Region:Central and South America

Author(s):Rebecca

Product Code:KRAB4111

Pages:99

Published On:October 2025

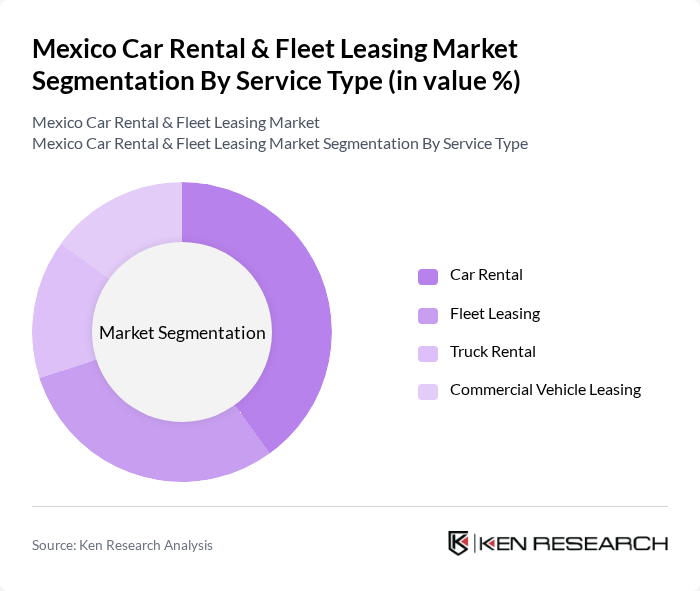

By Service Type:The service type segmentation includes car rental, fleet leasing, truck rental, and commercial vehicle leasing. Car rental remains popular among tourists and business travelers seeking flexibility, while fleet leasing is favored by corporations for operational efficiency and cost management. Truck rental and commercial vehicle leasing are increasingly utilized by logistics, e-commerce, and last-mile delivery operators to meet fluctuating demand and optimize fleet utilization .

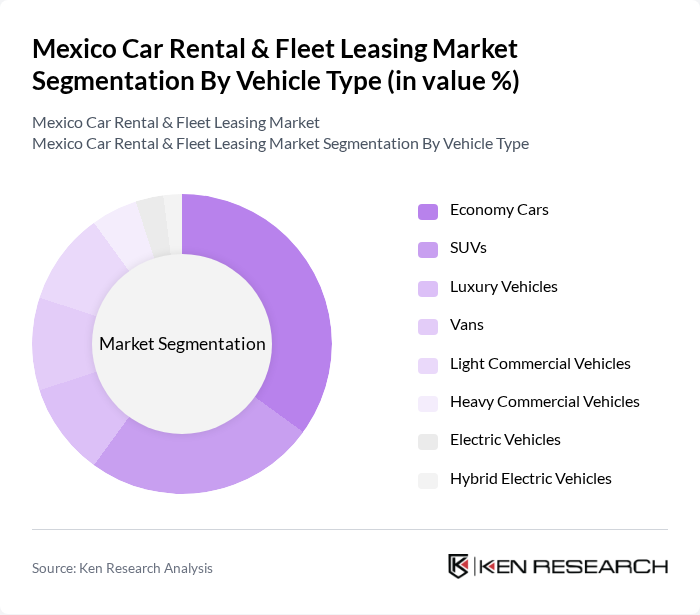

By Vehicle Type:The vehicle type segmentation covers economy cars, SUVs, luxury vehicles, vans, light commercial vehicles, heavy commercial vehicles, electric vehicles, and hybrid electric vehicles.Economy carsrepresent the largest segment, driven by cost-conscious travelers and corporate clients.SUVsandluxury vehiclesare gaining traction among tourists and executives seeking comfort and premium experiences. The adoption ofelectric and hybrid vehiclesis rising, supported by government incentives and growing environmental awareness .

The Mexico Car Rental & Fleet Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Global Holdings, Inc., Avis Budget Group, Inc., Enterprise Holdings, Inc., Sixt SE, Alamo Rent A Car, Budget Truck Rental, Penske Truck Leasing, Ryder System, Inc., U-Haul International, Inc., Localiza Rent a Car S.A., Grupo Lala (Fleet Services), Traxion (Fleet Management), Movex (Logistics & Fleet), DHL Supply Chain Mexico, and Transfar (Commercial Vehicle Rental) contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico car rental and fleet leasing market is poised for significant transformation driven by technological advancements and changing consumer preferences. The increasing adoption of digital booking platforms is expected to streamline operations, while the focus on sustainability will push companies to invest in eco-friendly vehicles. Additionally, the rise of shared mobility solutions will reshape traditional rental models, creating new opportunities for growth and innovation in the sector, particularly in urban areas.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Car Rental Fleet Leasing Truck Rental Commercial Vehicle Leasing |

| By Vehicle Type | Economy Cars SUVs Luxury Vehicles Vans Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles Hybrid Electric Vehicles |

| By End-User | Individual Consumers Corporate Clients Logistics Companies E-commerce Companies Delivery Services Government Agencies Tourism Industry |

| By Rental Duration | Short-term (Daily/Weekly) Medium-term (Monthly) Long-term (Annual) Flexible Lease Contracts |

| By Distribution Channel | Online Platforms Mobile Applications Direct Bookings Travel Agencies Corporate Contracts Airport Locations |

| By Lease Type | Closed-end Leases Open-end Leases Operating Leases Finance Leases |

| By Fleet Size | Small Fleet (1-50 vehicles) Medium Fleet (51-200 vehicles) Large Fleet (200+ vehicles) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Travelers, Vacation Planners |

| Corporate Fleet Leasing | 80 | Corporate Fleet Managers, Procurement Officers |

| Tourism Sector Rentals | 60 | Tour Operators, Hotel Managers |

| Long-term Rentals | 50 | Business Executives, Long-term Renters |

| Electric Vehicle Rentals | 40 | Environmentally Conscious Consumers, Tech-savvy Renters |

The Mexico Car Rental & Fleet Leasing Market is valued at approximately USD 3.8 billion, driven by increasing demand for mobility solutions, tourism growth, and the expansion of e-commerce and logistics sectors.