers. Destinations offering wellness retreats, spa services, and holistic experiences are becoming increasingly popular, attracting health-conscious tourists looking for rejuvenation and relaxation during their travels.