Region:Middle East

Author(s):Rebecca

Product Code:KRAD1391

Pages:80

Published On:November 2025

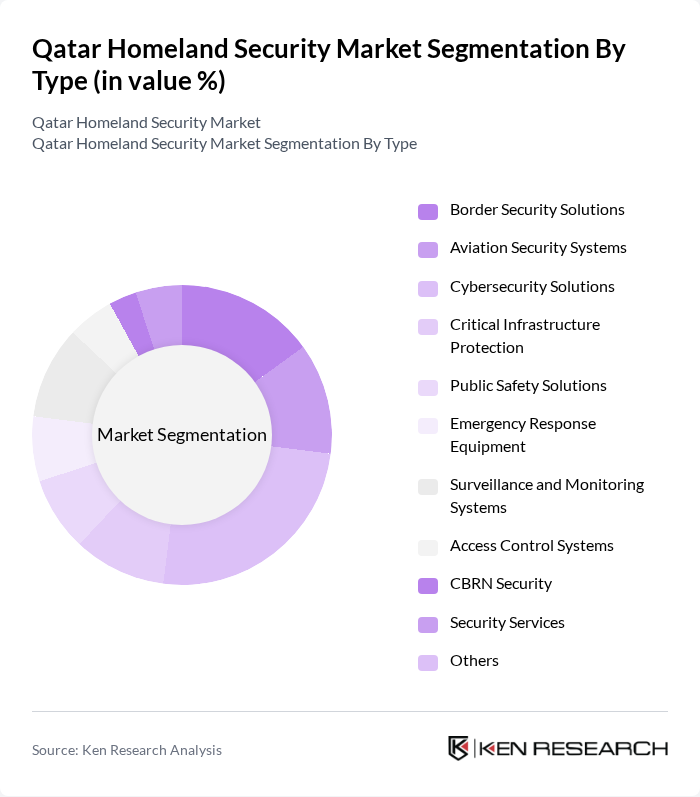

By Type:The market is segmented into Border Security Solutions, Aviation Security Systems, Cybersecurity Solutions, Critical Infrastructure Protection, Public Safety Solutions, Emergency Response Equipment, Surveillance and Monitoring Systems, Access Control Systems, CBRN (Chemical, Biological, Radiological, and Nuclear) Security, Security Services, and Others. Among these,Cybersecurity Solutionscurrently lead the market, driven by the increasing frequency of cyber threats and the need for robust digital security measures across all sectors. This segment has seen rapid expansion due to government and private sector investments in digital infrastructure protection.

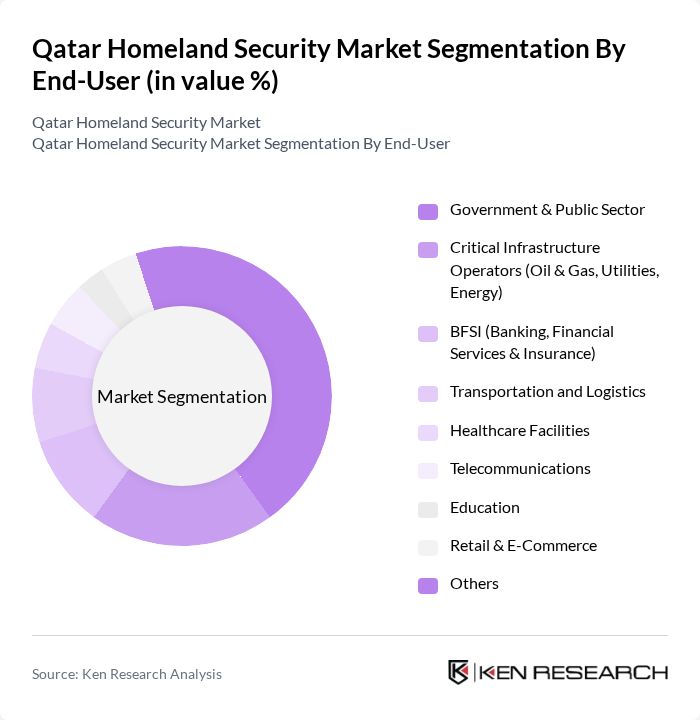

By End-User:The end-user segmentation includes Government & Public Sector, Critical Infrastructure Operators (Oil & Gas, Utilities, Energy), BFSI (Banking, Financial Services & Insurance), Transportation and Logistics, Healthcare Facilities, Telecommunications, Education, Retail & E-Commerce, and Others. TheGovernment & Public Sectorsegment is the largest end-user, driven by substantial government investments in security infrastructure and the need for enhanced public safety measures. This segment continues to expand as Qatar prioritizes national security and infrastructure protection.

The Qatar Homeland Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barzan Holdings, Milipol Qatar, G4S Qatar, Securitas Qatar, Raytheon Technologies (Qatar), Thales Group (Qatar), Huawei Technologies Qatar, Ooredoo Q.P.S.C., Qatar Security Systems Company (QSSC), Al Jazeera Security Services, Qatar Electronic Systems Company (QESCO), Al-Tamimi Group (Security Division), Mannai Corporation QPSC (Security Solutions), Siemens Qatar, Honeywell Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar homeland security market is poised for significant transformation as the government continues to prioritize safety and security initiatives. With a projected increase in funding for smart city projects and advanced surveillance technologies, the market is expected to evolve rapidly. Additionally, the integration of artificial intelligence and machine learning into security solutions will enhance operational efficiency. As public awareness of security issues grows, the demand for innovative solutions will likely drive further investment and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Border Security Solutions Aviation Security Systems Cybersecurity Solutions Critical Infrastructure Protection Public Safety Solutions Emergency Response Equipment Surveillance and Monitoring Systems Access Control Systems CBRN (Chemical, Biological, Radiological, and Nuclear) Security Security Services Others |

| By End-User | Government & Public Sector Critical Infrastructure Operators (Oil & Gas, Utilities, Energy) BFSI (Banking, Financial Services & Insurance) Transportation and Logistics Healthcare Facilities Telecommunications Education Retail & E-Commerce Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Technology | Video Surveillance Technology Intrusion Detection Systems Access Control Technology Cybersecurity Technology Communication Technology AI-Based Security Solutions CBRN Detection Technology Others |

| By Application | Border Security Aviation Security Critical Infrastructure Protection Public Safety and Security Cybersecurity Management Emergency Management Risk Management Others |

| By Investment Source | Government Funding Private Investments International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Training and Development Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Security Agencies | 60 | Policy Makers, Security Analysts |

| Private Security Firms | 50 | Operations Managers, Business Development Heads |

| Cybersecurity Solutions Providers | 40 | Technical Directors, Cybersecurity Experts |

| Emergency Response Services | 40 | Emergency Managers, Training Coordinators |

| Technology Vendors in Security | 50 | Product Managers, Sales Executives |

The Qatar Homeland Security Market is valued at approximately USD 165 million, reflecting significant investments in advanced security technologies and a commitment to enhancing public safety and infrastructure security.