Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4514

Pages:99

Published On:October 2025

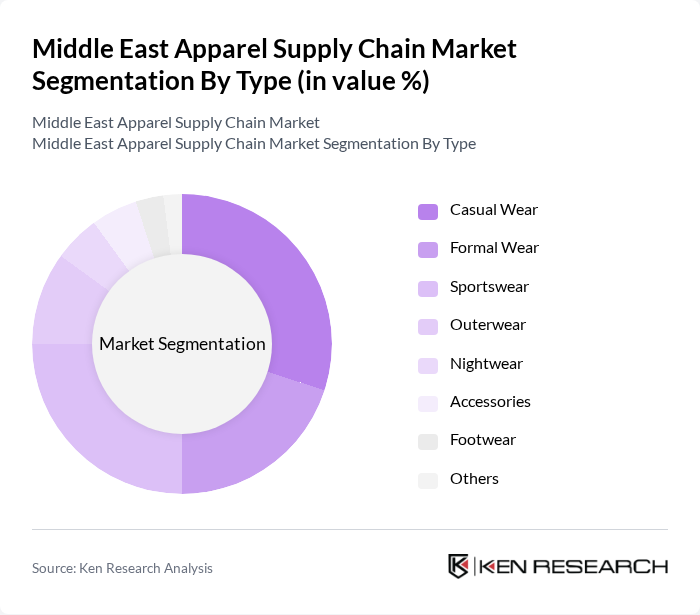

By Type:The apparel supply chain can be segmented into various types, including Casual Wear, Formal Wear, Sportswear, Outerwear, Nightwear, Accessories, Footwear, and Others. Each of these segments caters to different consumer preferences and occasions, with Casual Wear and Sportswear currently leading the market due to the growing trend of athleisure and relaxed dressing. The blurring line between sportswear and everyday fashion has redefined functional apparel from niche performance wear into a mainstream category, with both domestic and international players competing aggressively in this space.

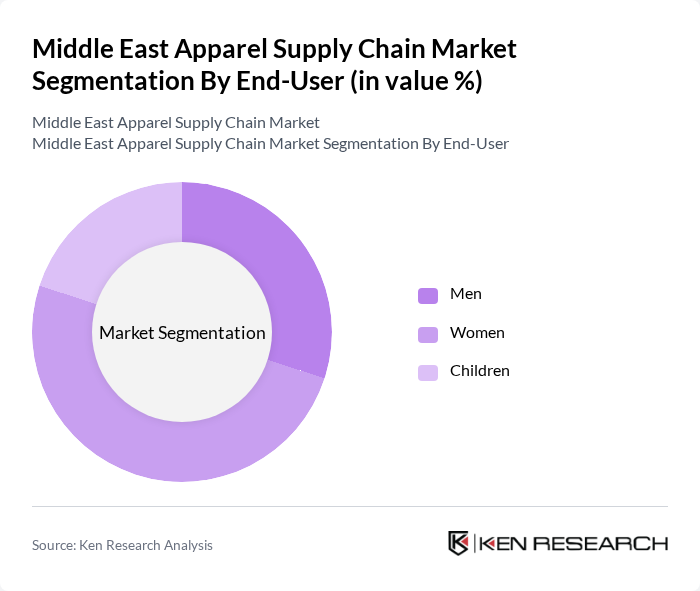

By End-User:The market can also be segmented by end-user demographics, including Men, Women, and Children. The Women's segment is particularly dominant, driven by a growing emphasis on fashion and personal expression among female consumers. Men's apparel is also witnessing growth, particularly in casual and sportswear categories. The youthful population in the region contributes to the vibrant fashion scene, with cultural influences shaping preferences across different demographic groups.

The Middle East Apparel Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landmark Group, Apparel Group, Al-Futtaim Group, Majid Al Futtaim, Chalhoub Group, Alshaya Group, Fawaz Alhokair Group, Azadea Group, Kamal Osman Jamjoom Group, Liwa Trading Enterprises, Al Jazeera Apparel, Splash (Landmark Group), Namshi, Ounass (Al Tayer Group), Huda Beauty Fashion (for regional e-commerce apparel) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East apparel supply chain is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As digital supply chain solutions become more prevalent, companies are expected to enhance efficiency and reduce costs. Additionally, the increasing consumer preference for sustainable fashion will likely push brands to adopt eco-friendly practices, reshaping production processes. This evolving landscape presents both challenges and opportunities for stakeholders aiming to adapt to changing market demands and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Wear Formal Wear Sportswear Outerwear Nightwear Accessories Footwear Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Department Stores, Specialty Stores) Wholesale/Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Wool Blends Technical/Functional Fabrics |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Sustainability Focus | Eco-Friendly Products Fair Trade Certified Recycled Materials Circular Economy Initiatives |

| By Supply Chain Component | Raw Materials Manufacturing Distribution Retail |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Apparel Manufacturing Supply Chain | 120 | Supply Chain Managers, Production Directors |

| Retail Distribution Channels | 90 | Logistics Coordinators, Retail Operations Managers |

| E-commerce Apparel Fulfillment | 60 | eCommerce Operations Managers, Warehouse Supervisors |

| Textile Waste Management Practices | 50 | Sustainability Managers, Environmental Compliance Officers |

| Consumer Behavior in Apparel Purchases | 100 | Market Researchers, Consumer Insights Analysts |

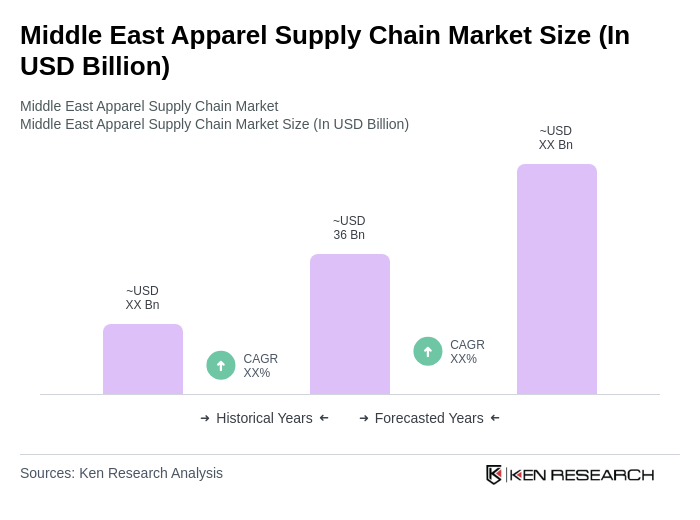

The Middle East Apparel Supply Chain Market is valued at approximately USD 36 billion, driven by increasing consumer demand, urbanization, and the growth of e-commerce platforms. This valuation is based on a five-year historical analysis of the market.