Region:Middle East

Author(s):Rebecca

Product Code:KRAD4928

Pages:82

Published On:December 2025

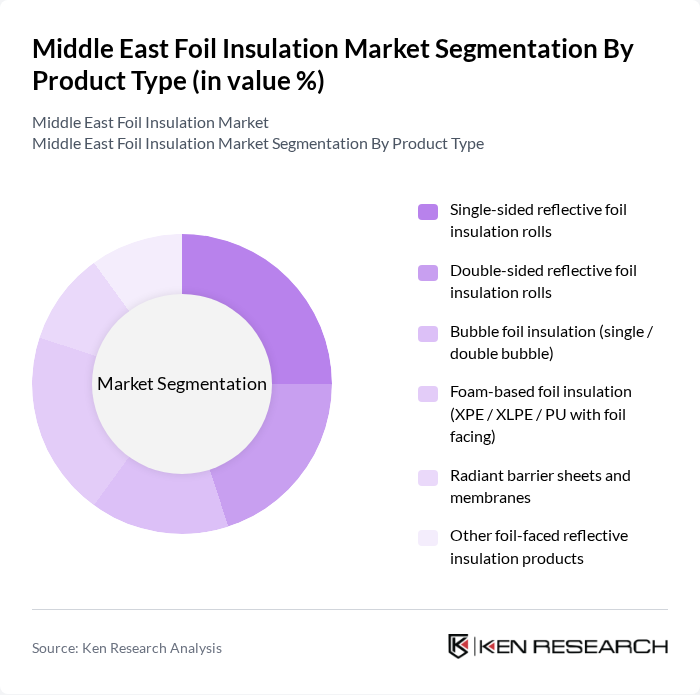

By Product Type:The product type segmentation includes various foil insulation products that cater to different applications and consumer needs. The subsegments are as follows:

The product type segmentation reveals that single-sided reflective foil insulation rolls have a strong presence in the market due to their versatility and ease of installation, especially in roofs, walls, and metal building applications. They are widely used in both residential and commercial buildings, making them a preferred choice among contractors and builders in hot-climate markets. The growing trend towards energy-efficient solutions and tighter building energy codes has also led to increased adoption of double-sided reflective foil insulation rolls, which offer enhanced thermal performance by reflecting radiant heat from both sides of the assembly. The demand for bubble foil insulation is rising as well, particularly in cold storage, warehousing, and HVAC duct applications, due to its combination of reflective surfaces and enclosed air pockets that improve overall thermal resistance.

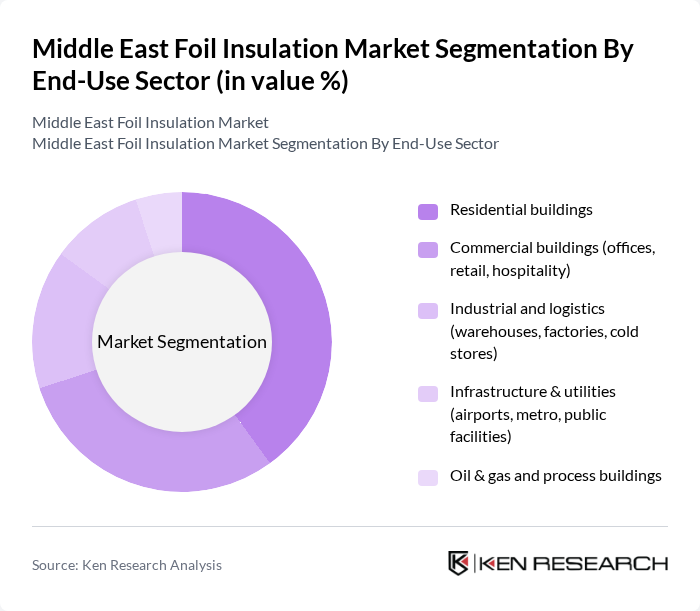

By End-Use Sector:The end-use sector segmentation highlights the various applications of foil insulation in different building types. The subsegments are as follows:

The end-use sector analysis indicates that residential buildings account for the largest share of the market, supported by rising adoption of energy-efficient housing, higher penetration of air conditioning, and government-backed sustainable construction programs across the region. The commercial sector follows closely, with significant investments in green building initiatives for offices, retail, healthcare, and hospitality projects, where foil insulation is used in roofs, façades, and HVAC systems to improve thermal comfort and reduce cooling loads. Industrial applications are also growing, particularly in logistics warehouses, cold chain infrastructure, and light industrial buildings, where effective insulation is crucial for maintaining temperature control and lowering operating energy costs. The infrastructure sector is witnessing steady growth due to ongoing airport, metro, and public facility developments that increasingly specify high-performance insulation within broader sustainability and carbon-reduction frameworks.

