Region:Middle East

Author(s):Dev

Product Code:KRAD0497

Pages:89

Published On:August 2025

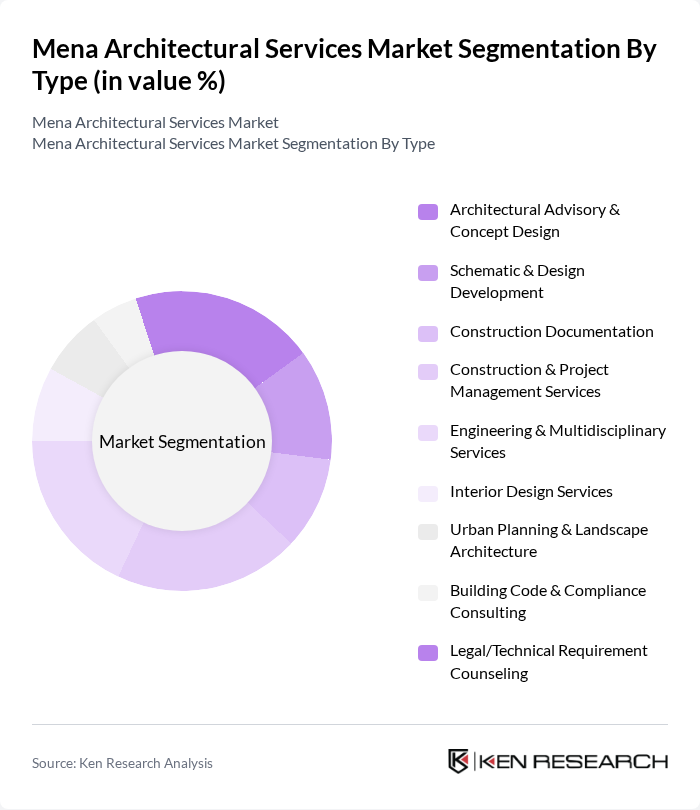

By Type:The architectural services market can be segmented into various types, including Architectural Advisory & Concept Design, Schematic & Design Development, Construction Documentation, Construction & Project Management Services, Engineering & Multidisciplinary Services, Interior Design Services, Urban Planning & Landscape Architecture, Building Code & Compliance Consulting, and Legal/Technical Requirement Counseling. Each of these subsegments plays a crucial role in the overall market dynamics.

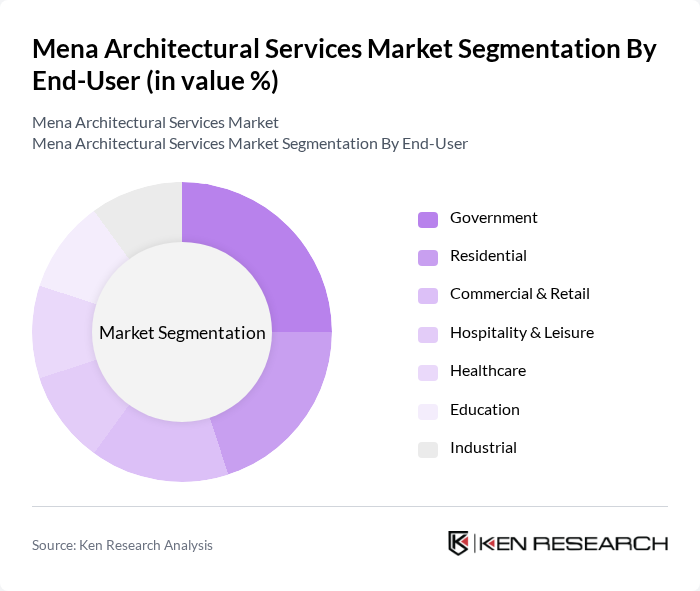

By End-User:The market can also be segmented by end-user categories, which include Government, Residential, Commercial & Retail, Hospitality & Leisure, Healthcare, Education, and Industrial. Each of these segments has unique requirements and contributes differently to the overall market.

The Mena Architectural Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as AECOM Middle East, Gensler Middle East, Perkins&Will, HOK, Zaha Hadid Architects, Foster + Partners, Kohn Pedersen Fox (KPF), Skidmore, Owings & Merrill (SOM), Buro Happold, Arup, HDR, Stantec, CallisonRTKL, AtkinsRéalis (formerly Atkins), Dar Al-Handasah (Shair and Partners), KEO International Consultants, SSH Design, Dewan Architects + Engineers, Godwin Austen Johnson (GAJ), RMJM contribute to innovation, geographic expansion, and service delivery in this space.

The MENA architectural services market is poised for significant transformation, driven by urbanization and sustainability trends. As cities expand, the demand for innovative and eco-friendly designs will intensify, prompting firms to adopt advanced technologies like Building Information Modeling (BIM). Additionally, public-private partnerships are expected to play a crucial role in funding infrastructure projects, enhancing collaboration between government and private sectors. This evolving landscape will create new opportunities for architectural firms to innovate and thrive in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Architectural Advisory & Concept Design Schematic & Design Development Construction Documentation Construction & Project Management Services Engineering & Multidisciplinary Services Interior Design Services Urban Planning & Landscape Architecture Building Code & Compliance Consulting Legal/Technical Requirement Counseling |

| By End-User | Government Residential Commercial & Retail Hospitality & Leisure Healthcare Education Industrial |

| By Region | GCC (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) North Africa (Egypt, Morocco, Algeria, Tunisia, Others) Levant (Jordan, Lebanon, Palestine, Iraq, Others) |

| By Application | New Construction Renovation & Restoration Urban Regeneration & Masterplanning |

| By Investment Source | Government Funding Private Investments International Aid & Development Finance |

| By Policy Support | Green Building Incentives & Energy Codes Grants/Tax Credits for Sustainable Projects Regulatory Support for Innovation & BIM |

| By Project Size | Small Projects Medium Projects Large & Mega Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Architectural Services | 120 | Architects, Home Builders, Interior Designers |

| Commercial Building Design | 90 | Project Managers, Real Estate Developers, Urban Planners |

| Public Infrastructure Projects | 80 | Government Officials, Civil Engineers, Contractors |

| Sustainable Architecture Initiatives | 60 | Sustainability Consultants, Architects, Policy Makers |

| Renovation and Retrofitting Services | 100 | Renovation Specialists, Building Managers, Architects |

The Mena Architectural Services Market is valued at approximately USD 12.8 billion, driven by significant infrastructure spending, mega-project pipelines, and real estate development across the GCC and North Africa, alongside a growing emphasis on sustainable and smart building designs.