Region:North America

Author(s):Rebecca

Product Code:KRAA2844

Pages:99

Published On:August 2025

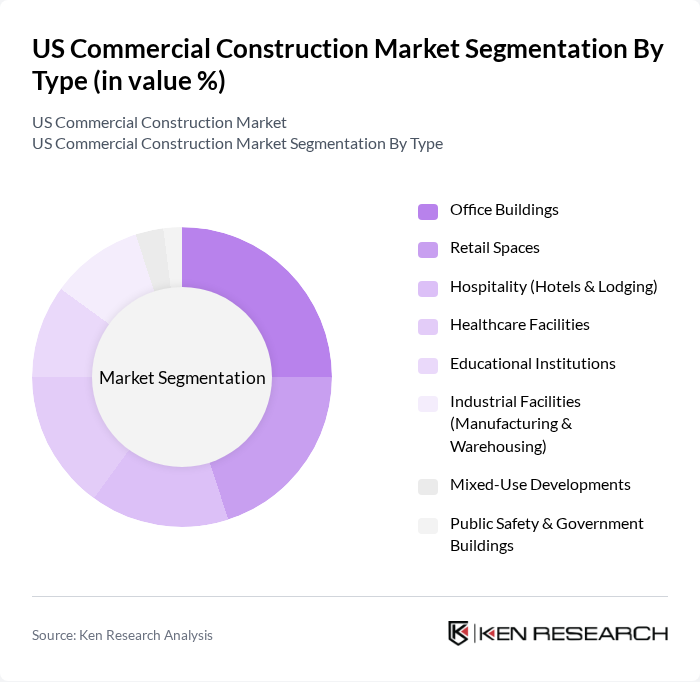

By Type:The commercial construction market is segmented into office buildings, retail spaces, hospitality, healthcare facilities, educational institutions, industrial facilities, mixed-use developments, and public safety buildings. Each segment addresses specific market demands, with data centers and healthcare facilities experiencing notable growth due to digital transformation and demographic shifts. Industrial facilities, particularly warehousing, have seen increased activity driven by e-commerce, while mixed-use developments reflect evolving urban planning trends.

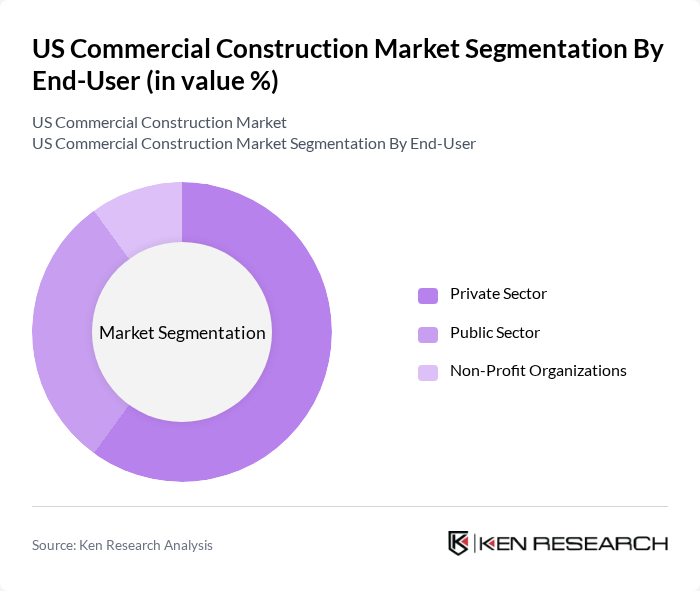

By End-User:The end-user segmentation includes private sector, public sector, and non-profit organizations. Private sector demand is led by commercial real estate developers and corporations, while public sector projects are driven by federal, state, and municipal investments in infrastructure and civic facilities. Non-profit organizations focus on educational, healthcare, and community-oriented developments, each segment influencing project types and funding sources.

The US Commercial Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turner Construction Company, Bechtel Corporation, Skanska USA, Kiewit Corporation, The Whiting-Turner Contracting Company, Jacobs Engineering Group Inc., Clark Construction Group, LLC, PCL Construction Enterprises, Inc., Hensel Phelps Construction Co., Gilbane Building Company, Mortenson Construction, McCarthy Building Companies, Inc., DPR Construction, Balfour Beatty US, Structure Tone contribute to innovation, geographic expansion, and service delivery in this space.

The US commercial construction market is poised for growth, driven by increased infrastructure spending and urbanization trends. As cities expand, the demand for innovative construction solutions will rise, particularly in sustainable and smart building technologies. Additionally, the integration of digital tools will enhance project efficiency. However, challenges such as labor shortages and rising material costs will require strategic management. Overall, the market is expected to adapt and evolve, presenting new opportunities for stakeholders in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Buildings Retail Spaces Hospitality (Hotels & Lodging) Healthcare Facilities Educational Institutions Industrial Facilities (Manufacturing & Warehousing) Mixed-Use Developments Public Safety & Government Buildings |

| By End-User | Private Sector Public Sector Non-Profit Organizations |

| By Application | New Construction Renovation Maintenance |

| By Investment Source | Private Investment Government Funding Foreign Direct Investment |

| By Project Size | Small Projects (Under $10M) Medium Projects ($10M–$100M) Large Projects (Over $100M) |

| By Construction Method | Traditional (Design-Bid-Build) Design-Build Construction Management at Risk (CMAR) Integrated Project Delivery (IPD) |

| By Policy Support | Tax Incentives Grants Subsidies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Construction | 100 | Project Managers, Architects |

| Retail Space Development | 80 | Construction Executives, Real Estate Developers |

| Hospitality Sector Projects | 60 | General Contractors, Hotel Development Managers |

| Industrial Facility Construction | 50 | Operations Managers, Facility Planners |

| Public Infrastructure Projects | 70 | Government Officials, Civil Engineers |

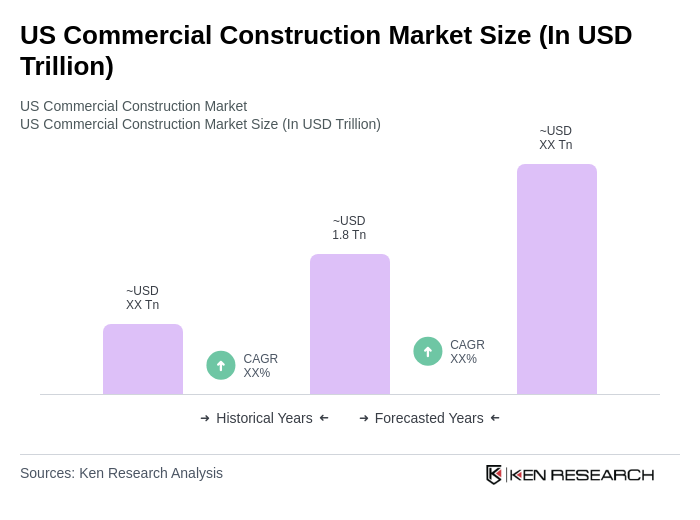

The US Commercial Construction Market is valued at approximately USD 1.8 trillion, reflecting a comprehensive analysis of non-residential and engineering construction activities over the past five years. This valuation highlights the sector's significant growth and ongoing demand for various commercial spaces.