Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3764

Pages:91

Published On:October 2025

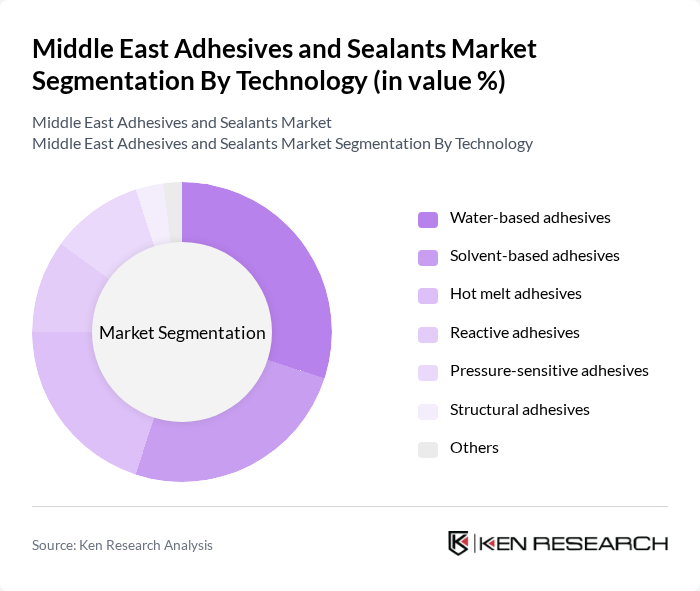

By Technology:The technology segment of the adhesives and sealants market includes water-based adhesives, solvent-based adhesives, hot melt adhesives, reactive adhesives, pressure-sensitive adhesives, structural adhesives, and others. Water-based adhesives are increasingly preferred for their eco-friendly properties, low toxicity, and ease of application, especially in packaging and construction. Solvent-based adhesives remain popular for their strong bonding capabilities in demanding environments. Hot melt adhesives are widely used in packaging, woodworking, and product assembly due to their fast-setting nature. Pressure-sensitive adhesives are essential for automotive, electronics, and medical applications, offering reliable performance and ease of use.

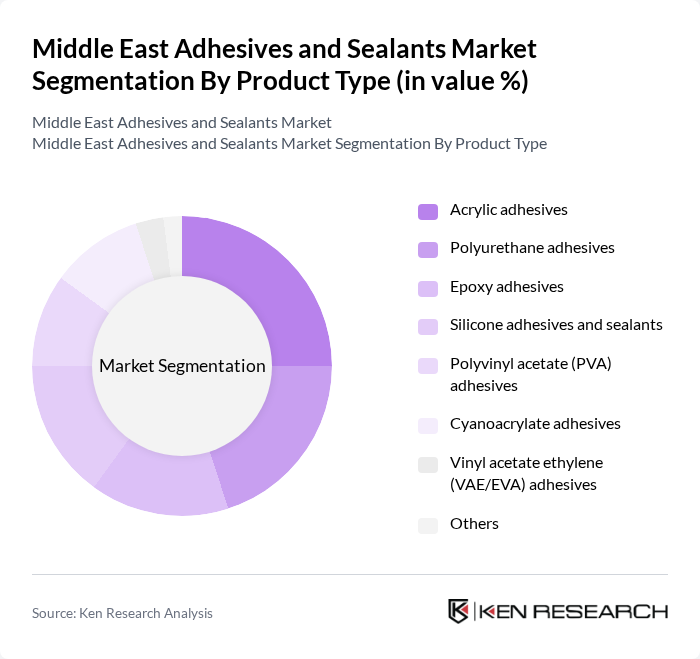

By Product Type:The product type segmentation covers acrylic adhesives, polyurethane adhesives, epoxy adhesives, silicone adhesives and sealants, polyvinyl acetate (PVA) adhesives, cyanoacrylate adhesives, vinyl acetate ethylene (VAE/EVA) adhesives, and others. Acrylic adhesives lead the market due to their versatility, strong bonding, and resistance to temperature and UV exposure. Polyurethane adhesives are valued for durability and flexibility, especially in automotive and construction. Epoxy adhesives are widely used in structural applications for their excellent mechanical properties and chemical resistance. Silicone adhesives and sealants are preferred for their weatherability and flexibility, making them suitable for construction and electronics.

The Middle East Adhesives and Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, Sika AG, 3M Company, BASF SE, Dow Inc., Huntsman Corporation, Bostik SA (Arkema Group), Pidilite Industries Limited, RPM International Inc., Illinois Tool Works Inc. (ITW), Wacker Chemie AG, H.B. Fuller Company, Mapei S.p.A., Jowat SE, National Adhesives Ltd. (Saudi Arabia), Gulf Adhesives & Sealants Factory (GASF, Saudi Arabia), Al Muqarram Group (UAE), Permoseal (Pty) Ltd. (Arkema Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East adhesives and sealants market is poised for significant growth, driven by ongoing construction projects and technological advancements in adhesive formulations. As industries increasingly prioritize sustainability, the demand for eco-friendly adhesives is expected to rise. Additionally, the automotive sector's shift towards electric vehicles will create new opportunities for innovative adhesive solutions. The expansion of e-commerce will further enhance distribution channels, allowing manufacturers to reach a broader customer base and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Technology | Water-based adhesives Solvent-based adhesives Hot melt adhesives Reactive adhesives Pressure-sensitive adhesives Structural adhesives Others |

| By Product Type | Acrylic adhesives Polyurethane adhesives Epoxy adhesives Silicone adhesives and sealants Polyvinyl acetate (PVA) adhesives Cyanoacrylate adhesives Vinyl acetate ethylene (VAE/EVA) adhesives Others |

| By End-User | Construction Automotive & Transportation Packaging Electronics & Electrical Furniture & Woodworking Aerospace Industrial Assembly Others |

| By Application | Bonding Sealing Coating Laminating Insulation Others |

| By Distribution Channel | Direct sales Distributors/Dealers Online sales Retail Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Egypt Rest of Middle East |

| By Price Range | Economy Mid-range Premium |

| By Product Form | Liquid adhesives Solid adhesives Film adhesives Paste adhesives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 100 | Project Managers, Site Supervisors |

| Automotive Sealants | 80 | Production Managers, Quality Control Engineers |

| Industrial Adhesives | 60 | Procurement Managers, Operations Managers |

| Consumer Adhesives | 50 | Retail Buyers, Product Development Managers |

| Aerospace Sealants | 40 | Engineering Managers, Compliance Officers |

The Middle East Adhesives and Sealants Market is valued at approximately USD 5.1 billion, driven by robust infrastructure development, construction activities, and rising demand in automotive manufacturing and packaging solutions.