Middle East EV Charging Public-Private Partnership Models Market Overview

- The Middle East EV Charging Public-Private Partnership Models Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing government initiatives to promote electric vehicles, coupled with rising consumer demand for sustainable transportation solutions. The market is also supported by advancements in charging technology and infrastructure development, which are essential for the widespread adoption of electric vehicles.

- Countries such as the United Arab Emirates, Saudi Arabia, and Israel dominate the market due to their proactive government policies, significant investments in EV infrastructure, and a growing number of electric vehicle models available to consumers. The UAE, in particular, has established itself as a leader in EV adoption, supported by initiatives like the Dubai Clean Energy Strategy 2050, which aims to increase the share of electric vehicles in the region.

- In 2023, the UAE government implemented a regulation mandating that all new buildings must include EV charging infrastructure. This regulation aims to facilitate the growth of electric vehicle usage and ensure that charging stations are readily available, thereby supporting the transition to sustainable transportation and reducing carbon emissions in urban areas.

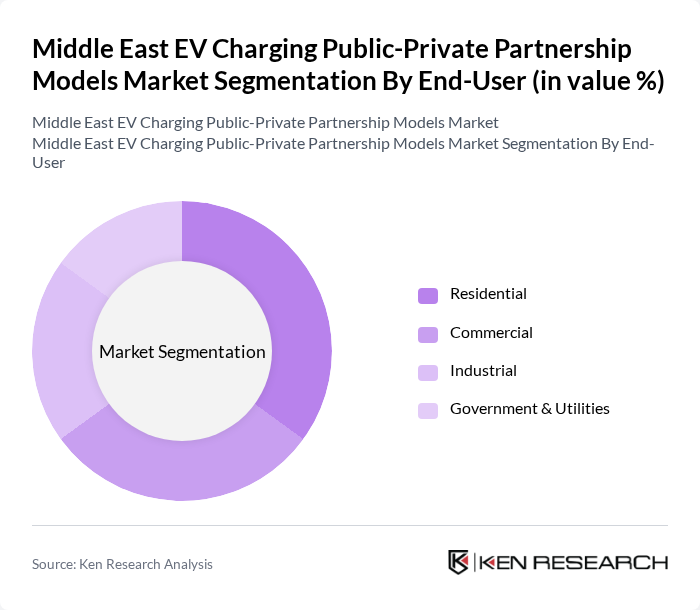

Middle East EV Charging Public-Private Partnership Models Market Segmentation

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Hubs, Mobile Charging Solutions, and Others. Each type serves different consumer needs and preferences, with AC and DC charging stations being the most widely adopted due to their efficiency and speed.

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and usage patterns, with residential users increasingly adopting EVs for personal use, while commercial and industrial sectors focus on fleet electrification.

Middle East EV Charging Public-Private Partnership Models Market Competitive Landscape

The Middle East EV Charging Public-Private Partnership Models Market is characterized by a dynamic mix of regional and international players. Leading participants such as ChargePoint, Inc., ABB Ltd., Siemens AG, Schneider Electric SE, Tesla, Inc., Blink Charging Co., EVBox B.V., Ionity GmbH, Electrify America, LLC, Greenlots, Inc., Shell Recharge, Engie SA, TotalEnergies SE, NIO Inc., Hyundai Motor Company contribute to innovation, geographic expansion, and service delivery in this space.

Middle East EV Charging Public-Private Partnership Models Market Industry Analysis

Growth Drivers

- Increasing Government Support for EV Infrastructure:The Middle East is witnessing substantial government investment in electric vehicle (EV) infrastructure, with over $1.8 billion allocated in the future. Countries like the UAE and Saudi Arabia are implementing policies to enhance charging networks, aiming for a 50% increase in public charging stations by 2025. This commitment is driven by national visions to reduce carbon emissions and promote sustainable urban mobility, aligning with global climate goals.

- Rising Demand for Sustainable Transportation Solutions:The demand for sustainable transportation in the Middle East is surging, with EV sales projected to reach 250,000 units in the future, a significant increase from 120,000 in the previous year. This shift is fueled by growing environmental awareness among consumers and businesses, alongside government incentives that encourage the adoption of electric vehicles. The transition to EVs is seen as essential for reducing air pollution and enhancing energy security in the region.

- Technological Advancements in Charging Solutions:The Middle East is experiencing rapid technological advancements in EV charging solutions, with investments exceeding $1 billion in the future. Innovations such as ultra-fast charging stations and wireless charging technologies are becoming more prevalent, enhancing user convenience and reducing charging times. These advancements are critical in addressing consumer concerns about charging accessibility and efficiency, thereby driving the adoption of electric vehicles across the region.

Market Challenges

- High Initial Investment Costs:The high initial investment required for establishing EV charging infrastructure poses a significant challenge in the Middle East. The average cost to install a public charging station ranges from $35,000 to $55,000, which can deter private investors. Additionally, the need for substantial upfront capital can limit the pace of infrastructure development, hindering the overall growth of the EV market in the region.

- Limited Charging Infrastructure:Despite government efforts, the current charging infrastructure in the Middle East remains limited, with only 1,500 public charging stations available as of early 2024. This scarcity creates range anxiety among potential EV users, impacting consumer adoption rates. The uneven distribution of charging stations, particularly in rural areas, further exacerbates this challenge, necessitating strategic planning and investment to expand the network effectively.

Middle East EV Charging Public-Private Partnership Models Market Future Outlook

The future of the Middle East EV charging market is poised for significant transformation, driven by increasing collaboration between public and private sectors. As governments enhance regulatory frameworks and provide financial incentives, private companies are likely to invest more in charging infrastructure. Additionally, the integration of renewable energy sources into charging solutions will further support sustainability goals, while advancements in smart grid technology will optimize energy distribution, ensuring a robust and efficient EV ecosystem in the region.

Market Opportunities

- Growth in Renewable Energy Integration:The integration of renewable energy sources, such as solar and wind, into EV charging infrastructure presents a significant opportunity. With over 35% of the region's energy expected to come from renewables in the future, this shift can reduce operational costs and enhance sustainability, making EV charging more attractive to consumers and investors alike.

- Development of Smart Charging Solutions:The development of smart charging solutions, which utilize real-time data to optimize charging times and energy use, is gaining traction. With an estimated 30% of new charging stations expected to incorporate smart technology in the future, this innovation can enhance user experience and improve grid management, creating a more efficient charging ecosystem in the Middle East.