Region:Asia

Author(s):Geetanshi

Product Code:KRAC8325

Pages:90

Published On:November 2025

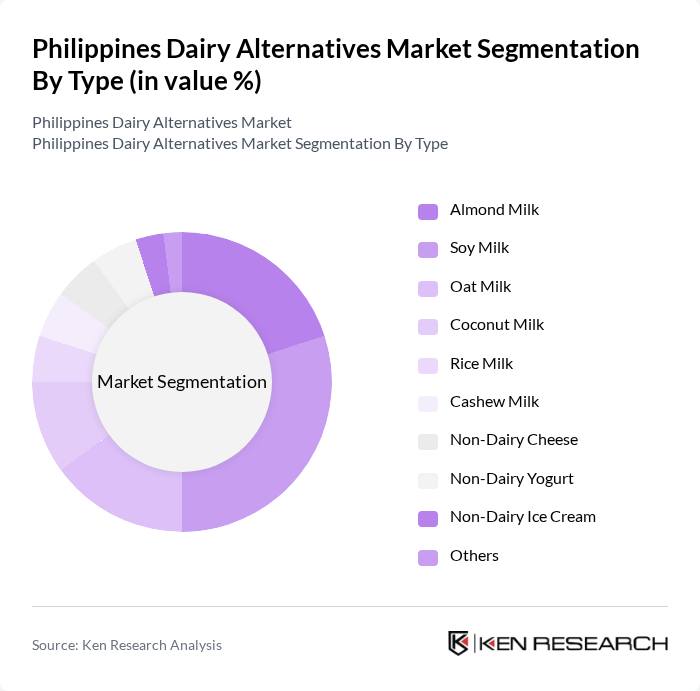

By Type:The dairy alternatives market is segmented into various types, including almond milk, soy milk, oat milk, coconut milk, rice milk, cashew milk, non-dairy cheese, non-dairy yogurt, non-dairy ice cream, and others. Among these, soy milk has emerged as the leading sub-segment due to its high protein content and versatility in cooking and baking. Almond milk is also gaining popularity, particularly among health-conscious consumers seeking low-calorie options. The increasing trend of veganism and lactose intolerance awareness further supports the growth of these sub-segments.

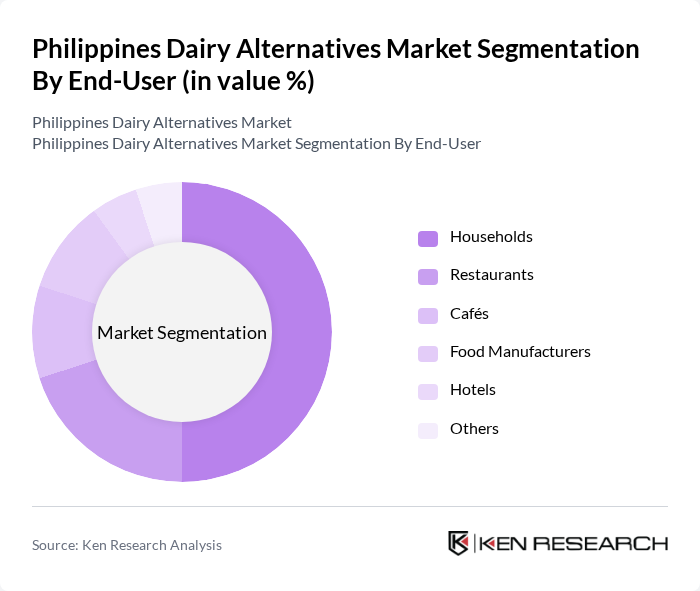

By End-User:The end-user segmentation includes households, restaurants, cafés, food manufacturers, hotels, and others. Households represent the largest segment, driven by the increasing trend of health-conscious eating and the growing number of lactose-intolerant individuals. Restaurants and cafés are also significant contributors, as they adapt their menus to include dairy alternatives to cater to the rising demand for vegan and plant-based options. The food manufacturing sector is increasingly incorporating dairy alternatives into their products, further driving market growth.

The Philippines Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro (Danone), Oatly, Vitasoy, Pureharvest, Silk (Danone North America), Califia Farms, So Delicious (Danone North America), Nutpods, Ripple Foods, Minor Figures, Dream (SunOpta), MALK Organics, Elmhurst 1925, Good Karma Foods, Vitasoy Philippines, Nestlé Philippines, Arla Foods, The Greenery Kitchen, Soyfresh, Blue Diamond Growers contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines dairy alternatives market is poised for significant growth, driven by increasing health consciousness and a rising vegan population. As consumers continue to seek healthier options, the demand for innovative dairy alternatives is expected to rise. Additionally, the expansion of retail channels and e-commerce platforms will facilitate greater accessibility to these products. With ongoing product development and marketing efforts, the market is likely to witness a robust transformation, positioning itself as a key player in the food and beverage sector in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Almond Milk Soy Milk Oat Milk Coconut Milk Rice Milk Cashew Milk Non-Dairy Cheese Non-Dairy Yogurt Non-Dairy Ice Cream Others |

| By End-User | Households Restaurants Cafés Food Manufacturers Hotels Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Grocery Stores Online Retail/E-commerce Health Food Stores Others |

| By Packaging Type | Tetra Packs Bottles Cans Pouches Others |

| By Flavor | Original Chocolate Vanilla Unsweetened Others |

| By Nutritional Content | High Protein Low Sugar Fortified Organic Lactose-Free Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Vegan, Flexitarian) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dairy Alternatives | 120 | Health-conscious Consumers, Millennials, Parents |

| Retail Distribution Insights | 60 | Retail Managers, Category Buyers, Store Owners |

| Production Insights from Manufacturers | 40 | Production Managers, Quality Control Officers |

| Market Trends from Nutrition Experts | 40 | Nutritionists, Dietitians, Health Coaches |

| Consumer Awareness and Education | 50 | Marketing Professionals, Brand Managers |

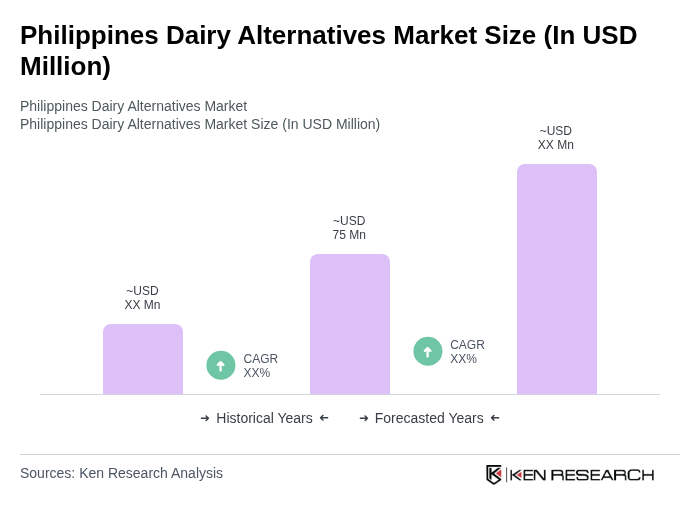

The Philippines Dairy Alternatives Market is valued at approximately USD 75 million, reflecting a significant growth trend driven by health consciousness, lactose intolerance awareness, and the popularity of plant-based diets among consumers.