Region:Asia

Author(s):Geetanshi

Product Code:KRAB2742

Pages:83

Published On:October 2025

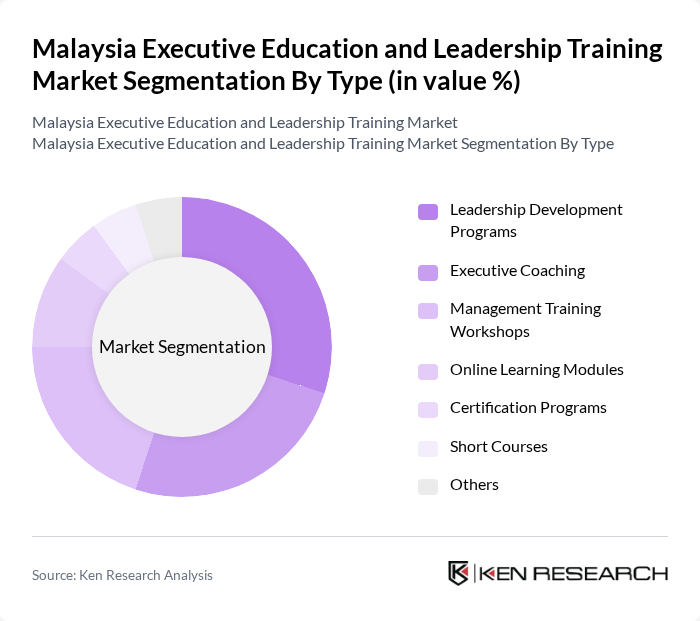

By Type:The market is segmented into various types of educational offerings, including Leadership Development Programs, Executive Coaching, Management Training Workshops, Online Learning Modules, Certification Programs, Short Courses, and Others. Each of these sub-segments caters to different needs and preferences of professionals seeking to enhance their leadership capabilities.

The Leadership Development Programs segment is currently dominating the market due to the increasing recognition of the importance of effective leadership in driving organizational success. Corporations are investing heavily in these programs to cultivate future leaders who can navigate complex business environments. The trend towards personalized learning experiences and the integration of technology in training delivery further enhance the appeal of leadership development initiatives.

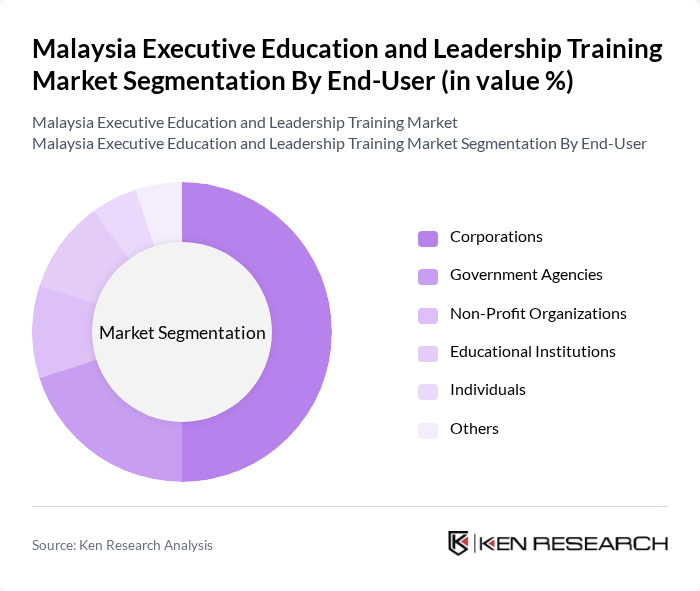

By End-User:The market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Each segment reflects the diverse range of stakeholders who seek executive education and leadership training to enhance their operational effectiveness and strategic capabilities.

Corporations are the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the increasing need for organizations to develop their leadership talent to remain competitive in a globalized economy. Companies are increasingly recognizing that investing in executive education is essential for fostering innovation, improving employee engagement, and achieving strategic objectives.

The Malaysia Executive Education and Leadership Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universiti Malaya, Asia School of Business, INSEAD, Malaysian Institute of Management, Monash University Malaysia, Universiti Kebangsaan Malaysia, Universiti Putra Malaysia, Taylor's University, HELP University, Sunway University, UCSI University, Universiti Sains Malaysia, Universiti Teknologi Malaysia, ELM Business School, The University of Nottingham Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education and leadership training market in Malaysia appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly prioritize leadership development, the integration of innovative training methods, such as virtual reality and gamification, is expected to enhance engagement. Furthermore, the focus on soft skills and emotional intelligence will likely shape curriculum offerings, ensuring that training programs remain relevant and effective in preparing leaders for future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Executive Coaching Management Training Workshops Online Learning Modules Certification Programs Short Courses Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Virtual Training Hybrid Training On-Demand Learning Others |

| By Duration | Short-Term Programs (1-3 days) Medium-Term Programs (1-3 months) Long-Term Programs (6 months and above) Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Services Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Others |

| By Pricing Tier | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Training Programs | 120 | HR Managers, Training Coordinators |

| Leadership Development Workshops | 90 | Department Heads, Team Leaders |

| Online Learning Platforms for Executives | 80 | eLearning Specialists, IT Managers |

| Industry-Specific Leadership Training | 70 | Industry Experts, Training Consultants |

| Feedback on Training Effectiveness | 110 | Program Participants, Alumni |

The Malaysia Executive Education and Leadership Training Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for skilled leadership across various sectors and the rise of digital learning platforms.