Region:Middle East

Author(s):Rebecca

Product Code:KRAA9427

Pages:83

Published On:November 2025

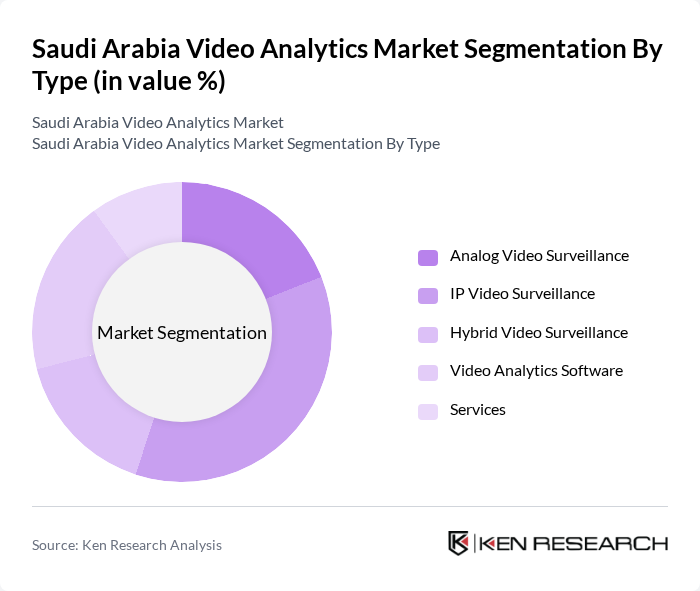

By Type:The video analytics market can be segmented into Analog Video Surveillance, IP Video Surveillance, Hybrid Video Surveillance, Video Analytics Software, and Services. Among these,IP Video Surveillanceis gaining traction due to its superior image quality, scalability, and remote accessibility, making it a preferred choice for many organizations. The demand for Video Analytics Software is also on the rise as businesses seek to leverage AI-driven data insights for operational efficiency and security enhancements .

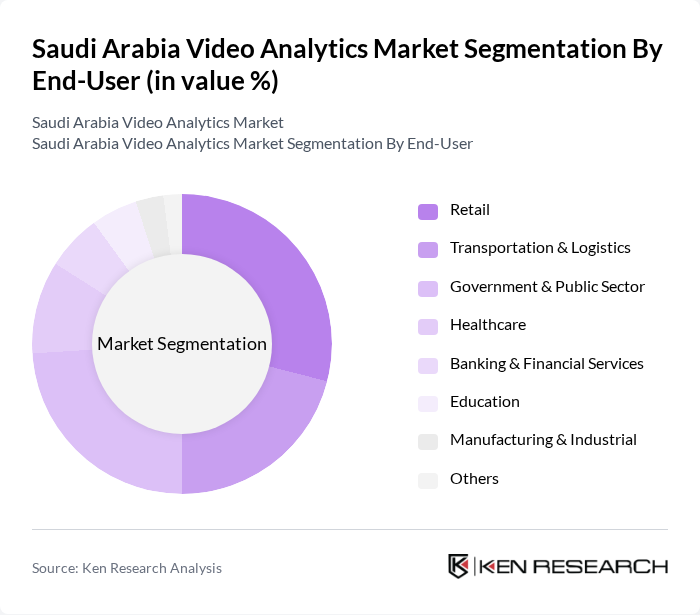

By End-User:The end-user segmentation includes Retail, Transportation & Logistics, Government & Public Sector, Healthcare, Banking & Financial Services, Education, Manufacturing & Industrial, and Others. TheRetail sectoris leading the market due to the increasing need for customer behavior analysis, loss prevention, and in-store analytics. Additionally, the Government & Public Sector is a significant contributor, driven by national security strategies and the expansion of smart city projects .

The Saudi Arabia Video Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision, Dahua Technology, Axis Communications, Genetec, Avigilon, Hanwha Techwin, Bosch Security Systems, FLIR Systems, Honeywell Security, NEC Corporation, Panasonic, Milestone Systems, Qognify, BriefCam, Tiandy Technologies, Motorola Solutions, Canon Inc., Zhejiang XCC Group, TKH Group, Shenzhen Infinova contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia video analytics market appears promising, driven by technological advancements and increasing investments in smart city initiatives. As organizations prioritize security and operational efficiency, the integration of AI and machine learning will enhance video analytics capabilities. Furthermore, the growing emphasis on real-time data processing will likely lead to innovative applications across various sectors, including healthcare and transportation, fostering a more data-driven approach to decision-making and resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Video Surveillance IP Video Surveillance Hybrid Video Surveillance Video Analytics Software Services |

| By End-User | Retail Transportation & Logistics Government & Public Sector Healthcare Banking & Financial Services Education Manufacturing & Industrial Others |

| By Application | Security and Surveillance Traffic Management Retail Customer Analytics Operational Efficiency Intrusion Detection Incident Detection Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | AI-Based Analytics Machine Learning Deep Learning Edge-Based Analytics Server-Based Analytics Others |

| By Industry Vertical | Banking and Financial Services Manufacturing Education Transportation Government Healthcare Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Video Analytics | 60 | Store Managers, IT Directors |

| Transportation and Logistics | 50 | Operations Managers, Fleet Supervisors |

| Public Safety and Security | 40 | Security Directors, City Planners |

| Healthcare Facilities | 40 | Facility Managers, IT Security Officers |

| Smart City Initiatives | 50 | Urban Planners, Technology Consultants |

The Saudi Arabia Video Analytics Market is valued at approximately USD 1.1 billion, driven by increasing demand for security and surveillance solutions across various sectors, including retail, transportation, and government.