Region:Middle East

Author(s):Shubham

Product Code:KRAD0878

Pages:96

Published On:November 2025

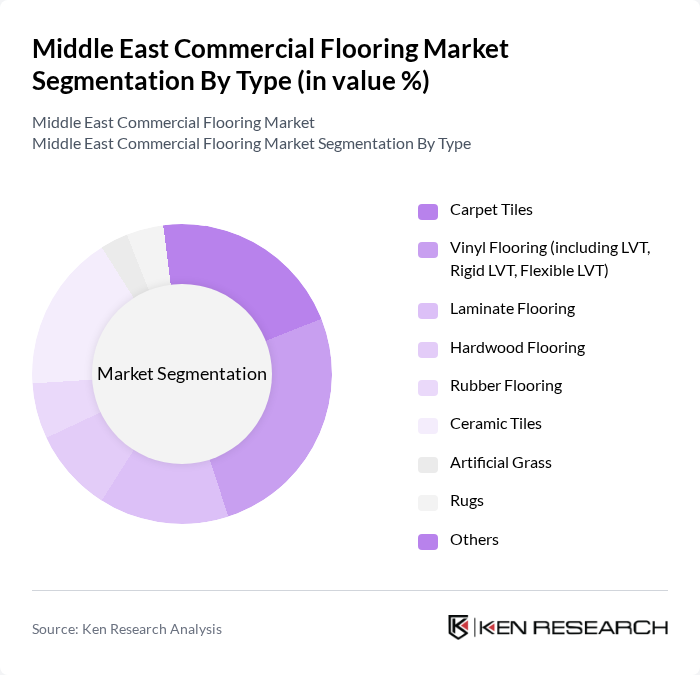

By Type:The market is segmented into various types of flooring materials, including Carpet Tiles, Vinyl Flooring (including LVT, Rigid LVT, Flexible LVT), Laminate Flooring, Hardwood Flooring, Rubber Flooring, Ceramic Tiles, Artificial Grass, Rugs, and Others. Each type caters to different consumer preferences and applications, with specific advantages such as durability, aesthetics, ease of maintenance, and compliance with sustainability standards. Vinyl flooring and ceramic tiles are particularly favored in commercial and hospitality projects for their resilience and design flexibility, while carpet tiles and laminate flooring are gaining traction in office and institutional settings due to their acoustic and comfort properties .

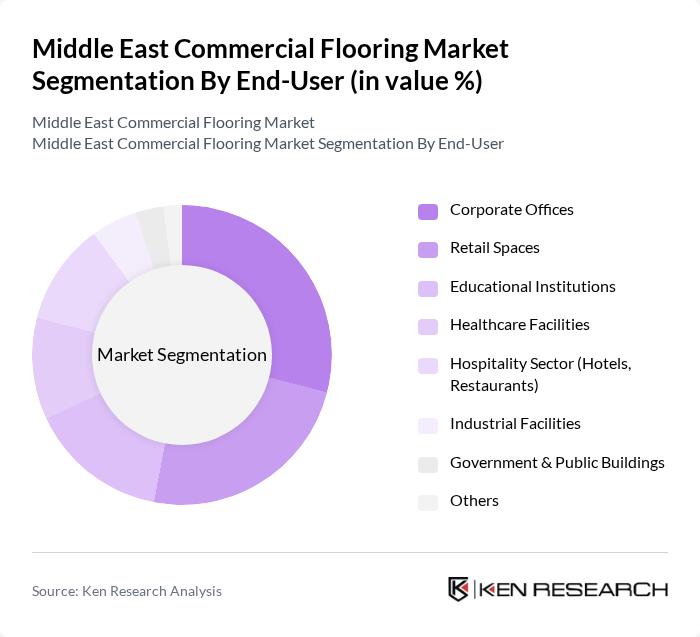

By End-User:The end-user segmentation includes Corporate Offices, Retail Spaces, Educational Institutions, Healthcare Facilities, Hospitality Sector (Hotels, Restaurants), Industrial Facilities, Government & Public Buildings, and Others. Each segment has unique requirements and preferences, influencing the choice of flooring materials based on functionality, aesthetics, durability, and compliance with health and safety standards. The corporate and retail segments are leading adopters due to ongoing commercial expansion and renovation activities, while the hospitality sector is witnessing increased demand for premium and custom flooring solutions aligned with luxury and sustainability trends .

The Middle East Commercial Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mohawk Industries, Shaw Industries Group, Inc., Tarkett S.A., Gerflor Group, Interface, Inc., Forbo Flooring Systems, Beaulieu International Group, LG Hausys (LX Hausys), Polyflor Ltd, Mapei S.p.A., Al Sorayai Group, Al Abdullatif Industrial Investment Company, Ras Al Khaimah Ceramics (RAK Ceramics), Al Aqili Group, Desso (a Tarkett company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East commercial flooring market appears promising, driven by increasing investments in sustainable construction and technological advancements. As urbanization accelerates, the demand for innovative flooring solutions is expected to rise, particularly in sectors like retail and hospitality. Additionally, the integration of smart technologies into flooring products will likely enhance functionality and appeal, positioning the market for robust growth in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Carpet Tiles Vinyl Flooring (including LVT, Rigid LVT, Flexible LVT) Laminate Flooring Hardwood Flooring Rubber Flooring Ceramic Tiles Artificial Grass Rugs Others |

| By End-User | Corporate Offices Retail Spaces Educational Institutions Healthcare Facilities Hospitality Sector (Hotels, Restaurants) Industrial Facilities Government & Public Buildings Others |

| By Application | Indoor Flooring Outdoor Flooring Specialty Flooring (e.g., sports, anti-static, acoustic) Others |

| By Material | Natural Materials (e.g., wood, stone) Synthetic Materials (e.g., vinyl, polypropylene, nylon, polyester) Composite Materials Recycled Materials Others |

| By Installation Method | Glue-Down Floating Nail-Down Click-Lock Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Flooring | 100 | Facility Managers, Office Space Planners |

| Retail Flooring Solutions | 80 | Store Managers, Retail Operations Directors |

| Hospitality Flooring Projects | 60 | Hotel Managers, Interior Designers |

| Healthcare Facility Flooring | 50 | Healthcare Administrators, Procurement Officers |

| Educational Institution Flooring | 60 | School Administrators, Facility Coordinators |

The Middle East Commercial Flooring Market is valued at approximately USD 10 billion, driven by rapid urbanization, infrastructure projects, and a growing demand for sustainable flooring solutions across various sectors, including commercial, healthcare, and education.