Region:Central and South America

Author(s):Shubham

Product Code:KRAB6252

Pages:88

Published On:October 2025

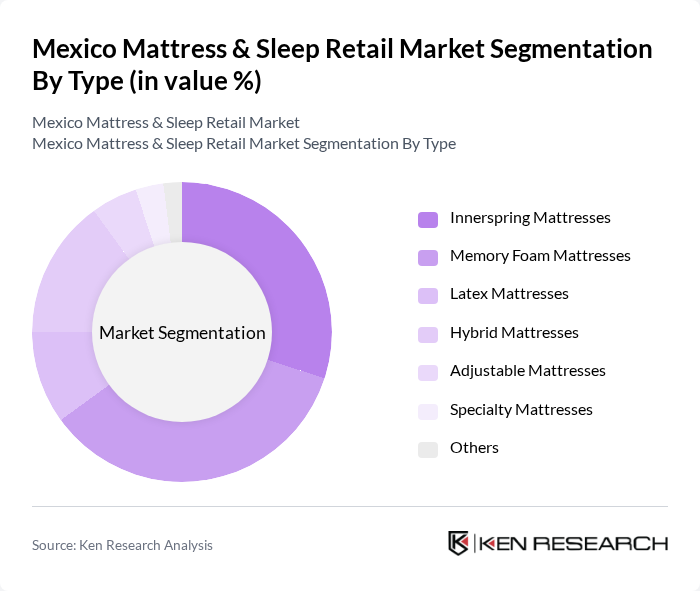

By Type:The mattress market can be segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Mattresses, Specialty Mattresses, and Others. Among these, Memory Foam Mattresses have gained significant popularity due to their comfort and support, catering to the growing demand for personalized sleep solutions. Innerspring Mattresses remain a traditional favorite, appealing to consumers seeking affordability and familiarity. The trend towards hybrid models is also rising, combining the benefits of different materials to enhance sleep quality.

By End-User:The end-user segmentation includes Residential, Hotels and Hospitality, Healthcare Facilities, Educational Institutions, Corporate Offices, and Others. The Residential segment dominates the market, driven by increasing consumer spending on home furnishings and a growing awareness of the importance of sleep quality. The Hotels and Hospitality sector is also significant, as establishments invest in high-quality mattresses to enhance guest experiences. The Healthcare Facilities segment is expanding, focusing on specialized mattresses for patient comfort and support.

The Mexico Mattress & Sleep Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Serta Simmons Bedding, LLC, Sleep Number Corporation, Ashley Furniture Industries, Inc., Zinus, Inc., IKEA, Sealy Mattress Company, Purple Innovation, LLC, Tempur-Pedic, Restonic Corporation, DreamCloud, Saatva, Helix Sleep, Nectar Sleep, Avocado Green Mattress contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico mattress market is poised for continued growth, driven by increasing consumer awareness of sleep health and rising disposable incomes. As more consumers prioritize quality sleep, the demand for innovative and premium products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Specialty Mattresses Others |

| By End-User | Residential Hotels and Hospitality Healthcare Facilities Educational Institutions Corporate Offices Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Foam Fabric Metal Wood Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| By Brand Positioning | Value Brands Mid-Tier Brands Premium Brands Luxury Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 150 | Homeowners, Renters aged 25-55 |

| Retailer Insights on Sleep Products | 100 | Store Managers, Sales Representatives |

| Health Professionals' Perspectives | 50 | Sleep Specialists, General Practitioners |

| Online Shopping Behavior | 80 | Frequent Online Shoppers, E-commerce Users |

| Market Trends and Innovations | 60 | Industry Analysts, Product Developers |

The Mexico Mattress & Sleep Retail Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increased consumer awareness of sleep health and rising disposable incomes.