Region:Middle East

Author(s):Shubham

Product Code:KRAD1844

Pages:88

Published On:December 2025

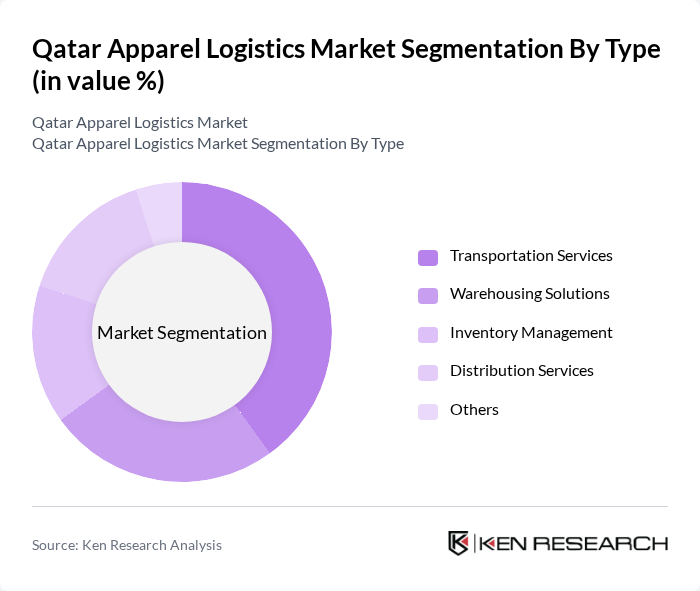

By Type:The Qatar Apparel Logistics Market is segmented into various types, including Transportation Services, Warehousing Solutions, Inventory Management, Distribution Services, and Others. Among these, Transportation Services dominate the market due to the increasing demand for efficient and timely delivery of apparel products. The rise of e-commerce has significantly influenced this segment, as businesses seek to optimize their logistics operations to meet consumer expectations for fast shipping and delivery.

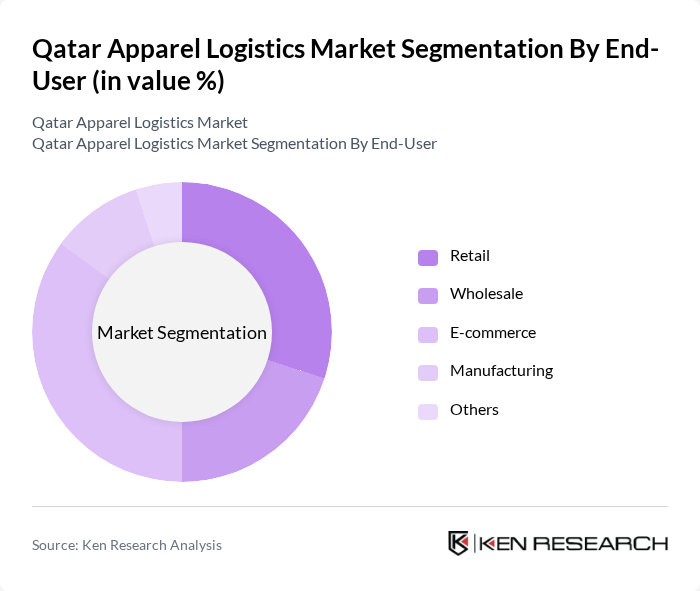

By End-User:The market is also segmented by end-user categories, including Retail, Wholesale, E-commerce, Manufacturing, and Others. The E-commerce segment is the leading end-user, driven by the rapid growth of online shopping platforms and consumer preferences for convenience. Retailers are increasingly partnering with logistics providers to enhance their supply chain efficiency, ensuring that products reach consumers quickly and reliably.

The Qatar Apparel Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Logistics, Gulf Warehousing Company, Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, Aramex, CEVA Logistics, FedEx Logistics, UPS Supply Chain Solutions, Al-Futtaim Logistics, Mena Logistics, Qatar Airways Cargo, Al-Mana Group, and Qatar National Import and Export Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar apparel logistics market appears promising, driven by emerging trends in digital and smart logistics. Investments in technologies such as IoT and blockchain are expected to reach approximately QAR 4 billion, enhancing operational efficiency and supply chain visibility. Additionally, sustainability initiatives are gaining traction, with logistics providers increasingly adopting eco-friendly practices to meet consumer demand for sustainable apparel. These trends will likely shape the logistics landscape in Qatar, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Solutions Inventory Management Distribution Services Others |

| By End-User | Retail Wholesale E-commerce Manufacturing Others |

| By Apparel Category | Men's Apparel Women's Apparel Children's Apparel Sportswear Others |

| By Logistics Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-House Logistics Others |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Technology Utilization | Automated Warehousing Real-Time Tracking Systems Inventory Management Software Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Apparel Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Wholesale Distribution Channels | 80 | Operations Managers, Inventory Control Specialists |

| E-commerce Apparel Fulfillment | 90 | eCommerce Managers, Warehouse Supervisors |

| Cold Chain Logistics for Apparel | 70 | Logistics Coordinators, Quality Assurance Managers |

| Returns Management in Apparel | 60 | Customer Service Managers, Returns Analysts |

The Qatar Apparel Logistics Market is valued at approximately USD 10 billion, driven by the growth of e-commerce and retail sectors, along with significant investments in logistics infrastructure such as Hamad Port and technology-enabled logistics parks.