Region:Middle East

Author(s):Geetanshi

Product Code:KRVN6090

Pages:92

Published On:December 2025

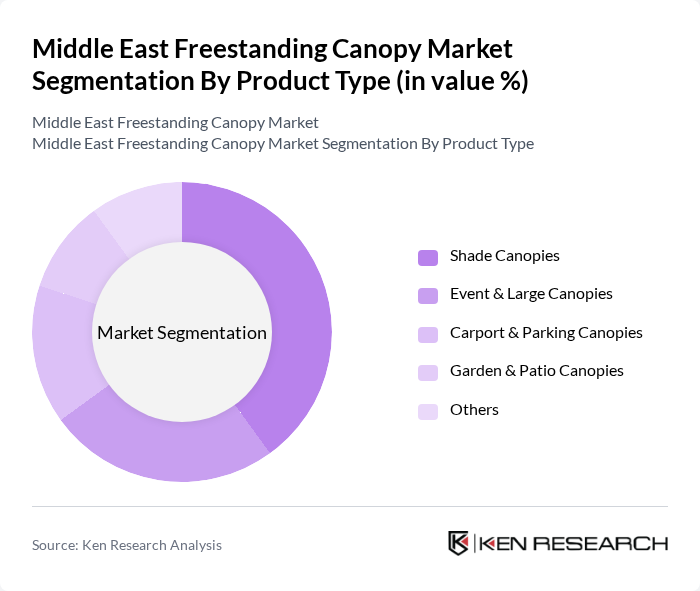

By Product Type:The product type segmentation includes Shade Canopies, Event & Large Canopies, Carport & Parking Canopies, Garden & Patio Canopies, and Others, which is aligned with the way global canopy studies categorize shade canopy, event or large canopy, and other formats. Among these, Shade Canopies are leading the market due to their versatility and widespread use in residential, commercial, and community applications such as walkways, outdoor seating, playgrounds, and retail frontages. The growing trend of outdoor living spaces, alfresco dining, and open-air retail has significantly increased the demand for these canopies, making them a preferred choice for consumers and developers looking for both functionality and aesthetics in climate-challenging environments.

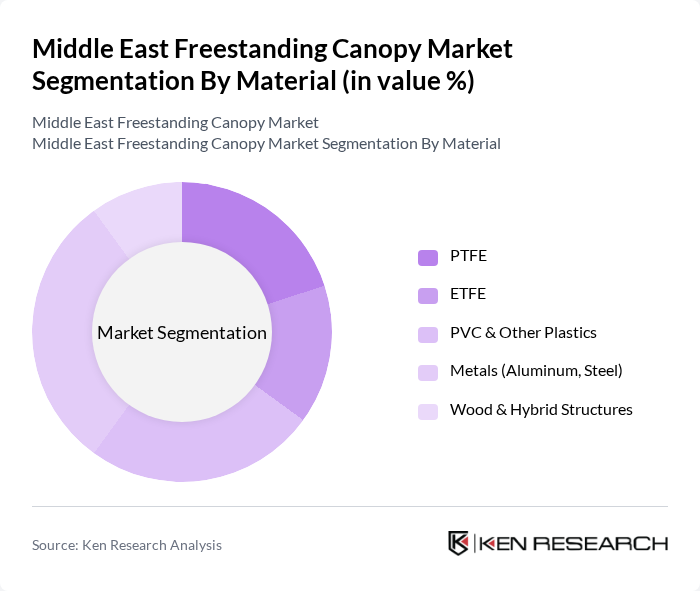

By Material:The material segmentation includes PTFE, ETFE, PVC & Other Plastics, Metals (Aluminum, Steel), and Wood & Hybrid Structures, consistent with global canopy material classifications where PTFE, ETFE, PVC, and metals are key categories. The leading subsegment is Metals (Aluminum, Steel), which is favored in the Middle East for its structural strength, corrosion resistance (especially powder-coated aluminum and galvanized or coated steel), and suitability for large-span car park and commercial shade structures. The increasing preference for long-lasting, wind-resistant, and low-maintenance framing systems in the construction of canopies has driven the demand for metal-based structures, particularly in commercial, institutional, and transport-related applications, while advanced membranes such as PTFE and ETFE are increasingly specified for premium architectural and tensile-canopy projects.

