Region:Middle East

Author(s):Dev

Product Code:KRAA8299

Pages:83

Published On:November 2025

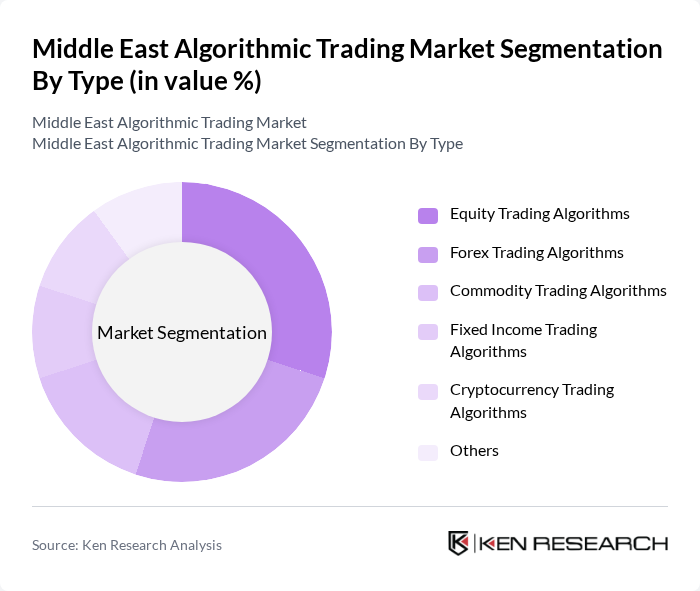

By Type:The market is segmented into various types of trading algorithms, including Equity Trading Algorithms, Forex Trading Algorithms, Commodity Trading Algorithms, Fixed Income Trading Algorithms, Cryptocurrency Trading Algorithms, and Others. Each of these sub-segments caters to different trading needs and strategies, with varying levels of complexity and market focus.

The Equity Trading Algorithms sub-segment is currently dominating the market due to the increasing volume of equity trades and the demand for sophisticated trading strategies among institutional investors. These algorithms are designed to analyze market data and execute trades at optimal prices, making them essential for firms looking to maximize returns. The rise of algorithmic trading in equity markets is also driven by advancements in technology, such as machine learning and big data analytics, which enhance trading efficiency and decision-making.

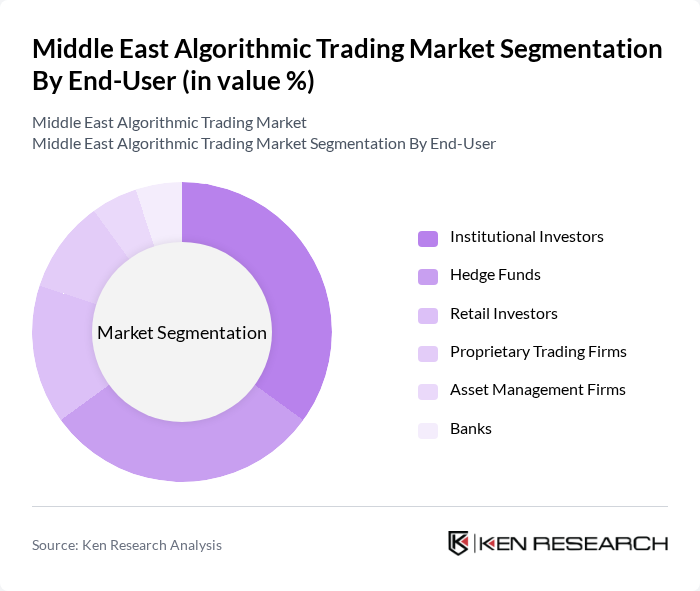

By End-User:The market is segmented by end-users, including Institutional Investors, Hedge Funds, Retail Investors, Proprietary Trading Firms, Asset Management Firms, Banks, and Others. Each end-user category has distinct requirements and preferences for algorithmic trading solutions, influencing the overall market dynamics.

Institutional Investors represent the largest end-user segment in the market, driven by their need for advanced trading solutions that can handle large volumes of trades efficiently. These investors leverage algorithmic trading to gain a competitive edge, reduce transaction costs, and improve execution speed. The increasing complexity of financial markets and the need for real-time data analysis further enhance the demand for algorithmic trading solutions among institutional investors.

The Middle East Algorithmic Trading Market is characterized by a dynamic mix of regional and international players. Leading participants such as MetaQuotes Software Corp., Saxo Bank A/S, IG Group Holdings plc, CMC Markets plc, BNP Paribas, Algotrade, Argo Software Engineering, InfoReach, Inc., Kuberre Systems, AlgoBulls, Virtue, SymphonyAI Media, Tata Consultancy Services, Mubasher Financial Services, ADSS (Abu Dhabi) contribute to innovation, geographic expansion, and service delivery in this space.

The future of algorithmic trading in the Middle East appears promising, driven by technological advancements and increasing market participation. As firms adopt more sophisticated trading algorithms and integrate artificial intelligence, the efficiency of trading operations is expected to improve significantly. Additionally, the collaboration between regional exchanges and global markets will likely enhance liquidity and attract foreign investments, further solidifying the region's position as a key player in the algorithmic trading landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Trading Algorithms Forex Trading Algorithms Commodity Trading Algorithms Fixed Income Trading Algorithms Cryptocurrency Trading Algorithms Others |

| By End-User | Institutional Investors Hedge Funds Retail Investors Proprietary Trading Firms Asset Management Firms Banks Others |

| By Trading Strategy | Arbitrage Market Making Trend Following Statistical Arbitrage Liquidity Detection Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Egypt) North Africa (Morocco, Algeria, Tunisia) Others |

| By Regulatory Compliance | Local Central Bank Regulations Securities and Commodities Authority (SCA) Compliance MiFID II Compliance (for cross-border operations) Others |

| By Technology Used | Machine Learning Natural Language Processing Big Data Analytics Cloud Computing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors in Algorithmic Trading | 100 | Portfolio Managers, Investment Analysts |

| Technology Providers for Trading Algorithms | 60 | Product Managers, Software Engineers |

| Regulatory Bodies and Compliance Officers | 40 | Compliance Managers, Regulatory Analysts |

| Hedge Fund Managers Utilizing Algorithms | 80 | Fund Managers, Risk Analysts |

| Retail Investors Engaged in Algorithmic Trading | 50 | Individual Traders, Financial Advisors |

The Middle East Algorithmic Trading Market is valued at approximately USD 2,090 million, reflecting significant growth driven by advanced trading technologies and high-frequency trading demand among institutional investors and hedge funds.