Region:Middle East

Author(s):Shubham

Product Code:KRAD5375

Pages:84

Published On:December 2025

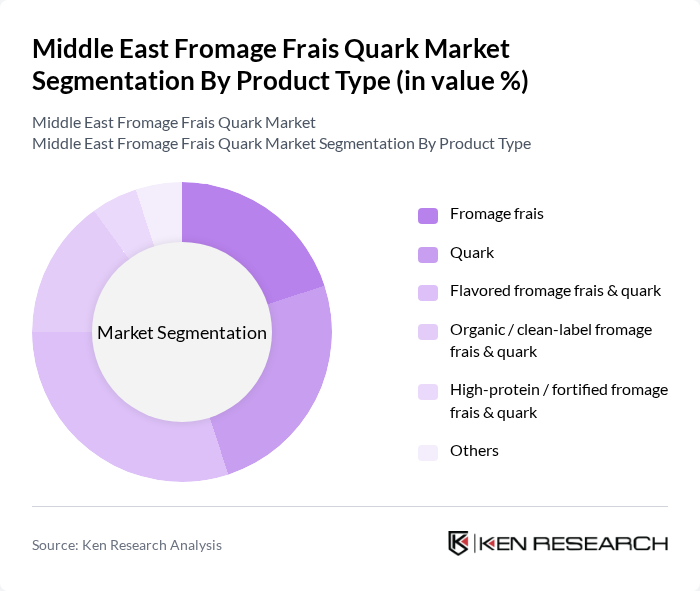

By Product Type:The product type segmentation includes various subsegments such as Fromage frais, Quark, Flavored fromage frais & quark, Organic / clean-label fromage frais & quark, High-protein / fortified fromage frais & quark, and Others. Among these, Flavored fromage frais & quark is currently leading the market due to the increasing consumer preference for taste and variety in dairy products. The trend towards healthier snacking options has also contributed to the popularity of high-protein and organic variants, appealing to health-conscious consumers.

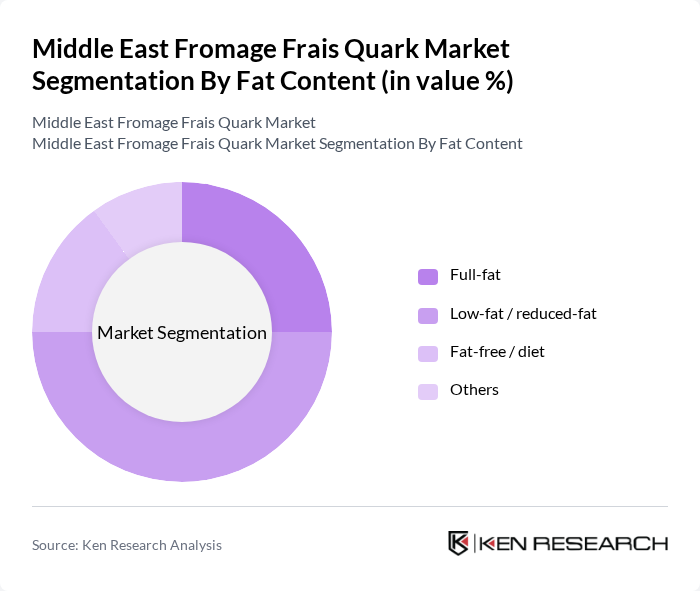

By Fat Content:The fat content segmentation includes Full-fat, Low-fat / reduced-fat, Fat-free / diet, and Others. The Low-fat / reduced-fat segment is currently dominating the market, driven by the rising health consciousness among consumers who are increasingly opting for lower-fat dairy options. This trend is further supported by the growing awareness of the health benefits associated with reduced-fat diets, making it a preferred choice for many households.

The Middle East Fromage Frais Quark Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company (Saudi Arabia), Al Safi Danone (Saudi Arabia), Al Rawabi Dairy Company (United Arab Emirates), Al Ain Farms (United Arab Emirates), National Agricultural Development Company – NADEC (Saudi Arabia), Saudi Dairy and Foodstuff Company – SADAFCO (Saudi Arabia), Arla Foods amba (regional operations), Danone S.A. (regional operations), Lactalis Group (regional operations), Nestlé S.A. (Middle East & North Africa), Tnuva Group (Israel), Almarai – Joosto / specialty cheese division, Gulf & Safa Dairies (United Arab Emirates), Marmum Dairy Farm (United Arab Emirates), Al Ain Dairy (legacy brand / integrated into Al Ain Farms) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East fromage frais quark market appears promising, driven by evolving consumer preferences and increasing health awareness. As the demand for functional and plant-based foods continues to rise, producers are likely to innovate and diversify their product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore a wider range of products. This dynamic environment presents opportunities for growth, particularly for brands that can effectively align with health and sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fromage frais Quark Flavored fromage frais & quark Organic / clean-label fromage frais & quark High?protein / fortified fromage frais & quark Others |

| By Fat Content | Full?fat Low?fat / reduced?fat Fat?free / diet Others |

| By Application | Retail consumption (spoonable) Foodservice (HORECA) Bakery and confectionery Desserts and snacks Food processing and industrial use Others |

| By Distribution Channel | Supermarkets / hypermarkets Convenience stores Specialty and gourmet stores HoReCa distributors / foodservice wholesalers Online retail / e?commerce Others |

| By Packaging Type | Plastic cups and tubs Flexible pouches Multi?serve buckets Glass jars Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Israel Rest of Middle East |

| By Consumer Profile | Health?conscious and fitness?oriented consumers Mass?market family consumers Premium / expatriate segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Fromage Frais Quark | 150 | Store Managers, Category Buyers |

| Consumer Preferences in Dairy Products | 120 | Health-Conscious Consumers, Families |

| Distribution Channels for Dairy Products | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends in Specialty Dairy | 80 | Food Industry Analysts, Market Researchers |

| Product Development Insights | 70 | Product Managers, R&D Specialists |

The Middle East Fromage Frais Quark Market is valued at approximately USD 600 million, reflecting a significant growth trend driven by increasing consumer demand for healthy dairy products and the expansion of retail distribution channels across the region.