Region:Africa

Author(s):Shubham

Product Code:KRAA1080

Pages:92

Published On:August 2025

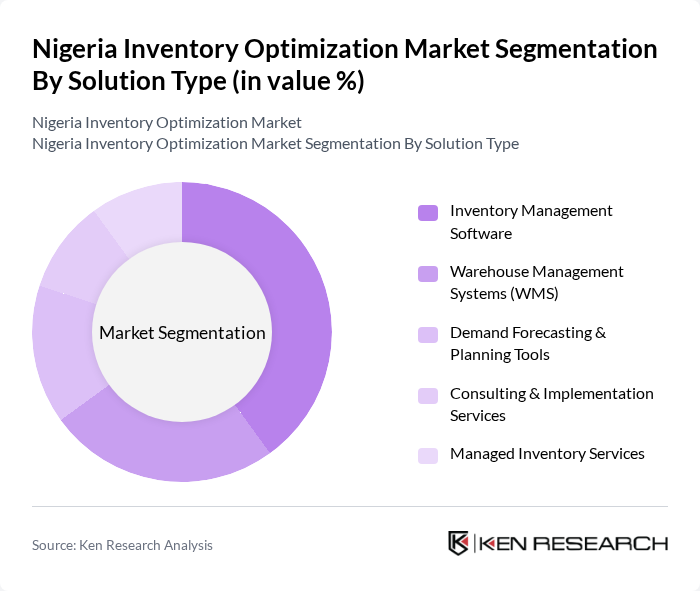

By Solution Type:The solution type segmentation includes Inventory Management Software, Warehouse Management Systems (WMS), Demand Forecasting & Planning Tools, Consulting & Implementation Services, and Managed Inventory Services. Inventory Management Software leads this segment due to its essential role in automating inventory processes, reducing human errors, and improving efficiency. The increasing adoption of cloud-based and integrated solutions is accelerating growth in this area .

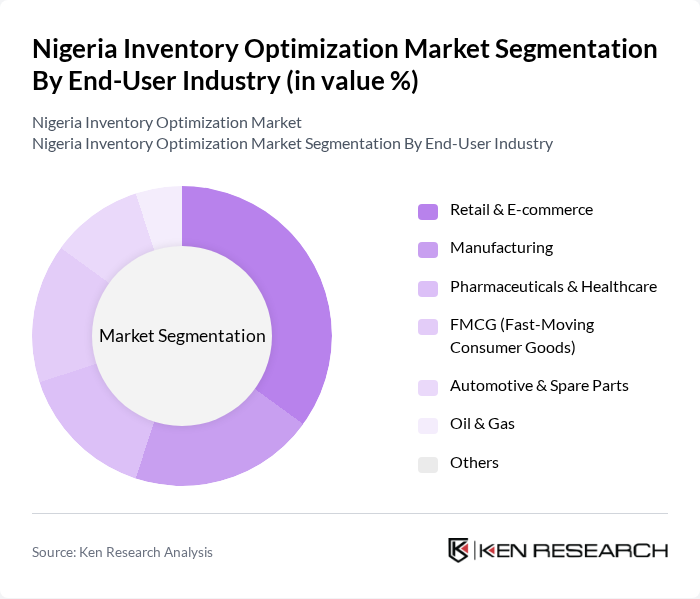

By End-User Industry:This segmentation includes Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, FMCG (Fast-Moving Consumer Goods), Automotive & Spare Parts, Oil & Gas, and Others. Retail & E-commerce is the dominant subsegment, driven by the rapid expansion of online shopping and the critical need for efficient inventory management to meet consumer expectations. The manufacturing and FMCG sectors are also major contributors, as they increasingly rely on sophisticated inventory optimization to streamline operations and minimize costs .

The Nigeria Inventory Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Logistics, Konga, DHL Supply Chain Nigeria, Interswitch, FedEx Nigeria, GIG Logistics, Aramex Nigeria, UPS Nigeria, Redline Logistics, Maersk Nigeria, SAP Africa, Oracle Nigeria, TradeDepot, Wema Logistics, and ABC Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's inventory optimization market appears promising, driven by technological advancements and increasing demand for efficient supply chain solutions. As businesses continue to embrace automation and real-time data analytics, the landscape will evolve significantly. The focus on sustainability and digital transformation will further shape the market, encouraging companies to adopt innovative practices that enhance operational efficiency and reduce environmental impact, ultimately positioning them for long-term success in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Inventory Management Software Warehouse Management Systems (WMS) Demand Forecasting & Planning Tools Consulting & Implementation Services Managed Inventory Services |

| By End-User Industry | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare FMCG (Fast-Moving Consumer Goods) Automotive & Spare Parts Oil & Gas Others |

| By Deployment Mode | On-premise Cloud-based Hybrid |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Sales Channel | Direct Sales Channel Partners Online Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 70 | Operations Managers, Production Supervisors |

| E-commerce Inventory Strategies | 60 | eCommerce Managers, Logistics Coordinators |

| Warehouse Management Systems | 50 | Warehouse Managers, IT Systems Analysts |

| Logistics Service Providers | 40 | Business Development Managers, Client Relationship Managers |

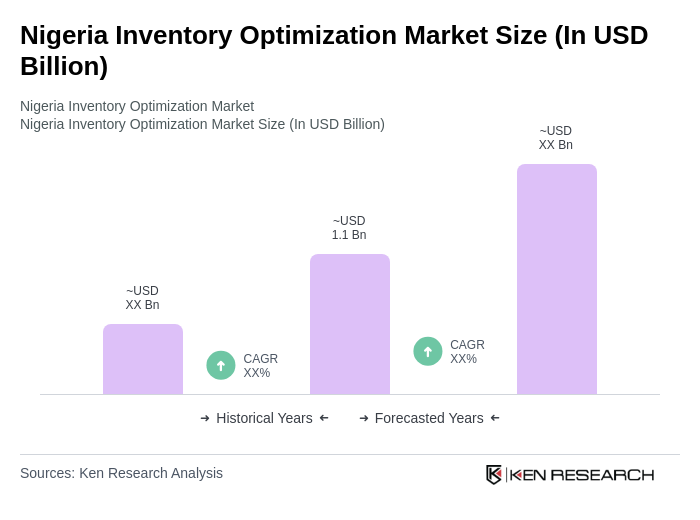

The Nigeria Inventory Optimization Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient supply chain management solutions and the rise of e-commerce activities.