Region:Middle East

Author(s):Dev

Product Code:KRAC4796

Pages:88

Published On:October 2025

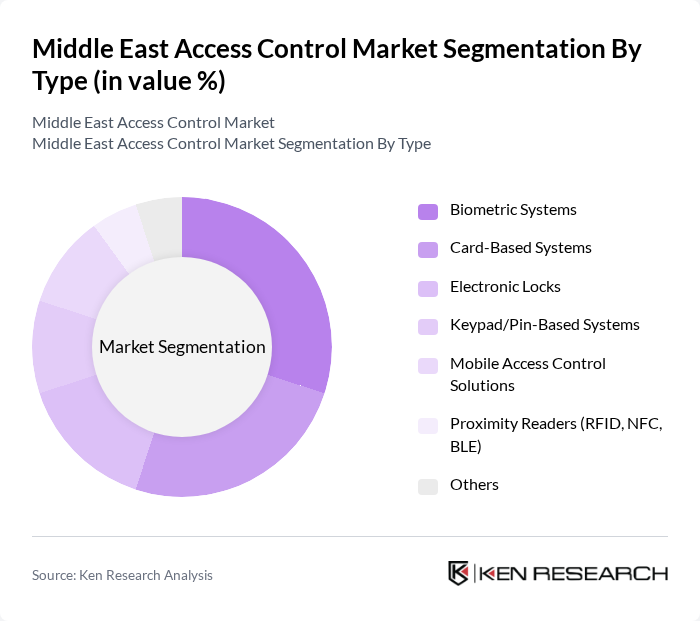

By Type:The access control market can be segmented into Biometric Systems, Card-Based Systems, Electronic Locks, Keypad/Pin-Based Systems, Mobile Access Control Solutions, Proximity Readers (RFID, NFC, BLE), and Others. Biometric Systems are gaining significant traction due to their high security, accuracy, and user-friendly features. The increasing adoption of mobile access control solutions is also noteworthy, driven by the integration of smartphones, mobile credentials, and cloud connectivity in modern security systems. Proximity readers, including RFID, NFC, and BLE, remain widely used in commercial and government sectors, while electronic locks and keypad systems continue to serve residential and small business applications .

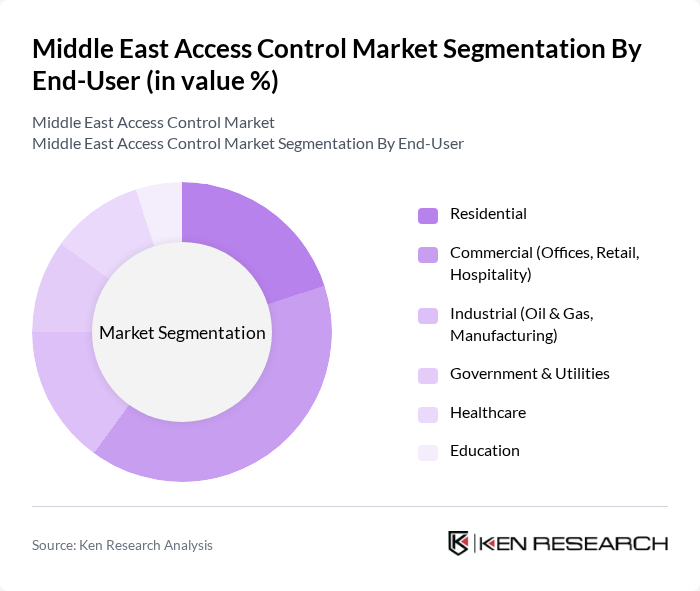

By End-User:The market is segmented by end-user categories, including Residential, Commercial (Offices, Retail, Hospitality), Industrial (Oil & Gas, Manufacturing), Government & Utilities, Healthcare, and Education. The Commercial segment leads the market, driven by the increasing need for security in office buildings, retail spaces, and hospitality venues. The Healthcare sector is also witnessing growth, propelled by regulatory requirements for secure access to sensitive areas and the protection of patient data. Industrial applications, particularly in oil & gas and manufacturing, are expanding due to heightened safety and compliance demands. Government and utilities, as well as education, continue to invest in access control to safeguard critical infrastructure and campuses .

The Middle East Access Control Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASSA ABLOY, Johnson Controls International plc, Honeywell International Inc., Bosch Security Systems, Gallagher Group Ltd., AMAG Technology, Genetec Inc., Axis Communications AB, Suprema Inc., HID Global Corporation, Tyco Integrated Security, ZKTeco, Avigilon Corporation, LenelS2, Paxton Access Ltd., Nedap N.V., dormakaba Group, Salto Systems S.L., Vanderbilt Industries, Hikvision Digital Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East access control market is poised for significant transformation, driven by technological innovations and increasing security demands. As organizations prioritize safety, the adoption of mobile access control and AI integration will become more prevalent. Additionally, the rise of contactless solutions will cater to evolving consumer preferences. With government support for smart city initiatives, the market is expected to witness robust growth, fostering a secure environment that encourages further investment in advanced access control technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Biometric Systems Card-Based Systems Electronic Locks Keypad/Pin-Based Systems Mobile Access Control Solutions Proximity Readers (RFID, NFC, BLE) Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial (Oil & Gas, Manufacturing) Government & Utilities Healthcare Education |

| By Application | Corporate Offices Educational Institutions Healthcare Facilities Retail Outlets Critical Infrastructure (Airports, Transport Hubs) Others |

| By Component | Hardware (Readers, Controllers, Locks) Software (Management Platforms, Mobile Apps) Services (Installation, Maintenance, Consulting) |

| By Sales Channel | Direct Sales Distributors/Value-Added Resellers Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Sector Access Control | 120 | Security Managers, Facility Directors |

| Government Security Systems | 80 | Public Safety Officials, Procurement Officers |

| Healthcare Facility Security | 60 | Healthcare Administrators, Security Coordinators |

| Residential Security Solutions | 50 | Homeowners, Property Managers |

| Industrial Access Control Systems | 45 | Operations Managers, Safety Officers |

The Middle East Access Control Market is valued at approximately USD 595 million, driven by increasing security concerns, rapid urbanization, and the adoption of advanced technologies such as cloud-based and IoT-enabled access control systems.