Region:Asia

Author(s):Rebecca

Product Code:KRAB4129

Pages:91

Published On:October 2025

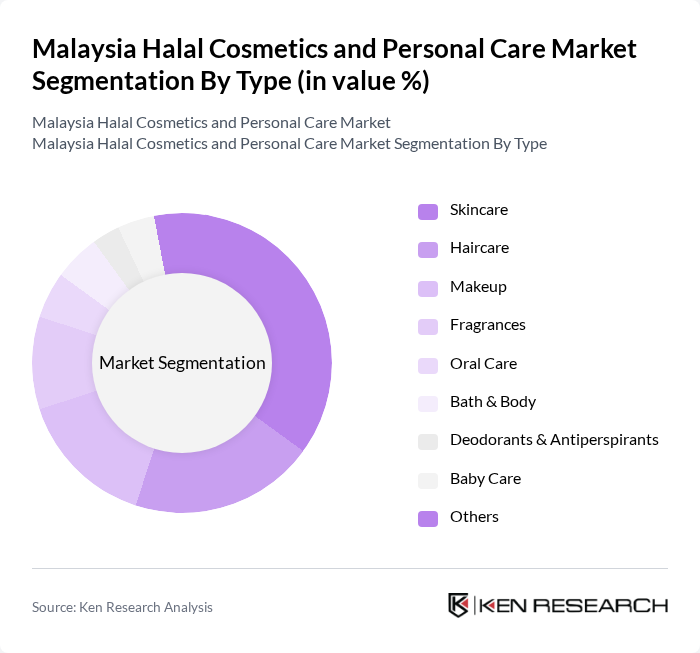

By Type:The market is segmented into various types, including skincare, haircare, makeup, fragrances, oral care, bath & body, deodorants & antiperspirants, baby care, and others. Among these,skincare products dominate the marketdue to the increasing focus on skin health and beauty, driven by consumer awareness and the influence of social media. The demand for natural and organic skincare products is particularly high, reflecting a broader trend towards health and wellness. The rise in vegan and cruelty-free claims within halal cosmetics is also notable, as consumers seek products that align with both religious and ethical values.

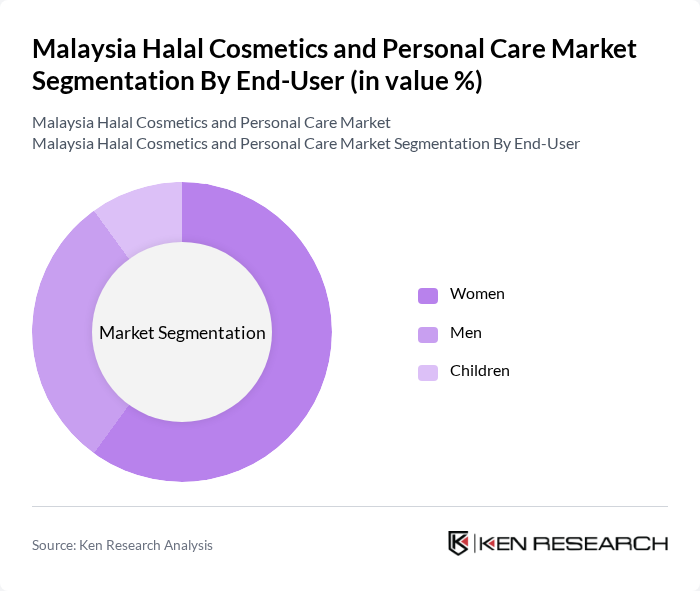

By End-User:The end-user segmentation includes women, men, and children.Women represent the largest segment, driven by their higher spending on beauty and personal care products. The increasing trend of men’s grooming is also notable, with a growing number of male consumers seeking halal-certified products. Children’s products are gaining traction as parents become more conscious of the ingredients in cosmetics and personal care items. Demand for hypoallergenic and gentle formulations is rising in the children’s segment, reflecting heightened parental concern for product safety and ingredient transparency.

The Malaysia Halal Cosmetics and Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aiken (Wipro Unza Malaysia Sdn Bhd), Wardah Cosmetics (PT Paragon Technology and Innovation), Safi (Wipro Unza Malaysia Sdn Bhd), SimplySiti (SimplySiti Sdn Bhd), Orkid Cosmetics (Orkid Cosmetics Sdn Bhd), Zawara (Zawara Cosmetics Sdn Bhd), Dherbs (Dherbs Holdings Sdn Bhd), Bio Essence (Bio-Essence Malaysia), Nurraysa (Nurraysa Global Sdn Bhd), Elysyle (Elken Sdn Bhd), Saffron (Saffron Cosmetics Sdn Bhd), Muna (Muna Cosmetics Sdn Bhd), Alha Alfa (Alha Alfa Rich Legacy Sdn Bhd), Siti Nurhaliza (SimplySiti Sdn Bhd), The Body Shop Malaysia (The Body Shop International plc, Malaysia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia halal cosmetics and personal care market appears promising, driven by increasing consumer demand for ethical and sustainable products. As the Muslim population continues to grow, reaching 22 million in the future, brands are likely to expand their offerings to cater to diverse consumer preferences. Additionally, advancements in technology will facilitate innovative product development, enhancing personalization and customization, which are becoming essential in attracting modern consumers seeking unique experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Haircare Makeup Fragrances Oral Care Bath & Body Deodorants & Antiperspirants Baby Care Others |

| By End-User | Women Men Children |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales Convenience Stores Others |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Bottles Tubes Jars Sachets Pumps & Sprays |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Halal Cosmetics | 120 | Female Consumers, Aged 18-45 |

| Retail Insights from Halal Beauty Stores | 60 | Store Managers, Beauty Advisors |

| Manufacturers of Halal Personal Care Products | 40 | Product Development Managers, Quality Assurance Officers |

| Market Trends from Beauty Industry Experts | 40 | Industry Analysts, Market Researchers |

| Distribution Channel Analysis | 50 | Logistics Managers, Supply Chain Coordinators |

The Malaysia Halal Cosmetics and Personal Care Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by consumer demand for halal-certified products and the increasing popularity of natural and organic ingredients.