Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0668

Pages:94

Published On:December 2025

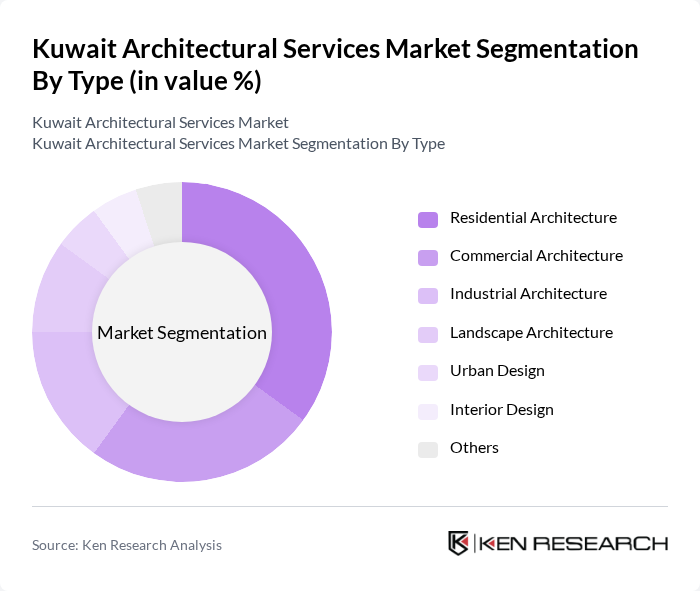

By Type:The architectural services market in Kuwait is segmented into various types, including residential architecture, commercial architecture, industrial architecture, landscape architecture, urban design, interior design, and others. Among these, residential architecture is currently the dominant segment, driven by the increasing demand for housing due to population growth and urbanization. The commercial architecture segment is also significant, fueled by the expansion of retail and office spaces in urban areas.

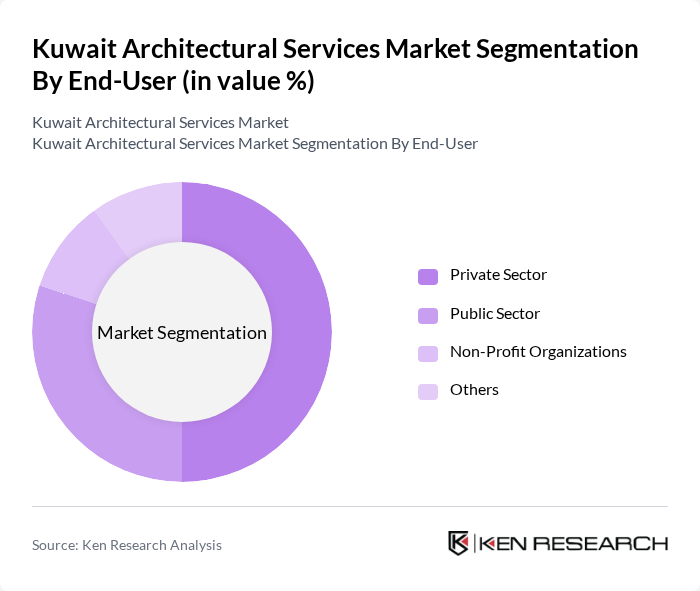

By End-User:The end-user segmentation of the architectural services market includes private sector clients, public sector clients, non-profit organizations, and others. The private sector is the leading end-user, driven by the increasing number of commercial and residential projects. The public sector also plays a crucial role, particularly in large infrastructure projects funded by government initiatives.

The Kuwait Architectural Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as KEO International Consultants, SSH International, Gulf Consult, Alghanim International, AECOM, Dar Al-Handasah, Buro Happold, Atkins, Ramboll, HOK, Perkins+Will, Zaha Hadid Architects, Foster + Partners, Gensler, SOM (Skidmore, Owings & Merrill) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait architectural services market appears promising, driven by ongoing urbanization and government initiatives aimed at enhancing infrastructure. As the demand for sustainable and technologically advanced designs grows, firms that adapt to these trends will likely thrive. Additionally, the integration of smart technologies in urban planning will reshape the architectural landscape, creating new avenues for innovation and collaboration. The focus on eco-friendly practices will further solidify the market's commitment to sustainability, ensuring long-term growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Architecture Commercial Architecture Industrial Architecture Landscape Architecture Urban Design Interior Design Others |

| By End-User | Private Sector Public Sector Non-Profit Organizations Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Others |

| By Design Complexity | Simple Designs Moderate Complexity Designs High Complexity Designs Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Service Type | Design Services Consulting Services Project Management Services Others |

| By Client Type | Individual Clients Corporate Clients Government Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Architectural Services | 100 | Architects, Homeowners, Real Estate Developers |

| Commercial Architectural Projects | 80 | Project Managers, Business Owners, Facility Managers |

| Public Sector Infrastructure Projects | 70 | Government Officials, Urban Planners, Civil Engineers |

| Sustainable Architecture Initiatives | 60 | Sustainability Consultants, Architects, Environmental Planners |

| Interior Design Services | 90 | Interior Designers, Homeowners, Commercial Space Managers |

The Kuwait Architectural Services Market is valued at approximately USD 15 billion, driven by significant government investments, infrastructure expansion, and the adoption of advanced technologies like modular construction and Building Information Modeling (BIM).