Region:Central and South America

Author(s):Shubham

Product Code:KRAA1063

Pages:94

Published On:August 2025

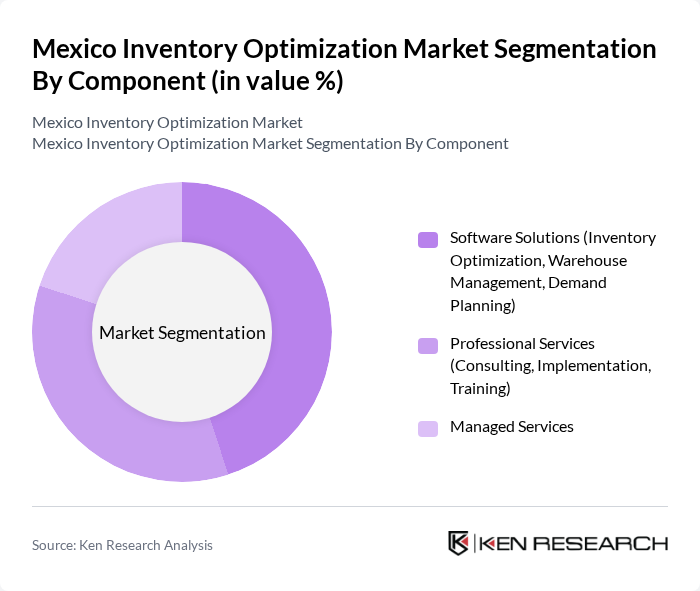

By Component:The components of the market include Software Solutions, Professional Services, and Managed Services. Software Solutions encompass inventory optimization, warehouse management, and demand planning, which are critical for businesses aiming to enhance operational efficiency and visibility. Professional Services include consulting, implementation, and training, supporting organizations in effectively utilizing inventory optimization tools and integrating them with existing systems. Managed Services provide ongoing support, monitoring, and management of inventory systems, ensuring optimal performance and adaptability to changing business needs .

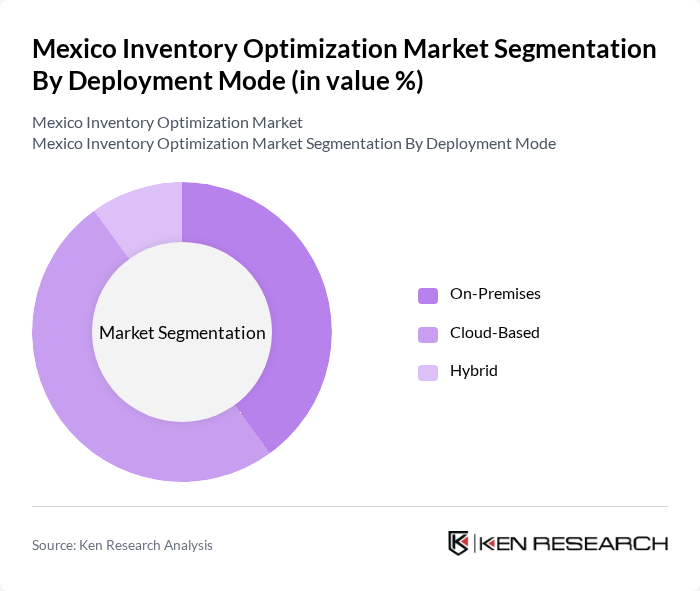

By Deployment Mode:The market is segmented into On-Premises, Cloud-Based, and Hybrid deployment modes. On-Premises solutions are preferred by large enterprises due to their control over data and security, especially in regulated industries. Cloud-Based solutions are gaining traction among SMEs for their scalability, lower upfront investment, and ease of integration with other digital tools. Hybrid models combine the benefits of both, allowing businesses to tailor their inventory management systems to specific operational and regulatory requirements, supporting flexibility and business continuity .

The Mexico Inventory Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, IBM, Microsoft, Kinaxis, Epicor Software Corporation, NetSuite (Oracle NetSuite), Fishbowl Inventory, Zoho Inventory, SkuVault, TradeGecko (now QuickBooks Commerce), Solistica, DHL Supply Chain, CEVA Logistics, and Ryder System, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory optimization market in Mexico appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and responsiveness, the adoption of cloud-based solutions and IoT integration is expected to rise. Furthermore, the focus on sustainability will likely shape inventory practices, encouraging companies to adopt greener technologies and processes. This shift will not only enhance operational efficiency but also align with global sustainability goals, positioning Mexican firms competitively in the international market.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Solutions (Inventory Optimization, Warehouse Management, Demand Planning) Professional Services (Consulting, Implementation, Training) Managed Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Retail & E-commerce Manufacturing Automotive Healthcare & Pharmaceuticals Food & Beverages Transportation & Logistics Others |

| By Geographic Region | Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, eCommerce Directors |

| Warehouse Management Systems | 60 | Warehouse Managers, IT Systems Analysts |

| Inventory Technology Adoption | 50 | Chief Technology Officers, Innovation Managers |

The Mexico Inventory Optimization Market is valued at approximately USD 820 million, reflecting a significant growth driven by the demand for efficient supply chain management and the adoption of advanced technologies like AI and IoT.