Region:Middle East

Author(s):Dev

Product Code:KRAD5266

Pages:90

Published On:December 2025

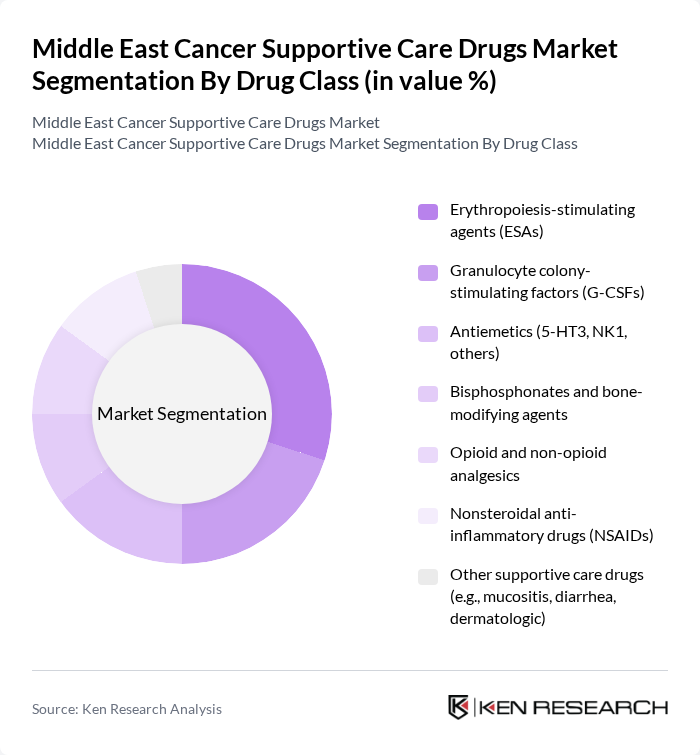

By Drug Class:The drug class segmentation includes various categories of supportive care drugs that are essential for managing the side effects of cancer treatments. The leading sub-segment in this category is the Erythropoiesis-stimulating agents (ESAs), which are crucial for treating anemia in cancer patients. The increasing incidence of chemotherapy-induced anemia has driven the demand for ESAs, making them a significant focus for healthcare providers and pharmaceutical companies.

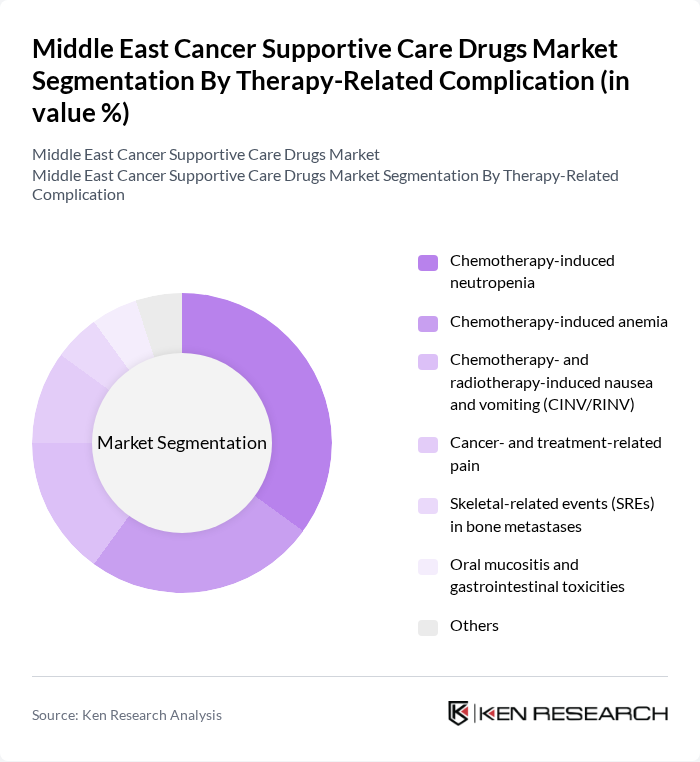

By Therapy-Related Complication:This segmentation focuses on the various complications arising from cancer treatments, with chemotherapy-induced neutropenia being the most prevalent. The demand for drugs addressing this complication has surged due to the increasing use of chemotherapy regimens, which often lead to severe side effects. As healthcare providers prioritize patient safety and treatment efficacy, the market for supportive care drugs targeting these complications continues to expand.

The Middle East Cancer Supportive Care Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as F. Hoffmann-La Roche Ltd, Amgen Inc., Novartis AG (including Sandoz), Pfizer Inc., Sanofi, GlaxoSmithKline plc (GSK), Merck & Co., Inc. (MSD), Bristol Myers Squibb Company, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd, Hikma Pharmaceuticals plc, Julphar – Gulf Pharmaceutical Industries, SPIMACO Addwaeih – Saudi Pharmaceutical Industries & Medical Appliances Corporation, Tabuk Pharmaceuticals Manufacturing Company, Aspen Pharmacare Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East cancer supportive care drugs market appears promising, driven by ongoing advancements in healthcare infrastructure and increased investment in research and development. As governments prioritize cancer care, the integration of innovative technologies and personalized medicine is expected to enhance treatment efficacy. Furthermore, collaborations with international pharmaceutical companies will likely facilitate the introduction of new therapies, ultimately improving patient outcomes and expanding market reach in the region.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Erythropoiesis-stimulating agents (ESAs) Granulocyte colony-stimulating factors (G-CSFs) Antiemetics (5-HT3, NK1, others) Bisphosphonates and bone-modifying agents Opioid and non-opioid analgesics Nonsteroidal anti-inflammatory drugs (NSAIDs) Other supportive care drugs (e.g., mucositis, diarrhea, dermatologic) |

| By Therapy-Related Complication | Chemotherapy-induced neutropenia Chemotherapy-induced anemia Chemotherapy- and radiotherapy-induced nausea and vomiting (CINV/RINV) Cancer- and treatment-related pain Skeletal-related events (SREs) in bone metastases Oral mucositis and gastrointestinal toxicities Others |

| By End-User | Hospitals Specialty oncology centers Home care settings Palliative care centers and hospices Others |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies Specialty pharmacies Wholesalers and distributors Others |

| By Route of Administration | Oral Intravenous Subcutaneous Transdermal Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Cancer Type | Breast cancer Lung cancer Colorectal cancer Prostate cancer Liver and stomach cancers Others |

| By Region | GCC countries Levant Iran Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologists in Major Hospitals | 100 | Medical Oncologists, Hematologists |

| Pharmacists in Cancer Treatment Centers | 80 | Clinical Pharmacists, Pharmacy Directors |

| Patients Receiving Supportive Care | 150 | Cancer Patients, Caregivers |

| Healthcare Administrators | 70 | Hospital Administrators, Procurement Officers |

| Clinical Researchers in Oncology | 60 | Clinical Research Coordinators, Oncological Researchers |

The Middle East Cancer Supportive Care Drugs Market is valued at approximately USD 400 million, reflecting a significant growth driven by the increasing prevalence of cancer and advancements in treatment protocols.