Region:Global

Author(s):Shubham

Product Code:KRAD0787

Pages:85

Published On:August 2025

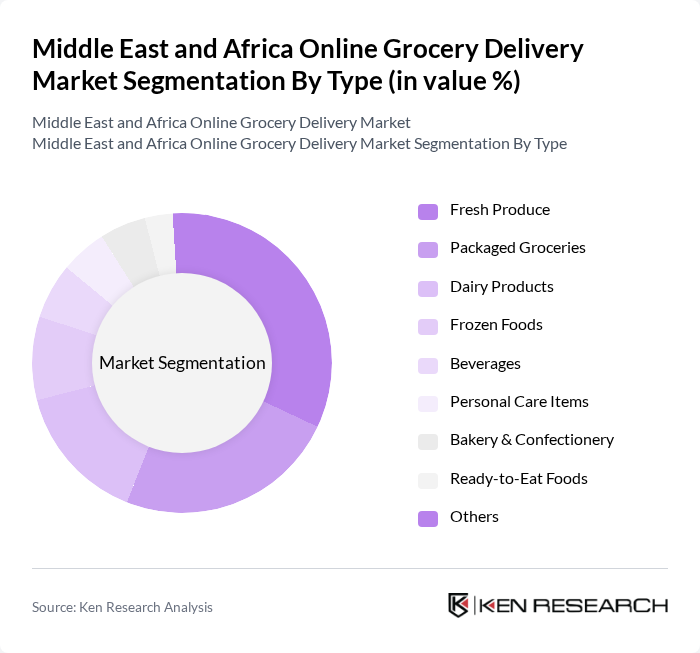

By Type:The market is segmented into various types of products available for online grocery delivery. The subsegments include Fresh Produce, Packaged Groceries, Dairy Products, Frozen Foods, Beverages, Personal Care Items, Bakery & Confectionery, Ready-to-Eat Foods, and Others. Among these, Fresh Produce and Packaged Groceries are the most popular due to their essential nature and high demand among consumers .

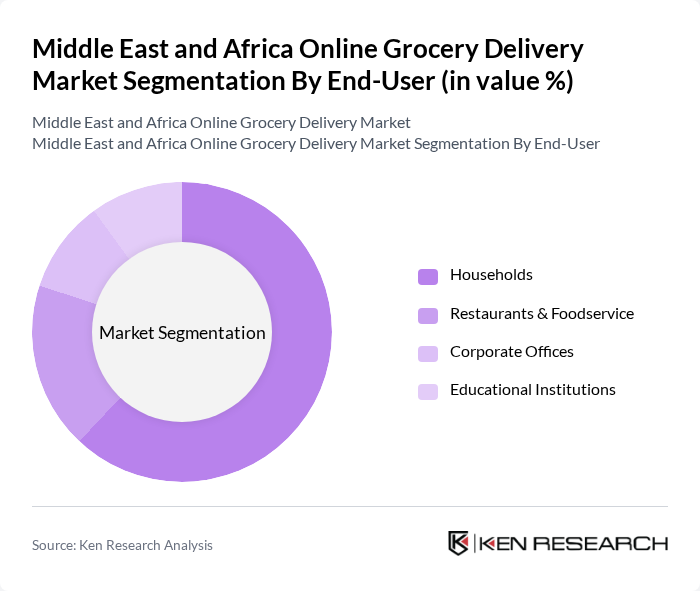

By End-User:The online grocery delivery market serves various end-users, including Households, Restaurants & Foodservice, Corporate Offices, and Educational Institutions. Households represent the largest segment, driven by the convenience of online shopping, the increasing number of dual-income families, and the expansion of digital payment solutions .

The Middle East and Africa Online Grocery Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as InstaShop, Trolley Trading, elGrocer, Kibsons International LLC, NRTC Fresh, Carrefour, Lulu Hypermarket, Spinneys, Monoprix, Jumia, Getir, Glovo, Instashop, Farmbox, FreshToHome contribute to innovation, geographic expansion, and service delivery in this space .

The future of the online grocery delivery market in the Middle East and Africa appears promising, driven by technological advancements and evolving consumer behaviors. As urbanization continues, companies are likely to enhance their logistics capabilities and invest in innovative delivery solutions. Furthermore, the integration of AI and machine learning technologies will streamline operations, improve customer experiences, and foster loyalty. The market is expected to adapt to changing consumer preferences, emphasizing convenience and sustainability in service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Dairy Products Frozen Foods Beverages Personal Care Items Bakery & Confectionery Ready-to-Eat Foods Others |

| By End-User | Households Restaurants & Foodservice Corporate Offices Educational Institutions |

| By Sales Channel | Mobile Applications Websites Social Media Platforms Third-Party Aggregators |

| By Distribution Mode | Home Delivery Click and Collect Subscription Services |

| By Price Range | Budget Mid-Range Premium |

| By Region | GCC Countries North Africa Sub-Saharan Africa |

| By Consumer Demographics | Age Group Income Level Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Consumer Preferences | 150 | Frequent Online Shoppers, Young Professionals |

| Delivery Service Providers | 100 | Operations Managers, Logistics Coordinators |

| Local Grocery Store Insights | 80 | Store Owners, Managers |

| Market Trends Analysis | 120 | Industry Analysts, Market Researchers |

| Consumer Behavior Studies | 150 | Household Decision Makers, Family Shoppers |

The Middle East and Africa Online Grocery Delivery Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increased smartphone adoption, e-commerce expansion, and changing consumer preferences towards convenience, especially during the pandemic.