Region:Middle East

Author(s):Dev

Product Code:KRAA8392

Pages:93

Published On:November 2025

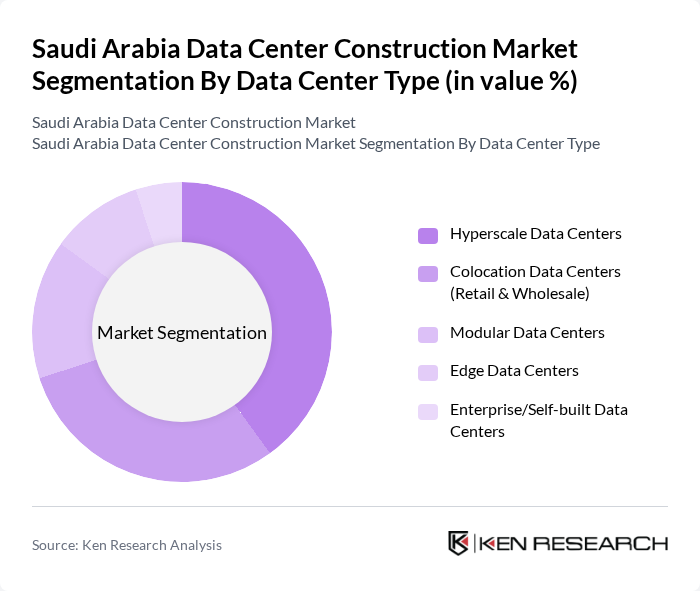

By Data Center Type:The data center construction market can be segmented into various types, including Hyperscale Data Centers, Colocation Data Centers (Retail & Wholesale), Modular Data Centers, Edge Data Centers, and Enterprise/Self-built Data Centers. Each type serves different needs, with hyperscale data centers catering to large-scale operations, while colocation centers provide shared facilities for multiple clients. Mega and hyperscale data centers are increasingly prevalent due to cloud adoption and the need for scalable infrastructure .

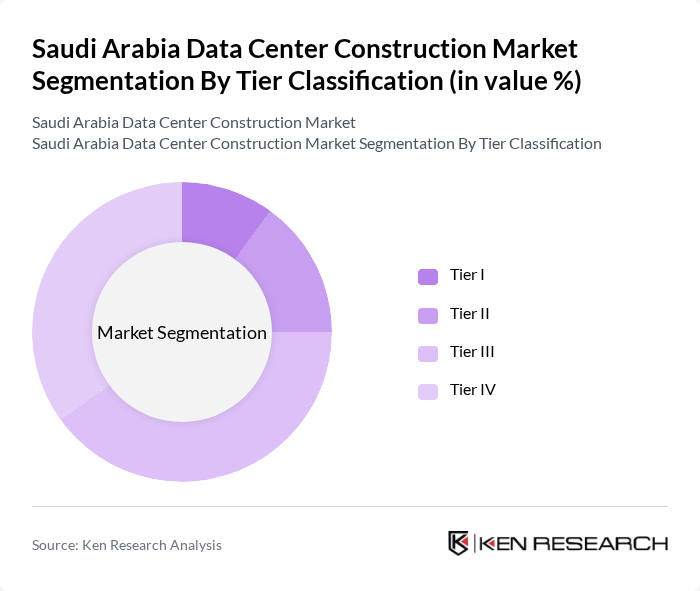

By Tier Classification:The market can also be segmented based on tier classification, which includes Tier I, Tier II, Tier III, and Tier IV data centers. Tier III and Tier IV data centers are particularly popular due to their high availability and redundancy features, making them suitable for mission-critical applications. The majority of new facilities target Tier III or higher certification to meet international standards and customer requirements .

The Saudi Arabia Data Center Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (STC), Mobily (Etihad Etisalat Company), Zain KSA, Gulf Data Hub, Equinix, Digital Realty, Khazna Data Centers, Edgnex Data Centres by DAMAC, Alibaba Cloud, Microsoft Azure, Amazon Web Services (AWS), Oracle Cloud, IBM Cloud, Google Cloud, Ooredoo, Etisalat, VIRTUS Data Centres contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia data center construction market appears promising, driven by ongoing government support and increasing demand for digital services. As the Kingdom continues to invest in its IT infrastructure, the market is likely to witness significant growth. Innovations in modular data centers and energy-efficient technologies will play a crucial role in shaping the landscape, while partnerships with global tech firms will enhance local capabilities and foster knowledge transfer, ensuring sustainable development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Data Center Type | Hyperscale Data Centers Colocation Data Centers (Retail & Wholesale) Modular Data Centers Edge Data Centers Enterprise/Self-built Data Centers |

| By Tier Classification | Tier I Tier II Tier III Tier IV |

| By End-User Industry | IT and Telecommunications Financial Services (BFSI) Government & Defense E-Commerce & Retail Healthcare Education Energy & Utilities Others |

| By Region | Riyadh Jeddah Dammam Khobar NEOM Al-Madinah Abha Others |

| By Technology | Cooling Technologies Power Supply Technologies Security Technologies Network Infrastructure Others |

| By Application | Colocation Services Managed Hosting Services Cloud Services Disaster Recovery Services Edge Computing Others |

| By Investment Source | Private Investments Public Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Grants and Funding Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Data Center Operators | 60 | IT Managers, Operations Directors |

| Construction Firms | 50 | Project Managers, Estimators |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-User Industries | 45 | IT Directors, Business Analysts |

| Consulting Firms | 40 | Market Analysts, Industry Experts |

The Saudi Arabia Data Center Construction Market is valued at approximately USD 1.9 billion, driven by increasing demand for cloud services, digital transformation initiatives under Vision 2030, and significant investments from hyperscale cloud providers.