Region:Global

Author(s):Dev

Product Code:KRAA3046

Pages:83

Published On:August 2025

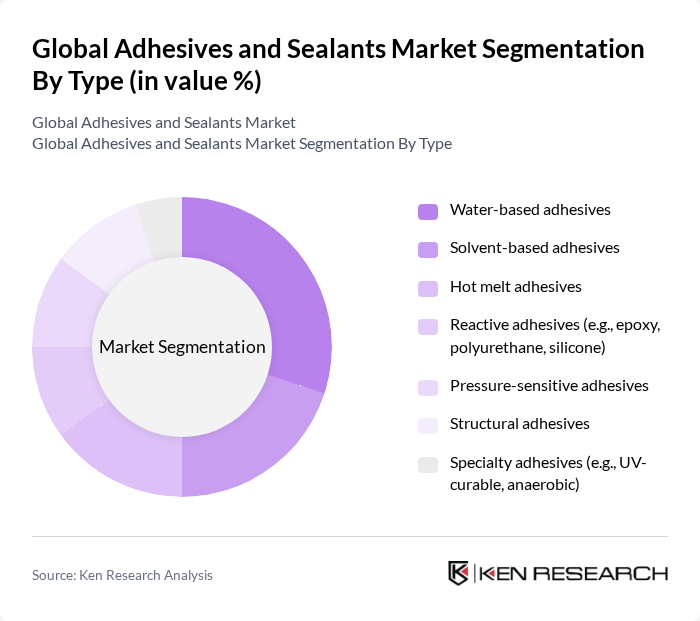

By Type:The adhesives and sealants market is segmented into water-based adhesives, solvent-based adhesives, hot melt adhesives, reactive adhesives (such as epoxy, polyurethane, and silicone), pressure-sensitive adhesives, structural adhesives, and specialty adhesives (like UV-curable and anaerobic). Among these,water-based adhesivesare gaining significant traction due to their eco-friendliness, low VOC emissions, and versatility in applications across packaging, construction, and consumer goods. Reactive adhesives are also experiencing rapid growth, especially in electronics and automotive, due to their superior bonding strength and chemical resistance .

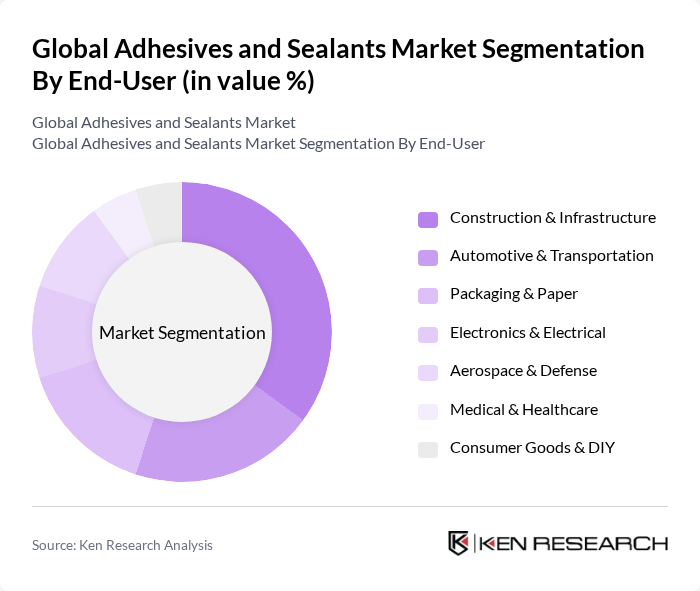

By End-User:The market is also segmented by end-user industries, including construction & infrastructure, automotive & transportation, packaging & paper, electronics & electrical, aerospace & defense, medical & healthcare, and consumer goods & DIY. Theconstruction and infrastructure sectorremains the largest consumer of adhesives and sealants, driven by ongoing urbanization and infrastructure development projects worldwide. Packaging is also a major segment, propelled by e-commerce growth and demand for sustainable sealing solutions. Automotive and electronics sectors are increasing their share due to the adoption of advanced adhesives for lightweight and high-performance applications .

The Global Adhesives and Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, BASF SE, Dow Inc., Huntsman Corporation, Arkema S.A., Avery Dennison Corporation, RPM International Inc., Illinois Tool Works Inc. (ITW), Pidilite Industries Limited, Bostik S.A., Momentive Performance Materials Inc., Wacker Chemie AG, H.B. Fuller Company, Shin-Etsu Chemical Co., Ltd., Mapei S.p.A., Ashland Global Holdings Inc., Soudal N.V., Franklin International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the adhesives and sealants market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the demand for bio-based adhesives is expected to rise. Additionally, the integration of smart technologies into adhesive products will enhance functionality and application versatility. Companies that adapt to these trends and invest in innovative solutions will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based adhesives Solvent-based adhesives Hot melt adhesives Reactive adhesives (e.g., epoxy, polyurethane, silicone) Pressure-sensitive adhesives Structural adhesives Specialty adhesives (e.g., UV-curable, anaerobic) |

| By End-User | Construction & Infrastructure Automotive & Transportation Packaging & Paper Electronics & Electrical Aerospace & Defense Medical & Healthcare Consumer Goods & DIY |

| By Application | Bonding & Assembly Sealing & Insulation Coating & Protection Laminating & Surface Mounting Encapsulation & Potting Others |

| By Distribution Channel | Direct sales (B2B) Distributors & Wholesalers Online retail & E-commerce Specialty chemical stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) Others |

| By Price Range | Low Medium High Premium Others |

| By Packaging Type | Bulk packaging (drums, totes, tankers) Retail packaging (cartridges, tubes, bottles) Industrial packaging (pails, intermediate bulk containers) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 120 | Project Managers, Procurement Specialists |

| Automotive Sealants | 90 | Manufacturing Engineers, Quality Control Managers |

| Packaging Adhesives | 60 | Product Development Managers, Supply Chain Analysts |

| Industrial Adhesives | 50 | Operations Managers, Technical Sales Representatives |

| Consumer Adhesives | 70 | Retail Buyers, Marketing Managers |

The Global Adhesives and Sealants Market was valued at approximately USD 78 billion, driven by demand from industries such as construction, automotive, packaging, and electronics, along with a growing trend towards eco-friendly products.