Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1086

Pages:82

Published On:November 2025

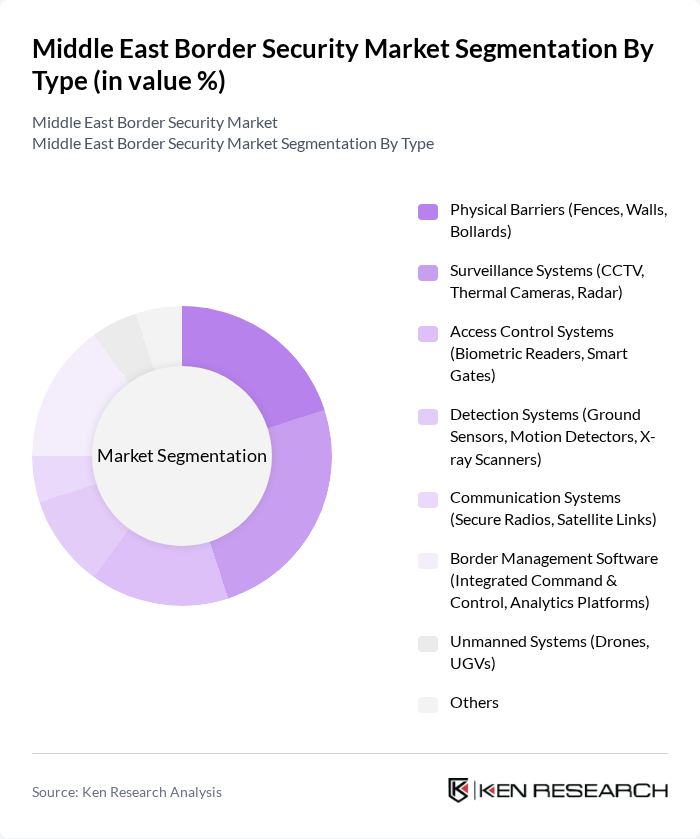

By Type:The segmentation of the market by type includes various technologies and systems essential for effective border security. The subsegments include Physical Barriers, Surveillance Systems, Access Control Systems, Detection Systems, Communication Systems, Border Management Software, Unmanned Systems, and Others. Each of these subsegments plays a crucial role in enhancing the security and management of borders. Physical barriers such as fences and walls remain foundational, while surveillance systems increasingly leverage thermal cameras, radar, and AI analytics. Access control and detection systems are driven by biometric readers and advanced sensors, supporting rapid and secure border crossings. Unmanned systems, including drones and unmanned ground vehicles, are increasingly deployed for real-time monitoring and rapid response .

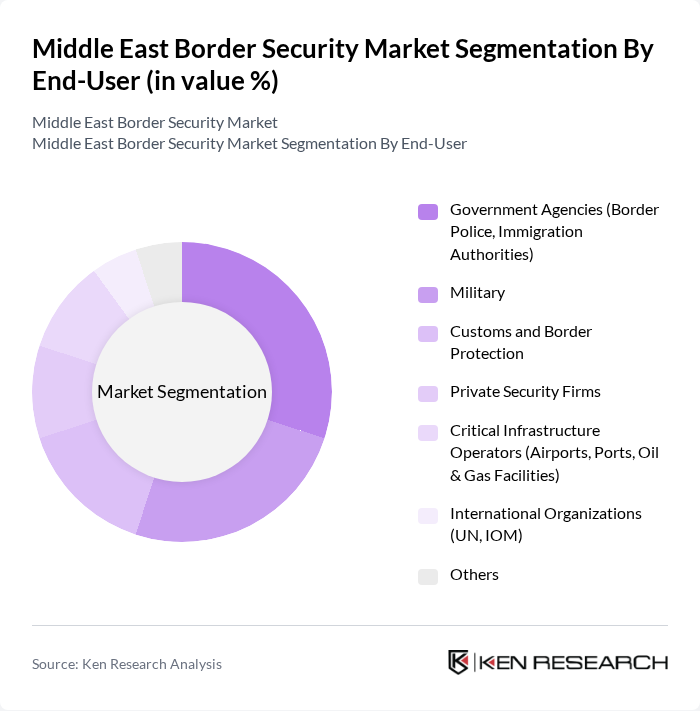

By End-User:The market segmentation by end-user includes various entities that utilize border security solutions. The subsegments consist of Government Agencies, Military, Customs and Border Protection, Private Security Firms, Critical Infrastructure Operators, International Organizations, and Others. Each end-user has distinct requirements and applications for border security technologies. Government agencies and military remain the largest consumers, focusing on integrated surveillance and biometric border management, while private security firms and critical infrastructure operators prioritize rapid response and perimeter protection for airports, ports, and energy facilities .

The Middle East Border Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, Elbit Systems, Leonardo S.p.A., HENSOLDT AG, Safran S.A., General Dynamics, L3Harris Technologies, Rheinmetall AG, FLIR Systems (Teledyne FLIR), Honeywell International Inc., Cisco Systems, Serco Group plc, Airbus Defence and Space, TCDD Ta??mac?l?k A.?., Securitas AB, NEC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East border security market is poised for transformation, driven by technological advancements and increased collaboration among nations. As countries prioritize national security, the integration of artificial intelligence and machine learning into security systems will enhance threat detection capabilities. Additionally, the shift towards automated border control systems will streamline processes, improving efficiency. Public-private partnerships are expected to play a crucial role in fostering innovation and addressing the evolving security landscape, ensuring that border security remains robust and adaptive to emerging challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Barriers (Fences, Walls, Bollards) Surveillance Systems (CCTV, Thermal Cameras, Radar) Access Control Systems (Biometric Readers, Smart Gates) Detection Systems (Ground Sensors, Motion Detectors, X-ray Scanners) Communication Systems (Secure Radios, Satellite Links) Border Management Software (Integrated Command & Control, Analytics Platforms) Unmanned Systems (Drones, UGVs) Others |

| By End-User | Government Agencies (Border Police, Immigration Authorities) Military Customs and Border Protection Private Security Firms Critical Infrastructure Operators (Airports, Ports, Oil & Gas Facilities) International Organizations (UN, IOM) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Turkey Others |

| By Technology | Biometric Systems (Facial, Fingerprint, Iris) RFID Technology Video Analytics (AI-based Threat Detection) Sensor Technologies (Seismic, Acoustic, Infrared) Drone & Robotics Solutions Others |

| By Application | Border Control Immigration Control Cargo Security Perimeter Security Counter-Terrorism Others |

| By Investment Source | Government Funding Private Investments International Aid (World Bank, UN) Public-Private Partnerships Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Border Security Agencies | 100 | Border Control Officers, Policy Makers |

| Private Security Technology Providers | 70 | Product Managers, Sales Directors |

| Consulting Firms Specializing in Security | 50 | Security Analysts, Risk Management Consultants |

| International Organizations Focused on Security | 40 | Program Directors, Regional Coordinators |

| Academic Institutions Conducting Security Research | 40 | Research Scholars, Professors in Security Studies |

The Middle East Border Security Market is valued at approximately USD 1.7 billion, driven by increasing geopolitical tensions, cross-border crimes, and the need for enhanced national security measures. This market is expected to grow as governments invest in advanced security technologies.