Region:Middle East

Author(s):Dev

Product Code:KRAB7429

Pages:82

Published On:October 2025

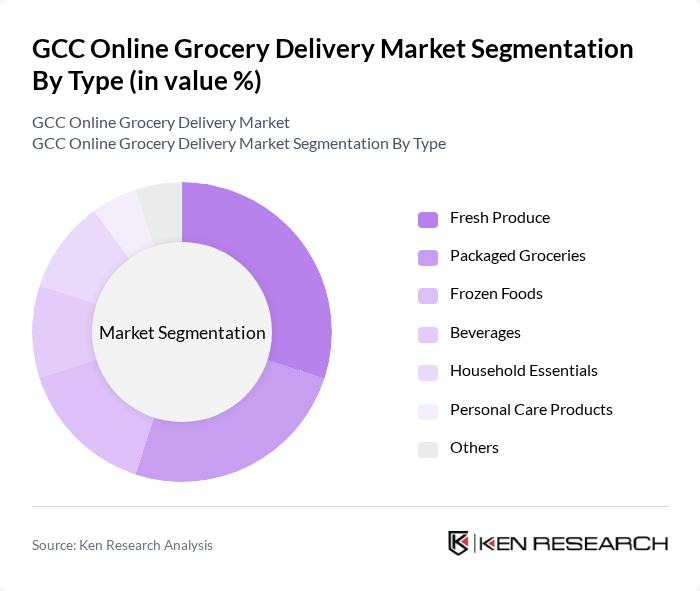

By Type:The market is segmented into various types, including Fresh Produce, Packaged Groceries, Frozen Foods, Beverages, Household Essentials, Personal Care Products, and Others. Among these, Fresh Produce and Packaged Groceries are the leading subsegments, driven by consumer demand for fresh and convenient food options. The trend towards healthy eating and the convenience of packaged goods have significantly influenced purchasing behavior.

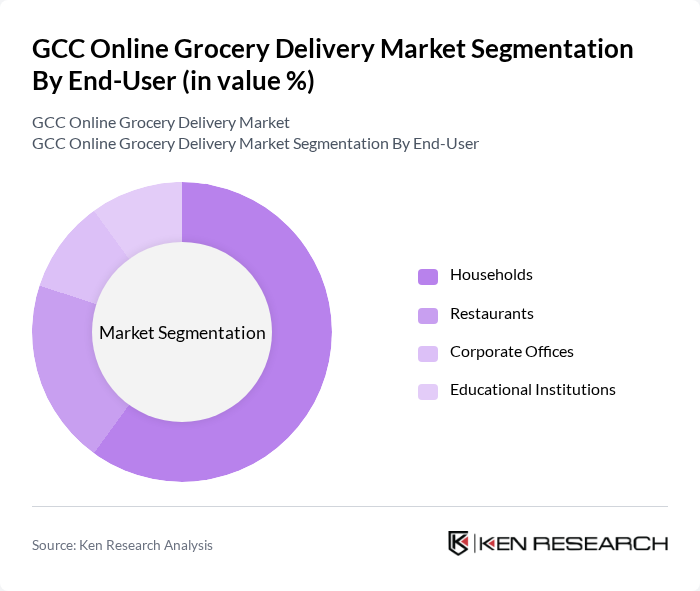

By End-User:The end-user segmentation includes Households, Restaurants, Corporate Offices, and Educational Institutions. Households dominate the market, driven by the increasing trend of online shopping for daily essentials. The convenience of home delivery and the ability to compare prices easily have made online grocery shopping a preferred choice for many families.

The GCC Online Grocery Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour, Lulu Hypermarket, Talabat, Nana, Carrefour Express, Monoprix, Fatafeat, Zomato, Noon, Sary, Getir, Instashop, Spinneys, Ounass, FreshToHome contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC online grocery delivery market appears promising, driven by technological advancements and evolving consumer behaviors. As urbanization continues, companies are likely to invest in enhancing their logistics and delivery capabilities. Furthermore, the integration of AI and data analytics will enable personalized shopping experiences, catering to individual consumer preferences. The market is expected to adapt to changing regulations and consumer demands, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Frozen Foods Beverages Household Essentials Personal Care Products Others |

| By End-User | Households Restaurants Corporate Offices Educational Institutions |

| By Sales Channel | Mobile Apps Websites Third-Party Platforms |

| By Distribution Mode | Home Delivery Click and Collect |

| By Price Range | Budget Mid-Range Premium |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Demographics | Age Groups Income Levels Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Online Grocery Shopping | 150 | Regular Online Shoppers, Occasional Users |

| Logistics and Delivery Operations | 100 | Operations Managers, Logistics Coordinators |

| Retail Partnerships and Collaborations | 80 | Business Development Managers, Partnership Executives |

| Technology Adoption in Grocery Delivery | 70 | IT Managers, Digital Transformation Leads |

| Market Trends and Consumer Insights | 90 | Market Analysts, Consumer Behavior Researchers |

The GCC Online Grocery Delivery Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased digital platform adoption and changing consumer preferences for convenience, particularly accelerated by the COVID-19 pandemic.