Region:Asia

Author(s):Dev

Product Code:KRAA3589

Pages:95

Published On:September 2025

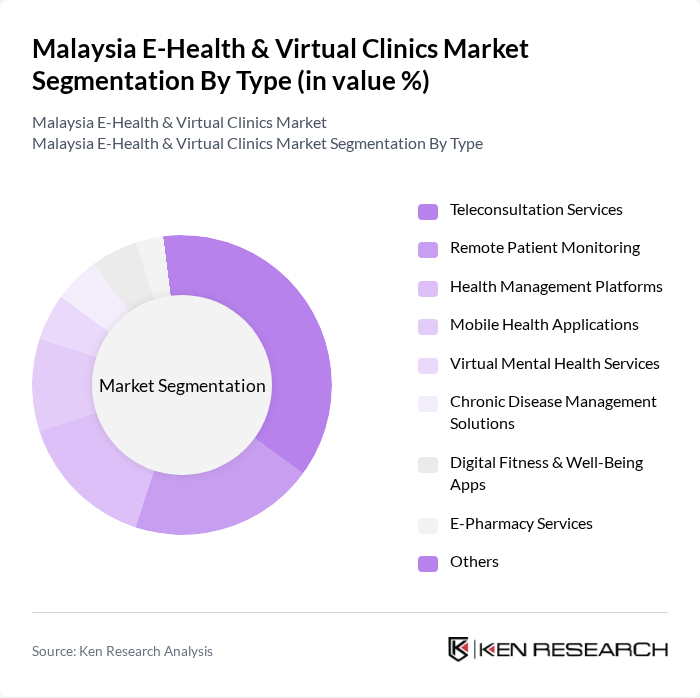

By Type:The market is segmented into various types, including Teleconsultation Services, Remote Patient Monitoring, Health Management Platforms, Mobile Health Applications, Virtual Mental Health Services, Chronic Disease Management Solutions, Digital Fitness & Well-Being Apps, E-Pharmacy Services, and Others. Among these, Teleconsultation Services have emerged as the leading segment due to the increasing preference for remote consultations, especially during the pandemic. Consumers appreciate the convenience and accessibility of virtual healthcare, which has led to a surge in demand for these services. The Digital Fitness & Well-Being segment has shown particularly strong growth, with young Malaysians increasingly inclined towards digital fitness apps for health tracking and maintaining active lifestyles.

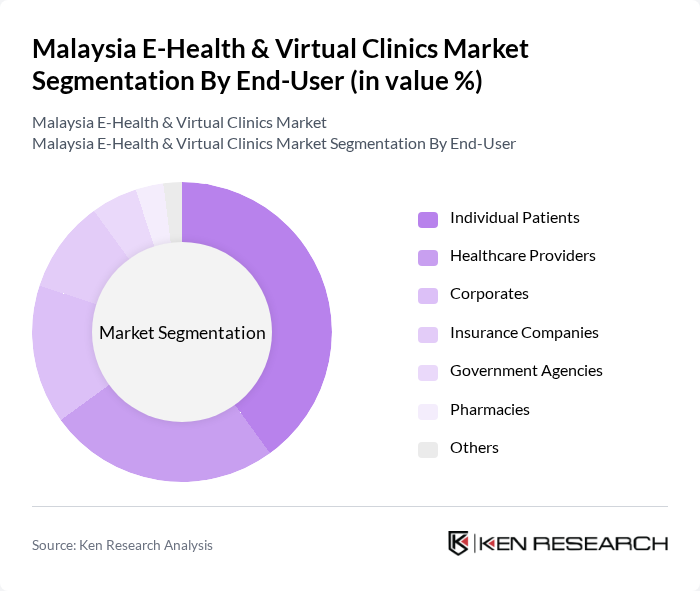

By End-User:The end-user segmentation includes Individual Patients, Healthcare Providers, Corporates, Insurance Companies, Government Agencies, Pharmacies, and Others. Individual Patients represent the largest segment, driven by the growing trend of self-care and the increasing use of telehealth services for routine consultations. The convenience of accessing healthcare from home has made this segment particularly appealing, especially among younger demographics. Mobile penetration and increasing health awareness are driving digital health adoption, with consumers increasingly shifting toward fitness-tracking apps, telemedicine consultations, and nutrition coaching via smartphones.

The Malaysia E-Health & Virtual Clinics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DoctorOnCall, Teleme, HealthMetrics, GetDoc, Doctor2U, BookDoc, Doc2Us, Naluri, Telehealth Malaysia, MyDoc, MClinica, HealthHub, Alpro Pharmacy, Qualitas Medical Group, Caring Pharmacy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia E-Health and Virtual Clinics market appears promising, driven by technological advancements and changing consumer preferences. As the healthcare landscape evolves, the integration of artificial intelligence and machine learning will enhance service delivery and patient outcomes. Additionally, the increasing focus on mental health services will likely lead to the development of specialized telehealth platforms, catering to diverse patient needs. These trends indicate a robust growth trajectory for the e-health sector in Malaysia, fostering innovation and improved healthcare access.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Services Remote Patient Monitoring Health Management Platforms Mobile Health Applications Virtual Mental Health Services Chronic Disease Management Solutions Digital Fitness & Well-Being Apps E-Pharmacy Services Others |

| By End-User | Individual Patients Healthcare Providers Corporates Insurance Companies Government Agencies Pharmacies Others |

| By Application | Primary Care Specialist Consultations Emergency Services Follow-Up Care Preventive Health Services Chronic Disease Management Mental Health Support Others |

| By Distribution Channel | Direct-to-Consumer B2B Partnerships Online Platforms Mobile Applications Pharmacies Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Freemium Model Others |

| By Technology | Cloud-Based Solutions AI-Driven Platforms Mobile Technologies Wearable Devices Integration Blockchain for Health Records Others |

| By User Demographics | Age Groups Income Levels Geographic Locations Urban vs Rural Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Users | 100 | Patients, Caregivers |

| Healthcare Providers in Virtual Clinics | 60 | Doctors, Clinic Administrators |

| Technology Providers for E-Health Solutions | 40 | IT Managers, Product Developers |

| Regulatory Bodies and Health Policy Makers | 50 | Health Policy Analysts, Government Officials |

| Patients with Chronic Conditions | 80 | Chronic Disease Patients, Health Advocates |

The Malaysia E-Health & Virtual Clinics Market is valued at approximately USD 620 million, reflecting significant growth driven by the increasing adoption of digital health solutions and the rising demand for convenient healthcare services.