Region:Middle East

Author(s):Dev

Product Code:KRAD3390

Pages:88

Published On:November 2025

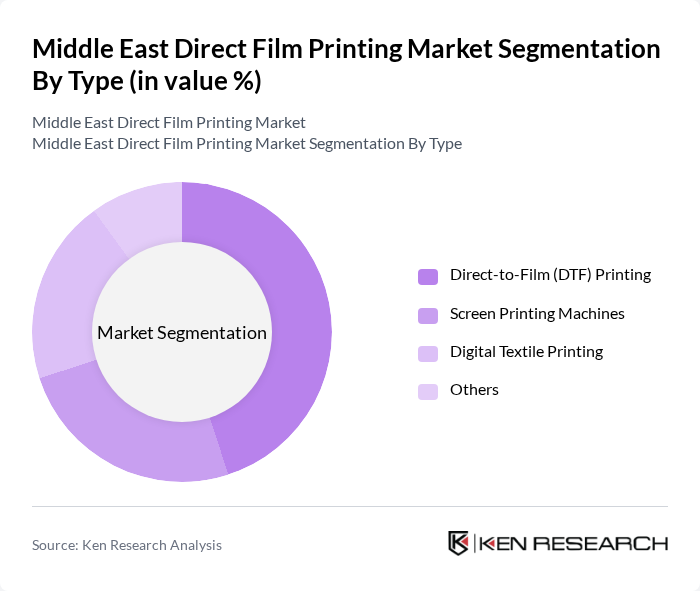

By Type:The market is segmented into Direct-to-Film (DTF) Printing, Screen Printing Machines, Digital Textile Printing, and Others. Among these, Direct-to-Film (DTF) Printing is gaining significant traction due to its versatility, ability to produce high-resolution prints on diverse substrates, and suitability for short-run, customized production. The demand for DTF printing is propelled by the rise of personalized apparel, on-demand merchandise, and the need for rapid turnaround in fashion and promotional sectors .

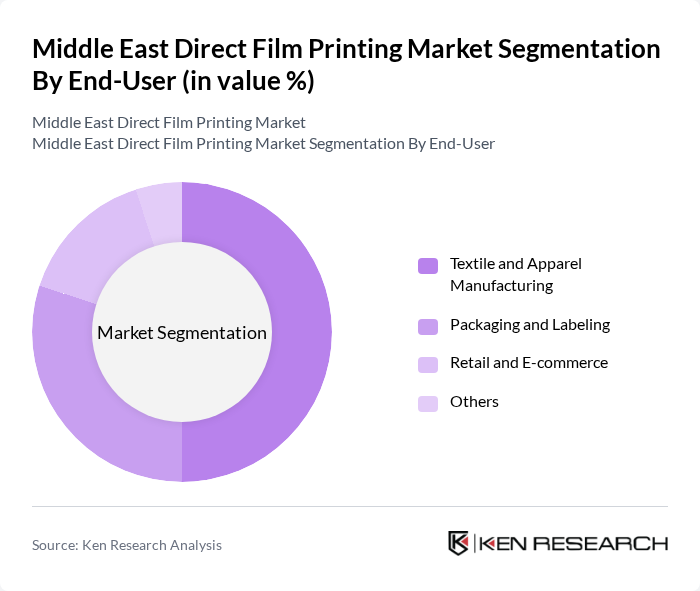

By End-User:The end-user segmentation includes Textile and Apparel Manufacturing, Packaging and Labeling, Retail and E-commerce, and Others. Textile and Apparel Manufacturing is the leading segment, driven by the surge in demand for customized clothing, promotional merchandise, and the proliferation of e-commerce platforms. The need for flexible, high-quality, and quick-turnaround printing solutions is especially pronounced among regional apparel exporters and online retailers .

The Middle East Direct Film Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mimaki Engineering Co., Ltd., Roland DG Corporation, Epson Corporation, Canon Inc., HP Inc., Brother Industries, Ltd., Ricoh Company, Ltd., Fujifilm Holdings Corporation, Agfa-Gevaert Group, Durst Phototechnik AG, Konica Minolta, Inc., Xerox Corporation, Sato Holdings Corporation, Zund Systemtechnik AG, and Sawgrass Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the direct film printing market in the Middle East appears promising, driven by ongoing technological innovations and a growing emphasis on sustainability. As businesses increasingly prioritize eco-friendly practices, the demand for sustainable printing solutions is expected to rise. Additionally, the integration of digital technologies will likely enhance operational efficiencies, enabling companies to meet the evolving needs of consumers. This dynamic environment presents significant opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct-to-Film (DTF) Printing Screen Printing Machines Digital Textile Printing Others |

| By End-User | Textile and Apparel Manufacturing Packaging and Labeling Retail and E-commerce Others |

| By Application | Custom Apparel and Merchandise Product Labels and Packaging Promotional Materials Others |

| By Material Used | Polyester Films Cotton Blends Specialty Substrates Others |

| By Distribution Channel | Indirect Sales (Distributors and Dealers) Direct Sales Online Sales Others |

| By Region | Saudi Arabia United Arab Emirates Other GCC Countries North Africa and Levant |

| By Technology | Inkjet Technology Thermal Transfer Technology Hybrid Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Film Production | 60 | Producers, Directors, Production Managers |

| Advertising Agencies | 50 | Creative Directors, Account Managers |

| Printing Equipment Suppliers | 40 | Sales Managers, Technical Support Staff |

| Film Distribution Companies | 45 | Distribution Managers, Marketing Executives |

| Educational Institutions (Film Studies) | 40 | Professors, Curriculum Developers |

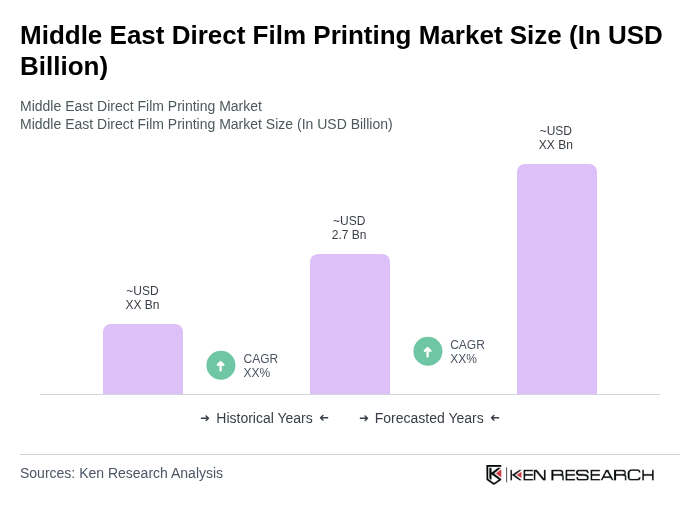

The Middle East Direct Film Printing Market is valued at approximately USD 2.7 billion, reflecting a robust growth trajectory driven by increasing demand for customized printing solutions across various sectors, including textiles, packaging, and labeling.