Region:Middle East

Author(s):Shubham

Product Code:KRAA1907

Pages:84

Published On:August 2025

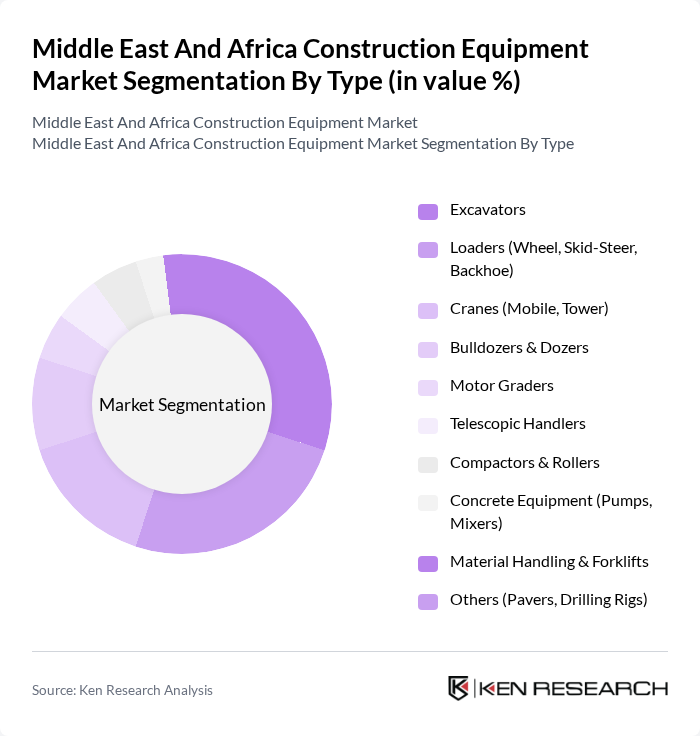

By Type:The construction equipment market can be segmented into various types, including excavators, loaders, cranes, bulldozers, motor graders, telescopic handlers, compactors, concrete equipment, material handling equipment, and others. Among these, excavators and loaders are the most widely used due to their versatility and essential roles in various construction activities.

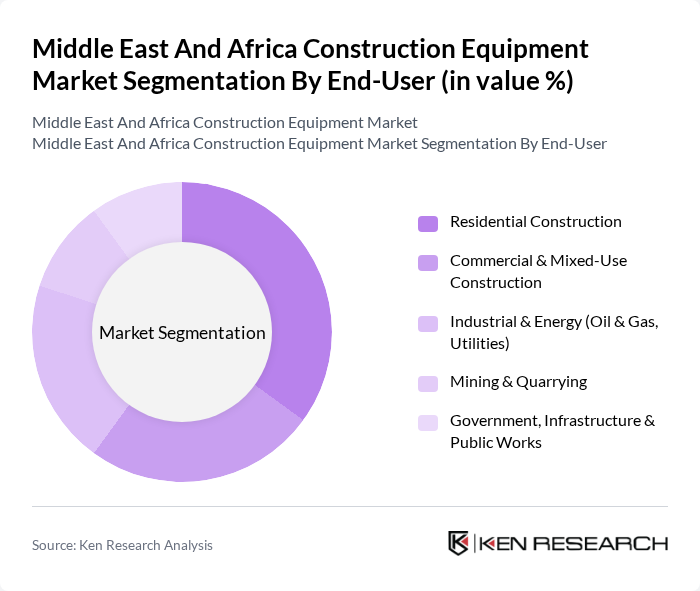

By End-User:The end-user segmentation includes residential construction, commercial and mixed-use construction, industrial and energy sectors, mining and quarrying, and government infrastructure projects. The residential construction segment is currently leading the market due to the increasing demand for housing and urban development initiatives.

The Middle East And Africa construction equipment market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, JCB, Liebherr Group, HD Hyundai Construction Equipment, CNH Industrial (CASE Construction Equipment), SANY Group, XCMG, Zoomlion Heavy Industry, Manitou Group, Bobcat Company, Wacker Neuson SE, Doosan Bobcat (ME&A), Terex Corporation, BEML Limited, Bell Equipment (South Africa), Shandong Lingong Construction Machinery (SDLG), Tata Hitachi Construction Machinery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction equipment market in the Middle East and Africa appears promising, driven by ongoing infrastructure projects and urbanization trends. As governments continue to invest in large-scale developments, the demand for advanced machinery is expected to rise. Additionally, the integration of smart technologies and eco-friendly practices will likely shape the market landscape, enhancing operational efficiency and sustainability. This evolving environment presents opportunities for innovation and growth within the sector, positioning it for a robust future.

| Segment | Sub-Segments |

|---|---|

| By Type | Excavators Loaders (Wheel, Skid-Steer, Backhoe) Cranes (Mobile, Tower) Bulldozers & Dozers Motor Graders Telescopic Handlers Compactors & Rollers Concrete Equipment (Pumps, Mixers) Material Handling & Forklifts Others (Pavers, Drilling Rigs) |

| By End-User | Residential Construction Commercial & Mixed-Use Construction Industrial & Energy (Oil & Gas, Utilities) Mining & Quarrying Government, Infrastructure & Public Works |

| By Application | Road & Highway Construction Building Construction Earthmoving & Excavation Mining & Material Handling Demolition & Recycling |

| By Sales Channel | Direct Sales (OEMs) Authorized Dealers/Distributors Rental/Leasing Online & E-commerce |

| By Distribution Mode | Retail (Dealerships) Wholesale/B2B Rental Services (Short- and Long-Term) |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Region | GCC (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Israel, Jordan, Lebanon) North Africa (Egypt, Morocco, Algeria, Tunisia) Sub-Saharan Africa (South Africa, Nigeria, Kenya, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heavy Machinery Sales | 140 | Sales Managers, Regional Distributors |

| Construction Equipment Rentals | 110 | Rental Fleet Managers, Operations Directors |

| Infrastructure Development Projects | 90 | Project Managers, Civil Engineers |

| Government Procurement Policies | 60 | Government Officials, Policy Advisors |

| Emerging Technologies in Construction | 70 | Technology Officers, Innovation Managers |

The Middle East and Africa construction equipment market is valued at approximately USD 11 billion, driven by rapid urbanization, increased infrastructure investments, and a surge in construction activities across various sectors, including residential, commercial, and industrial projects.