Region:Europe

Author(s):Shubham

Product Code:KRAA0895

Pages:89

Published On:August 2025

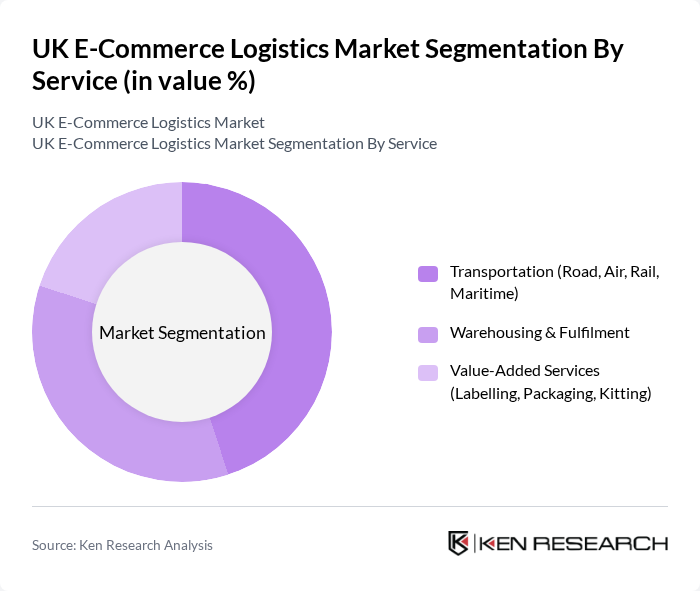

By Service:The service segment encompasses various logistics functions essential for e-commerce operations. The primary subsegments include Transportation (Road, Air, Rail, Maritime), Warehousing & Fulfilment, and Value-Added Services (Labelling, Packaging, Kitting). Each of these subsegments plays a crucial role in ensuring timely and efficient delivery of goods to consumers. Transportation remains the largest segment, reflecting the critical importance of last-mile delivery and the expansion of express and same-day services. Warehousing & Fulfilment is driven by the proliferation of fulfillment centers and automation, while Value-Added Services are increasingly integrated to support branding and customer experience .

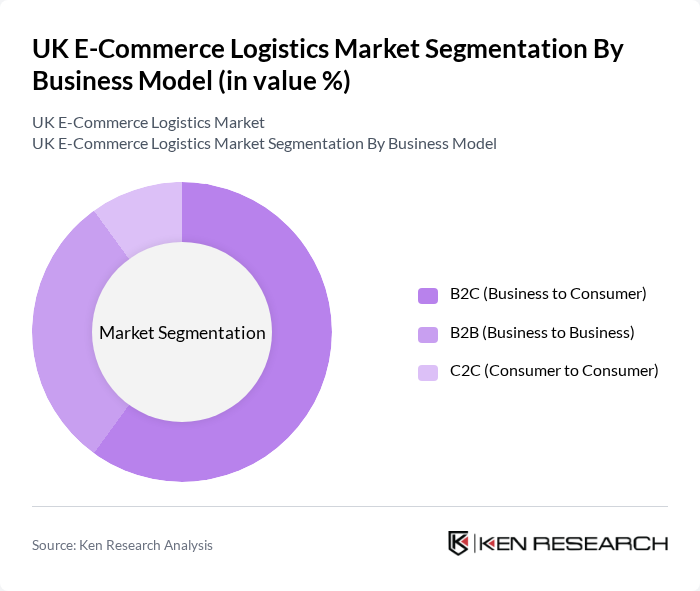

By Business Model:The business model segment categorizes logistics services based on the type of transactions they facilitate. The subsegments include B2C (Business to Consumer), B2B (Business to Business), and C2C (Consumer to Consumer). Each model has distinct logistics requirements and consumer behaviors that influence the overall market dynamics. B2C dominates due to the high volume of online retail transactions, while B2B is supported by the growth of wholesale e-commerce and integrated supply chain solutions. C2C, though smaller, is expanding with the rise of peer-to-peer marketplaces and second-hand goods platforms .

The UK E-Commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Royal Mail Group, DPD Group, Evri (formerly Hermes UK), Yodel, FedEx UK, UPS UK, Whistl, Amazon Logistics, Parcelforce Worldwide, Tuffnells, Palletways, Geodis UK, Kuehne + Nagel UK contribute to innovation, geographic expansion, and service delivery in this space.

The UK e-commerce logistics market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will likely shape logistics strategies, with more firms investing in eco-friendly practices. The demand for faster delivery options will persist, compelling logistics providers to innovate and adapt to meet the expectations of a dynamic consumer base in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation (Road, Air, Rail, Maritime) Warehousing & Fulfilment Value-Added Services (Labelling, Packaging, Kitting) |

| By Business Model | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

| By Destination | Domestic Cross-Border – Inbound Cross-Border – Outbound |

| By Delivery Speed | Same-Day Delivery (<24h) Next-Day Delivery (24–48h) Standard Delivery (3–5 days) Economy (>5 days) Others |

| By Product Category | Foods & Beverages Personal & Household Care Fashion & Lifestyle (Accessories, Apparel, Footwear) Furniture Electronics & Household Appliances Other Products |

| By City-Tier | Tier 1 Tier 2 Tier 3 & Below |

| By Geography | England Scotland Wales Northern Ireland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 60 | Logistics Coordinators, Delivery Managers |

| Returns Management Strategies | 50 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Technologies | 40 | Warehouse Managers, IT Specialists |

| Cross-Border E-commerce Logistics | 45 | International Trade Managers, Compliance Officers |

| Sustainability in Logistics | 50 | Sustainability Managers, Supply Chain Analysts |

The UK E-Commerce Logistics Market is valued at approximately USD 20.7 billion, reflecting significant growth driven by the increasing popularity of online shopping and advancements in logistics technology.