The Middle East Freestanding Canopy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunshade Gulf LLC, Tensile Shade Structures LLC, Al-Futtaim Engineering & Technologies, Arabian Canopies & Shades, Shade Systems Arabia, Qatar Shade Engineering, Saudi Tensile Fabric Structures Co., Al Jazeera Steel Products Co. SAOG, Emirates Canopy & Tents, Gulf Outdoor Structures, Oman Canopy & Shade Solutions, Al Zamil Steel & Shade Division, Bahrain Sunshade Solutions, Kuwait Outdoor Canopies Co., Regional & International Niche Players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East freestanding canopy market appears promising, driven by ongoing urbanization and a growing emphasis on outdoor living spaces. As governments continue to invest in infrastructure and tourism, the demand for innovative and aesthetically pleasing canopy solutions is expected to rise. Additionally, the integration of smart technologies and eco-friendly materials will likely shape product offerings, catering to environmentally conscious consumers. This evolving landscape presents opportunities for manufacturers to innovate and expand their market presence.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shade Canopies Event & Large Canopies Carport & Parking Canopies Garden & Patio Canopies Others |

| By Material | PTFE ETFE PVC & Other Plastics Metals (Aluminum, Steel) Wood & Hybrid Structures |

| By End-Use Sector | Residential Commercial Industrial Hospitality & Tourism Public Infrastructure & Institutional |

| By Application | Outdoor Seating & Dining Areas Parking & Car Shade Structures Walkways, Entrances & Transit Areas Sports, Recreation & Leisure Facilities Events, Exhibitions & Temporary Installations |

| By Installation & Mobility | Permanent Freestanding Canopies Semi-permanent Structures Portable / Modular Canopies Retractable Freestanding Canopies Custom Architectural Canopies |

| By Sales Channel | Direct (Project & Contract Sales) Specialized Distributors & Dealers DIY Retail & Home Improvement Stores Online / E-commerce Platforms Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Canopy Installations | 110 | Project Managers, Facility Managers |

| Residential Canopy Solutions | 85 | Homeowners, Landscape Architects |

| Public Space Canopy Projects | 75 | Urban Planners, City Officials |

| Event and Temporary Canopy Rentals | 65 | Event Coordinators, Rental Company Owners |

| Material Suppliers for Canopies | 95 | Procurement Managers, Product Development Specialists |

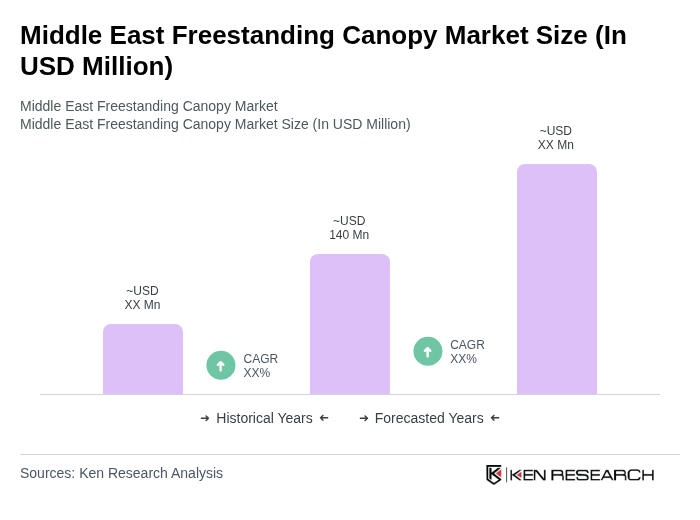

The Middle East Freestanding Canopy Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by urbanization, outdoor events, and increased demand for shade solutions across various sectors.