Region:Middle East

Author(s):Shubham

Product Code:KRAC4933

Pages:100

Published On:October 2025

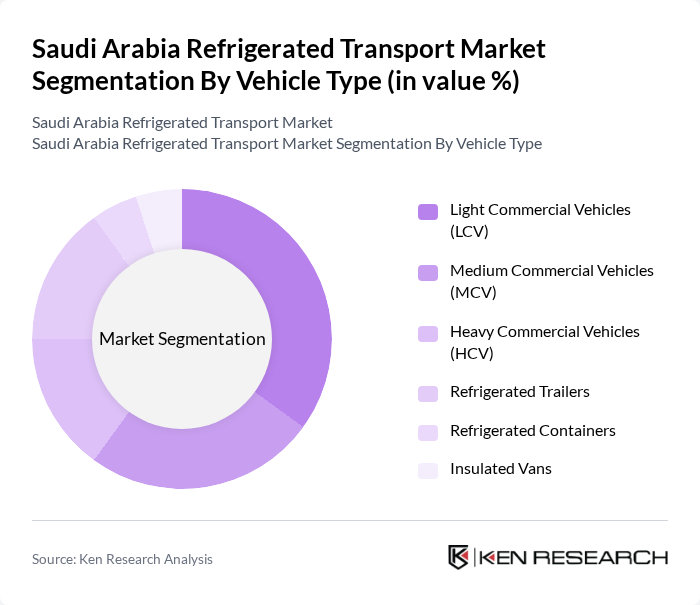

By Vehicle Type:

The vehicle type segmentation includes Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), Heavy Commercial Vehicles (HCV), Refrigerated Trailers, Refrigerated Containers, and Insulated Vans. Among these, Light Commercial Vehicles (LCV) dominate the market due to their versatility and suitability for urban deliveries. The increasing trend of online grocery shopping has further boosted the demand for LCVs, as they are ideal for navigating city traffic and delivering smaller loads efficiently. Additionally, the growth of the food and beverage sector has led to a higher adoption of refrigerated trailers and containers, which are essential for transporting larger quantities of perishable goods .

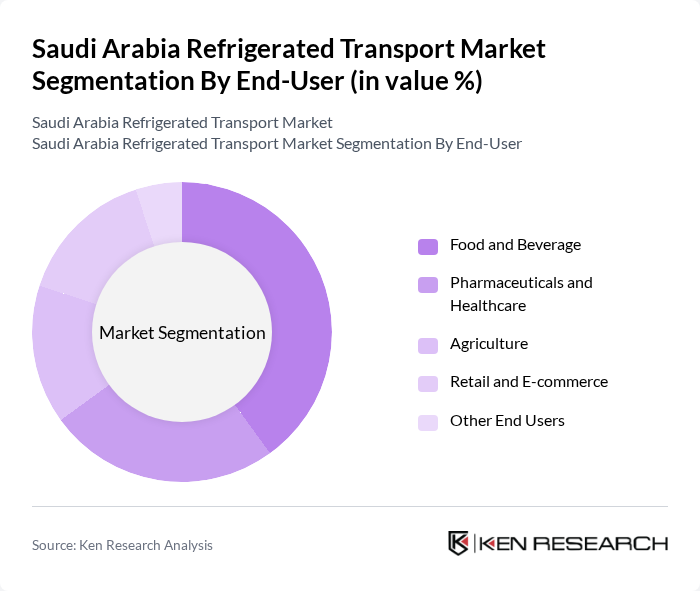

By End-User:

The end-user segmentation encompasses Food and Beverage, Pharmaceuticals and Healthcare, Agriculture, Retail and E-commerce, and Other End Users. The Food and Beverage sector is the leading segment, driven by the rising consumer demand for fresh and frozen products. The growth of the e-commerce sector has also significantly impacted the Retail and E-commerce segment, as more consumers prefer online shopping for groceries and other perishable items. The Pharmaceuticals and Healthcare segment is gaining traction due to the increasing need for temperature-controlled transport for vaccines and other medical supplies, further diversifying the market .

The Saudi Arabia Refrigerated Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Logistics Company (SAL), Almarai Company, Gulf Agency Company (GAC), Almajdouie Logistics, Agility Logistics, Kuehne+Nagel Saudi Arabia, DHL Group Saudi Arabia, Red Sea Global, Al-Watania Poultry, Al-Qassim Agricultural Products, Al-Babtain Group, Al-Suwaidi Industrial Services, Al-Futtaim Logistics, Thermo King Saudi Arabia, Carrier Transicold Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the refrigerated transport market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer awareness regarding food safety. The integration of IoT technologies is expected to enhance tracking and monitoring capabilities, improving efficiency. Additionally, the shift towards electric refrigerated vehicles aligns with global sustainability trends, potentially reducing operational costs and emissions. As the market evolves, companies that adapt to these changes will likely gain a competitive edge in the growing landscape.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Light Commercial Vehicles (LCV) Medium Commercial Vehicles (MCV) Heavy Commercial Vehicles (HCV) Refrigerated Trailers Refrigerated Containers Insulated Vans |

| By End-User | Food and Beverage Pharmaceuticals and Healthcare Agriculture Retail and E-commerce Other End Users |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms |

| By Tonnage Capacity | Less than 10 tons to 20 tons More than 20 tons |

| By Application | Frozen Goods Transport Chilled Goods Transport Temperature-Controlled Transport |

| By Sales Channel | Online Sales Offline Sales |

| By Region | Riyadh Jeddah Dammam Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 70 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 50 | Operations Managers, Quality Assurance Heads |

| Retail Refrigerated Transport | 40 | Procurement Officers, Store Managers |

| Cold Storage Facility Operations | 40 | Facility Managers, Inventory Control Specialists |

| Logistics Technology Solutions | 40 | IT Managers, Technology Officers |

The Saudi Arabia Refrigerated Transport Market is valued at approximately USD 350 million, driven by the increasing demand for temperature-sensitive goods in sectors like food and beverage, as well as pharmaceuticals, alongside the growth of e-commerce and retail activities.