Region:Middle East

Author(s):Shubham

Product Code:KRAB8647

Pages:93

Published On:October 2025

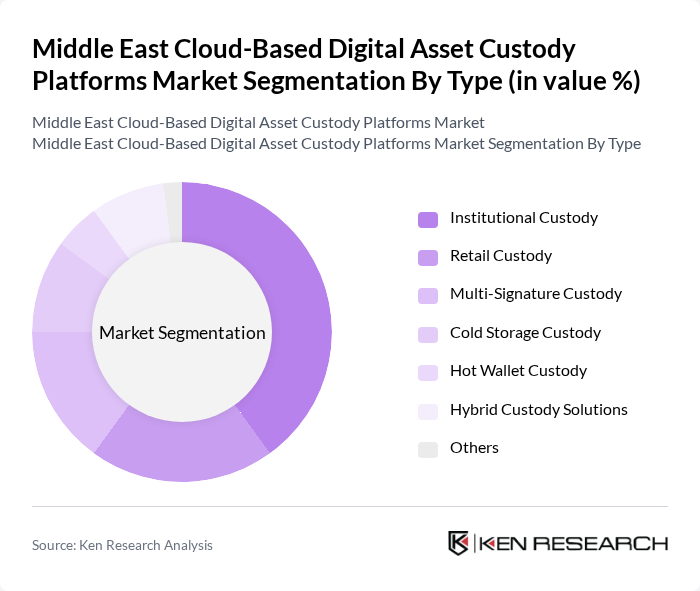

By Type:The market is segmented into various types of custody solutions, including Institutional Custody, Retail Custody, Multi-Signature Custody, Cold Storage Custody, Hot Wallet Custody, Hybrid Custody Solutions, and Others. Among these, Institutional Custody is currently the leading sub-segment due to the increasing participation of institutional investors in the digital asset space. These investors require robust security measures and compliance with regulatory standards, which institutional custody solutions provide effectively.

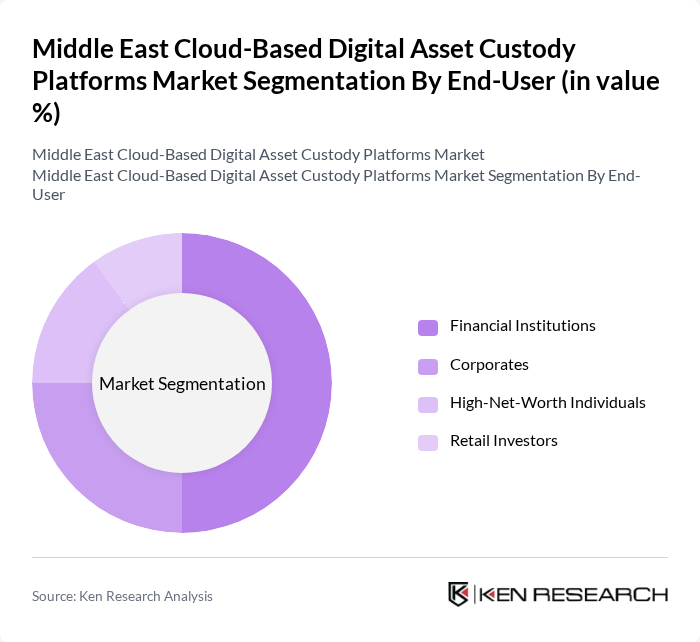

By End-User:The market is segmented by end-users, including Financial Institutions, Corporates, High-Net-Worth Individuals, and Retail Investors. Financial Institutions dominate this segment as they increasingly seek secure and compliant solutions for managing digital assets. The growing trend of institutional investment in cryptocurrencies and other digital assets has led to a surge in demand for tailored custody solutions that meet their specific needs.

The Middle East Cloud-Based Digital Asset Custody Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coinbase Custody, BitGo, Fidelity Digital Assets, Anchorage, Gemini Custody, Ledger Vault, Fireblocks, Bakkt, Trustology, Zodia Custody, Copper, Komainu, Cobo, Onchain Custodian, Digital Asset Custody Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud-based digital asset custody platforms in the Middle East appears promising, driven by technological advancements and increasing regulatory support. As institutions continue to embrace digital assets, the demand for secure and efficient custody solutions will likely rise. Furthermore, the integration of artificial intelligence and blockchain technology is expected to enhance operational efficiencies, while partnerships with traditional financial institutions will facilitate broader market acceptance and innovation in custody services.

| Segment | Sub-Segments |

|---|---|

| By Type | Institutional Custody Retail Custody Multi-Signature Custody Cold Storage Custody Hot Wallet Custody Hybrid Custody Solutions Others |

| By End-User | Financial Institutions Corporates High-Net-Worth Individuals Retail Investors |

| By Asset Class | Cryptocurrencies Tokenized Assets NFTs Stablecoins |

| By Service Model | Fully Managed Services Self-Custody Solutions Hybrid Models |

| By Compliance Level | Regulated Custodians Unregulated Custodians |

| By Geographic Focus | Domestic Focus International Focus |

| By Pricing Model | Subscription-Based Transaction Fee-Based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors | 100 | Portfolio Managers, Investment Analysts |

| Regulatory Bodies | 50 | Compliance Officers, Regulatory Analysts |

| Cloud Custody Service Providers | 80 | Product Managers, Business Development Executives |

| Financial Technology Experts | 70 | Consultants, Technology Advisors |

| Legal Advisors in Digital Assets | 60 | Legal Counsel, Compliance Specialists |

The Middle East Cloud-Based Digital Asset Custody Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased institutional adoption and demand for secure storage solutions for digital assets.