Region:Middle East

Author(s):Rebecca

Product Code:KRAC3183

Pages:94

Published On:October 2025

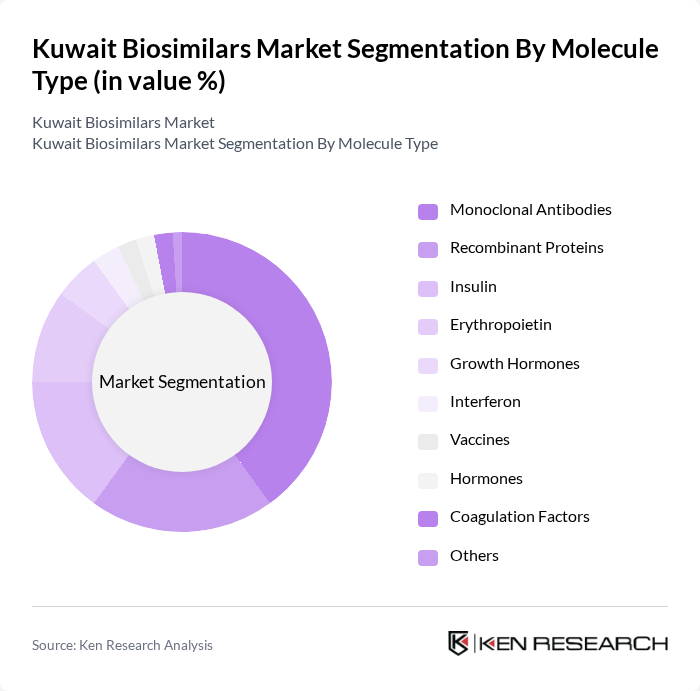

By Molecule Type:The biosimilars market can be segmented based on the type of molecules used. The key subsegments include Monoclonal Antibodies, Recombinant Proteins, Insulin, Erythropoietin, Growth Hormones, Interferon, Vaccines, Hormones, Coagulation Factors, and Others. Among these, Monoclonal Antibodies are leading the market due to their widespread application in oncology and autoimmune diseases, driven by increasing patient demand for effective therapies. Hormones represent the fastest-growing segment, reflecting broader therapeutic needs and market dynamics.

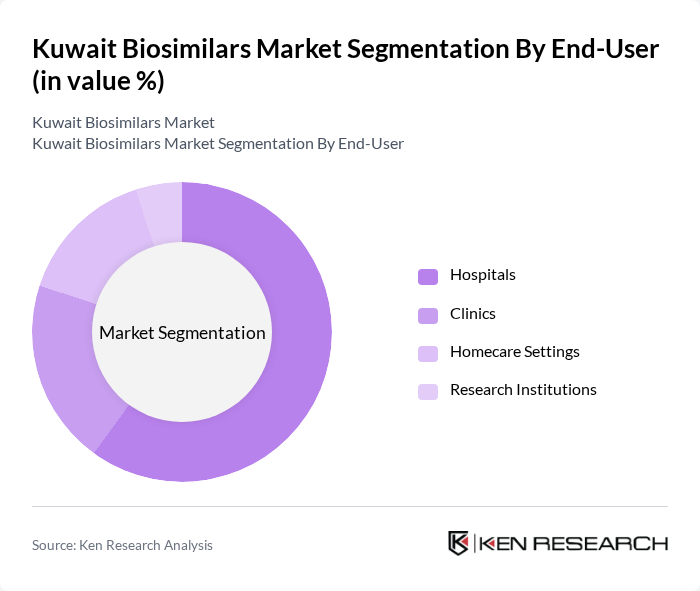

By End-User:The biosimilars market is segmented by end-users, which include Hospitals, Clinics, Homecare Settings, and Research Institutions. Hospitals are the leading end-user segment, primarily due to their capacity to administer complex therapies and the increasing number of patients requiring treatment for chronic diseases. The trend towards outpatient care is also driving growth in homecare settings, as patients seek more convenient and cost-effective treatment options outside traditional hospital environments.

The Kuwait Biosimilars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Sandoz International GmbH (Novartis), Pfizer Inc., Viatris Inc. (formerly Mylan N.V.), Teva Pharmaceutical Industries Ltd., Celltrion Healthcare Co., Ltd., Samsung Bioepis Co., Ltd., AbbVie Inc., Biocon Ltd., GlaxoSmithKline plc (GSK), Merck & Co., Inc., Novartis AG, Roche Holding AG, Eli Lilly and Company, Sanofi S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biosimilars market in Kuwait appears promising, driven by increasing healthcare investments and a growing emphasis on cost-effective treatment solutions. As the government continues to implement supportive policies and enhance regulatory frameworks, the market is likely to witness a surge in biosimilar approvals. Additionally, the rising acceptance of biosimilars among healthcare professionals and patients will further facilitate their integration into treatment protocols, ultimately improving patient access to essential therapies.

| Segment | Sub-Segments |

|---|---|

| By Molecule Type | Monoclonal Antibodies Recombinant Proteins Insulin Erythropoietin Growth Hormones Interferon Vaccines Hormones Coagulation Factors Others |

| By End-User | Hospitals Clinics Homecare Settings Research Institutions |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Pharmacies |

| By Application | Oncology Autoimmune Diseases Diabetes Infectious Diseases Others |

| By Patient Demographics | Pediatric Adult Geriatric |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Regulatory Status | Approved Under Review Pipeline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 60 | Oncologists, Rheumatologists, Endocrinologists |

| Pharmacists | 40 | Community Pharmacists, Hospital Pharmacists |

| Patients Using Biosimilars | 50 | Chronic Disease Patients, Patient Advocacy Group Members |

| Regulatory Experts | 40 | Regulatory Affairs Managers, Compliance Officers |

| Pharmaceutical Distributors | 40 | Sales Managers, Business Development Executives |

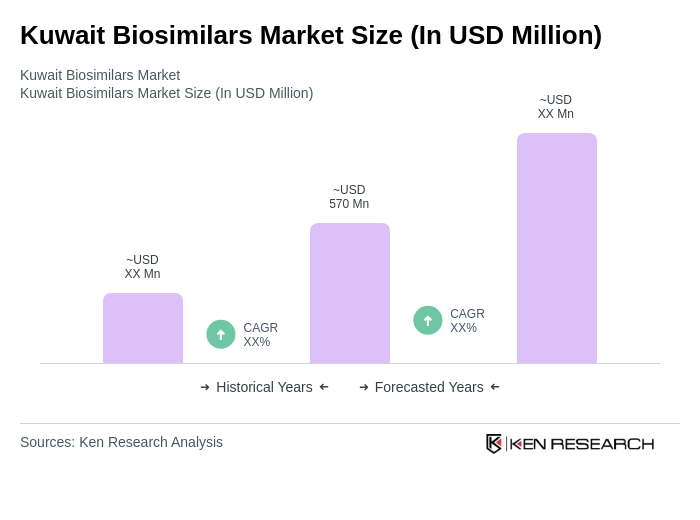

The Kuwait Biosimilars Market is valued at approximately USD 570 million, driven by the increasing prevalence of chronic diseases and the demand for affordable treatment options. This growth reflects a significant shift towards cost-effective alternatives to expensive biologics.