Region:Central and South America

Author(s):Shubham

Product Code:KRAA4708

Pages:81

Published On:September 2025

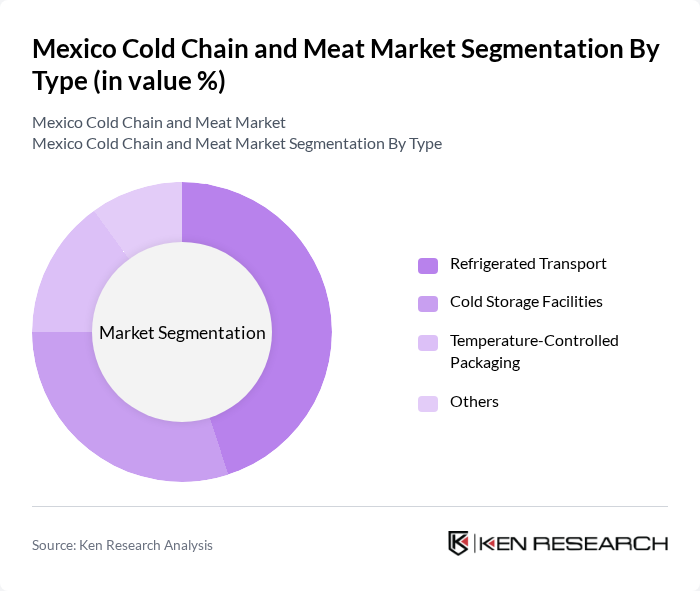

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for efficient logistics solutions that ensure the safe delivery of perishable goods. The rise in e-commerce and online grocery shopping has further amplified the need for reliable refrigerated transport services.

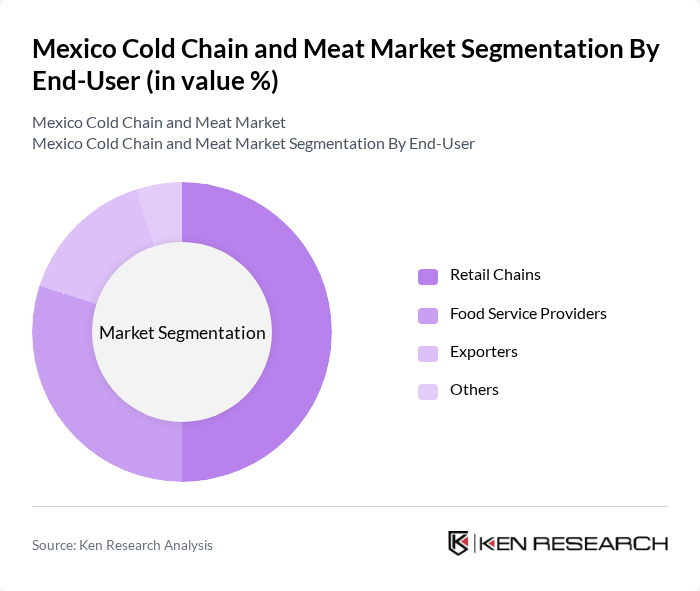

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Exporters, and Others. Retail Chains dominate this segment, driven by the growing trend of organized retailing and the increasing consumer demand for fresh meat products. The expansion of supermarkets and hypermarkets has necessitated the establishment of robust cold chain systems to maintain product quality and safety.

The Mexico Cold Chain and Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bafar, Sigma Alimentos, JBS USA, Tyson Foods, Alsea, SuKarne, Cargill, Pilgrim's Pride, Grupo Lala, Bachoco, Nutriara Alimentos, Frigorificos de Mexico, Productos del Campo, Empacadora de Carnes de Monterrey, Carnes de la Huasteca contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico cold chain and meat market appears promising, driven by technological advancements and increasing consumer demand for quality products. As the government continues to invest in infrastructure improvements, the efficiency of cold chain logistics is expected to enhance significantly. Furthermore, the growing trend towards sustainable practices will likely encourage companies to adopt eco-friendly technologies, ensuring compliance with evolving regulations and meeting consumer expectations for transparency and quality.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Retail Chains Food Service Providers Exporters Others |

| By Distribution Mode | Direct Sales Online Sales Wholesale Distribution Others |

| By Application | Meat Processing Retail Sales Export Markets Others |

| By Price Range | Premium Products Mid-Range Products Budget Products Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Skin Packaging Others |

| By Certification Type | Organic Certification Halal Certification Quality Assurance Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Chain Logistics Providers | 100 | Logistics Managers, Operations Directors |

| Meat Processing Plants | 80 | Plant Managers, Quality Assurance Officers |

| Retail Meat Outlets | 70 | Store Managers, Supply Chain Coordinators |

| Food Service Operators | 60 | Purchasing Managers, Executive Chefs |

| Consumer Insights on Meat Products | 90 | General Consumers, Health-Conscious Shoppers |

The Mexico Cold Chain and Meat Market is valued at approximately USD 15 billion, driven by increasing demand for fresh and frozen meat products and the expansion of retail chains and food service providers, necessitating efficient cold chain logistics.