Region:Asia

Author(s):Rebecca

Product Code:KRAD1449

Pages:94

Published On:November 2025

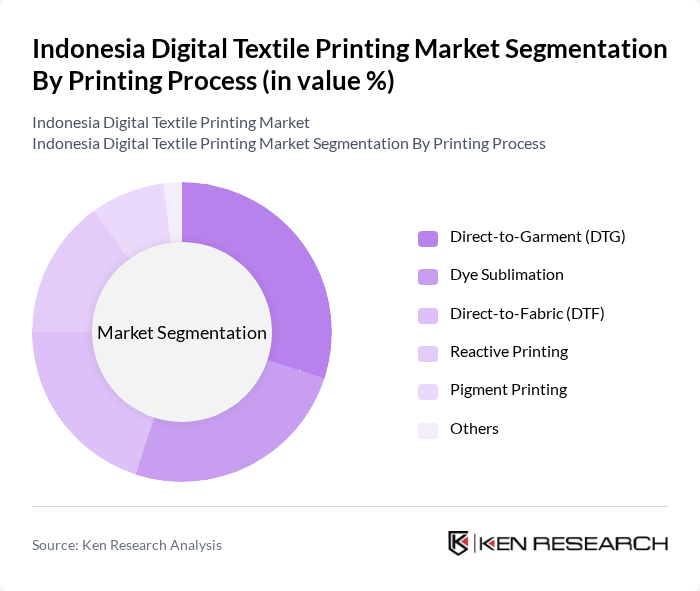

By Printing Process:The digital textile printing market is segmented by printing process into Direct-to-Garment (DTG), Dye Sublimation, Direct-to-Fabric (DTF), Reactive Printing, Pigment Printing, and Others. Each process addresses specific consumer and industry needs: DTG and DTF are favored for short-run, customizable apparel; Dye Sublimation is prominent for sportswear and polyester-based textiles; Reactive and Pigment Printing are used for cotton and blended fabrics. The market is shifting toward more versatile, efficient, and sustainable printing methods, reflecting technological progress and evolving consumer preferences.

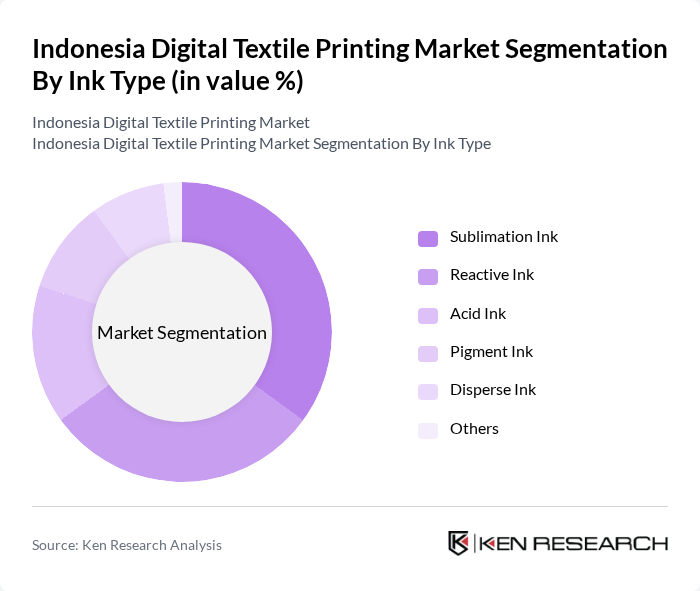

By Ink Type:Ink type segmentation includes Sublimation Ink, Reactive Ink, Acid Ink, Pigment Ink, Disperse Ink, and Others. Each ink type is selected based on fabric compatibility and end-use requirements: Sublimation Ink is dominant for polyester textiles; Reactive and Acid Inks are used for natural fibers; Pigment Ink is valued for its versatility and eco-friendly profile. The market is experiencing a shift toward water-based and low-impact inks, aligning with sustainability objectives and regulatory requirements.

The Indonesia Digital Textile Printing Market features a dynamic mix of regional and international players. Leading participants such as Epson Indonesia, Mimaki Indonesia, Roland DG Indonesia, Durst Group, Brother Indonesia, HP Indonesia, Kornit Digital, Atexco, DGI Digital Graphic Innovation, MS Printing Solutions, Agfa Graphics, Sefa Technology, Mimaki Engineering, Mutoh Indonesia, and Zünd Systemtechnik AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian digital textile printing market appears promising, driven by technological advancements and a shift towards sustainable practices. As consumer preferences evolve, manufacturers are likely to invest in innovative printing technologies that enhance customization and reduce environmental impact. Additionally, the integration of automation in production processes will streamline operations, further boosting efficiency. The market is expected to adapt to these trends, positioning itself as a leader in the Southeast Asian textile industry in the future.

| Segment | Sub-Segments |

|---|---|

| By Printing Process | Direct-to-Garment (DTG) Dye Sublimation Direct-to-Fabric (DTF) Reactive Printing Pigment Printing Others |

| By Ink Type | Sublimation Ink Reactive Ink Acid Ink Pigment Ink Disperse Ink Others |

| By Substrate/Material | Cotton Polyester Silk Rayon Linen Blends Others |

| By Application | Apparel (Fashion, Sportswear, T-Shirts, etc.) Home Textiles (Curtains, Bed Linen, Upholstery) Industrial Textiles Promotional Products Technical Textiles Others |

| By End-User | Textile Manufacturers Fashion Brands & Designers Home Furnishing Companies Printing Service Providers Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Others |

| By Region | Java Sumatra Bali Sulawesi Kalimantan Others |

| By Technology | Inkjet Printing Eco-Solvent Printing UV Printing Latex Printing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Industry Stakeholders | 60 | Fashion Designers, Brand Managers |

| Home Textile Manufacturers | 50 | Production Managers, Product Development Heads |

| Industrial Textile Applications | 40 | Procurement Managers, Operations Directors |

| Digital Printing Technology Providers | 45 | Sales Executives, Technical Support Managers |

| Textile Retailers and Distributors | 55 | Retail Managers, Supply Chain Coordinators |

The Indonesia Digital Textile Printing Market is valued at approximately USD 170 million, reflecting a five-year historical analysis. This growth is attributed to rising demand for customized textile products and advancements in digital printing technologies.