The Middle East Foil Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kingspan Group plc, Saint-Gobain (Isover & Celotex), Knauf Insulation, Owens Corning, Armacell International S.A., BASF SE (foil-faced insulation systems), Johns Manville, Rockwool A/S, Thermaflex International, Emirates Extruded Polystyrene LLC (UAE), Gulf Insulation Group (Saudi Arabia), Saudi Rockwool Factory Co., Union Foam S.p.A., Dubai Insulation Material Manufacturing Co. LLC, Unipro Trading & Contracting LLC (regional reflective insulation supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East foil insulation market appears promising, driven by increasing regulatory support for energy efficiency and sustainability. As governments enforce stricter building codes and energy standards, the demand for advanced insulation solutions is expected to rise. Additionally, the growing trend towards smart building technologies will likely enhance the integration of foil insulation, further boosting its adoption. Overall, the market is poised for significant growth as awareness and technological advancements continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Single-sided reflective foil insulation rolls Double-sided reflective foil insulation rolls Bubble foil insulation (single / double bubble) Foam-based foil insulation (XPE / XLPE / PU with foil facing) Radiant barrier sheets and membranes Other foil-faced reflective insulation products |

| By End-Use Sector | Residential buildings Commercial buildings (offices, retail, hospitality) Industrial and logistics (warehouses, factories, cold stores) Infrastructure & utilities (airports, metro, public facilities) Oil & gas and process buildings |

| By Application Area | Roof and attic insulation External and internal wall insulation HVAC duct and pipe insulation Cold storage and refrigeration rooms Other building envelope and specialized applications |

| By Material Structure | Aluminum foil–based reflective insulation Metallized film (PET/PP) foil insulation Bubble-foil composite structures Foam-foil laminate structures Other composite foil insulation structures |

| By Installation Method | New-build installation Retrofit installation Do-it-yourself (DIY) installation Professional contractor installation |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of Middle East |

| By Sales Channel | Direct sales to contractors and developers Building material distributors and dealers Specialist insulation distributors Online and project-based sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Architects, Builders, Homeowners |

| Commercial Building Developments | 100 | Project Managers, Facility Managers, Developers |

| Industrial Applications of Insulation | 80 | Operations Managers, Safety Officers, Engineers |

| Energy Efficiency Initiatives | 60 | Energy Auditors, Sustainability Consultants, Policy Makers |

| Foil Insulation Product Suppliers | 70 | Sales Managers, Product Development Heads, Distributors |

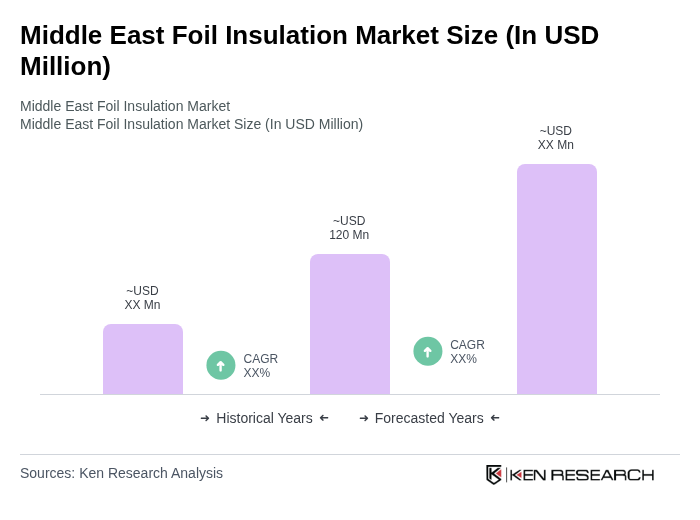

The Middle East Foil Insulation Market is valued at approximately USD 120 million, driven by the increasing demand for energy-efficient building materials and the expansion of the construction sector, particularly in the Gulf Cooperation Council (GCC) countries.