Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4783

Pages:98

Published On:September 2025

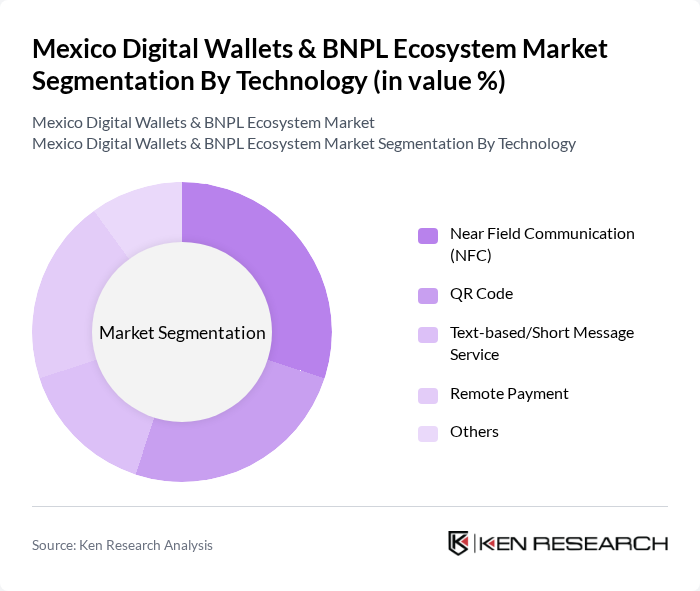

By Technology:The technology segment encompasses various methods of digital payment, including Near Field Communication (NFC), QR Code, Text-based/Short Message Service, Remote Payment, and others. Each of these technologies caters to different consumer preferences and usage scenarios, contributing to the overall growth of the market. NFC and QR code payments are increasingly popular due to their convenience and compatibility with smartphones, while remote payments and SMS-based solutions remain relevant for broader accessibility .

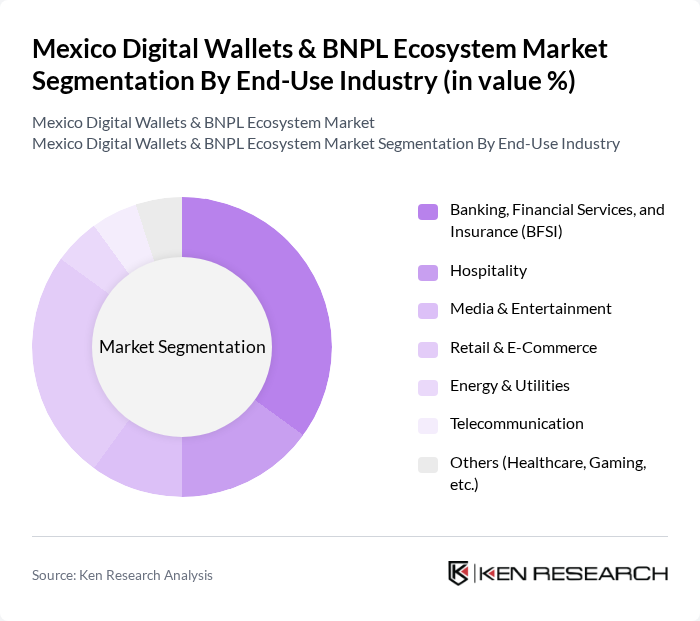

By End-Use Industry:The end-use industry segment includes Banking, Financial Services, and Insurance (BFSI), Hospitality, Media & Entertainment, Retail & E-Commerce, Energy & Utilities, Telecommunication, and others. Each industry utilizes digital wallets and BNPL solutions to enhance customer experience and streamline payment processes. The BFSI and retail sectors are leading adopters, leveraging digital payment solutions to drive customer engagement and operational efficiency .

The Mexico Digital Wallets & BNPL Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Pago, Clip, Kueski, PayPal México, OXXO Pay, BBVA Wallet, Citibanamex, Santander Wallet, Banorte, RappiPay, Dapp, Aplazo, Klar, Nubank México, Bitso, Conekta, Saldazo, Prisma, Stripe México contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico digital wallets and BNPL ecosystem appears promising, driven by technological advancements and changing consumer behaviors. As smartphone penetration continues to rise, more consumers will engage with digital financial services. Additionally, the increasing integration of digital wallets with e-commerce platforms will enhance user experience. Companies that prioritize security and compliance will likely gain consumer trust, paving the way for sustained growth in this sector. The focus on innovation will further shape the landscape, creating new opportunities for market players.

| Segment | Sub-Segments |

|---|---|

| By Technology | Near Field Communication (NFC) QR Code Text-based/Short Message Service Remote Payment Others |

| By End-Use Industry | Banking, Financial Services, and Insurance (BFSI) Hospitality Media & Entertainment Retail & E-Commerce Energy & Utilities Telecommunication Others (Healthcare, Gaming, etc.) |

| By Sales Channel | Direct Sales Online Marketplaces Mobile Applications Retail Partnerships Others |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash Payments Digital Currencies Others |

| By Demographic | Age Groups (18-24, 25-34, 35-44, etc.) Income Levels (Low, Middle, High) Urban vs Rural Others |

| By Customer Type | Individual Users Business Users Government Entities Others |

| By Geographic Distribution | Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users, Non-Users |

| BNPL Adoption Among Retailers | 60 | Retail Managers, E-commerce Managers |

| Merchant Perspectives on Digital Payments | 50 | Small Business Owners, Franchise Operators |

| Consumer Attitudes Towards BNPL | 100 | Millennials, Gen Z, Low-Income Consumers |

| Regulatory Impact on Digital Payments | 40 | Policy Makers, Financial Regulators |

The Mexico Digital Wallets and BNPL Ecosystem Market is valued at approximately USD 26 billion, driven by the increasing adoption of smartphones, e-commerce growth, and a shift towards cashless transactions.